Ah here.

3Stella writes:

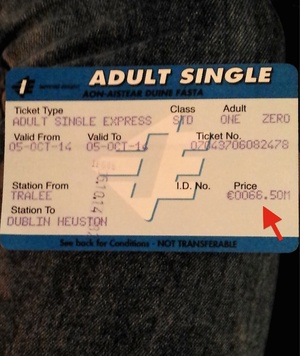

Despite being two weeks late on delivery…An post charging a €7 admin VAT collection fee on €10.87. what’s to stop the rest of who are VAT registered charging the government per invoice for collecting their tax?

FIGHT!

Sponsored Link

All the delivery couriers charge an administration fee. AnPost has the lowest at €7

DHL don’t charge fees for collecting a government tax, An Post is the national Post service an shouldn’t charge fee to the customer for collecting a tax, charge the government. It’s usual rip off Ireland Sh*te…

3stella, your grammar is awful. I’m not being a snob but it makes it very difficult firstly to understand what your trying to say and secondly to care.

“you’re”, not “your”, less a snob, more a knob.

You’re going to be very embarassed when you read that again.

Easy spartacus. I nearly went for it but what soundings’ talking about is there in the second sentence. Everyone’s a mug this morning. :)

Je suis un eejit.

Haha, that’s hilarious. Generally I don’t have too much of a problem with bad grammar etc. except when it means I have to read things over again to understand what’s being said. Communications about being understood after all. Been instead of being and an instead of and just make me have to reread a few times to get my head around it. *adjusts mental filter and takes chill pill*. Thatz betta.

Mickeyflex, only one sentence, you mean the second clause of the sentence

Spartacus, “Eejitus sum” surely, now write it out 100 times

Notluas, I see what you are getting at, sympathise, withdraw my comment, and agree, 3stella could make it easier to read and make it flow a little better, more Mozart, less Stostakovich.

Apologies notluas, I am so sorry sorry I offended your delicate sensibilities…

not luas. Grammar errors when correcting grammar. Ultimate fail

Are you thetruth or one of the many tribute accounts, les?

No idea what your beef is here, ALL delivery companies charge a fee for collection of taxes and excise duty and it’s more than An Post. You bought something outside the EU, it’s got tax to be paid. No rip off Ireland, just typical Irish moaning.

I’ve never been charged by DHL or UPS

Or DPD

I have, by all 3.

And the PSNI.

Thank you! I was about to say they got off easy as DHL and FedEx have very large handling fee’s for imports. 7 euro is entirely reasonable. And as for the State owned comments, they are entirely different organisations and budgets. Of course they have to pay people to process and forward these fees to Revenue etc.

Your supposed to include this in your ‘savings’ calculations when you are getting a ‘good deal’ outside the EU. Sour grapes over a Black Friday / Cyber Money purchase I’m guessing?

Well, actually what I said was what’s to stop anyone that are VAT registered to charge the government to collect VAT on there behalf. An Post seem to think it’s such a burden it attracts a fee of €7 fee per delivery, I shouldn’t be paying this, charge the government, It’s there tax…

Well, someone has to view the package, check the contents / value, check this against the relevant duty to be paid and process it. That’s what you are paying for. But I assume you are trolling as I would have thought that would have been beyond obvious? The VAT is the duty paid. The 7 euro is the admin fee. You are not paying 7 euro for the VAT to be collected. 7 euro isn’t cheap but its a lot cheaper than other handlers.

‘It has tax to be paid’. Seeing as the grammar police about…. ;-)

Nope, still don’t understand what they are trying to say.

Vote Sinn Fein, everything will be free! Greedy billionaires will pay for everything.

Being/been is the new than/then… #sadface.com

It’s so awful

NO CONTRACT NO CONSENT

Ha. That made me laugh!

In Australia, you have to import goods above AU$1000 (about EU670), before you have to pay any duty/tax.

That is why a lot of bicycle shops have closed, in recent years.

“despite been” – wha’?

My main gripe is that you have to pay the driver by cash or cheque in order to receive the goods. Our company won’t issue cheques that quickly so we have to give the driver cash. Pain in the ass for us, risky for him.

Also admin fee was €6 last year..

I know im going to sound completely idiotic but what VAT charge are you people talking about. I regularly buy products online from none Eu countries, mostly China, very cheap electronics. Iv never once had to pay anything bar the item price and delivery charge from the site.

NOT a vat collection fee.. it is a customs clearance fee as per their schedule of charges

http://www.anpost.ie/AnPost/Downloads/Anpost/Schedule_of_Charges_effective_21_July_2014.pdf

I’m sorry Stella got a nasty surprise when it arrived, but an post didn’t charge her a vat handling fee..

However, my sympathy dissolved when she started shiteing on about why don’t businesses charge the goverment a vat handling fee..

get over it

Why not?? It takes my time… what’s your point? It’s a fee for collecting government tax. BTW. I think charging 7 euro to collect 10.87 is outrageous.

Of course it takes your time. You are the one importing products into Ireland. An Post are just the courier with a legal obligation to police rogue importers who haven’t paid the required taxes and duties.

This isn’t a VAT point of sale transaction. You paid money to someone in a foreign country and instructed them to ship that product to you. You are obliged to pay the VAT and import duties on import. As you didn’t do this An post are obliged to stop the package hold it assess the VAT owed and charge you the VAT. The €7 fee is a very cheap flat fee for the amount that this costs an post.

This isn’t the same as buying something in a shop. If you buy something from An post you don’t pay a fee for collecting the VAT as this is built into their cost of doing business. In this case you have no purchasing contract with them. They are acting as revenue enforcement.