From top: Begging on the Ha’penny Bridge, Dublin; Dr Rory Hearne

The rich are getting richer and the vultures are circling.

Dr Rory Hearne writes:

“The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little.”

Very true words spoken by former US president, Franklin D. Roosevelt. Unfortunately if we apply them to Ireland we can see that we are certainly making plenty of ‘progress’ in adding to the abundance of ‘those who have much’, according to a report released last week by property agent Knight Frank.

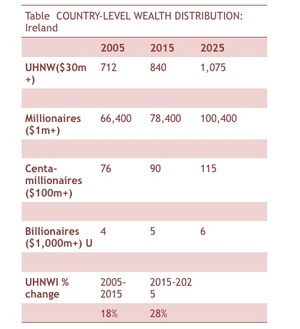

Their Wealth Report 2016 showed that the number of ultra-wealthy individuals in Ireland increased by 18% between 2005 and 2015, and that number is set to increase by 28% over the coming decade. This follows on from the recent Sunday Independent Rich List which showed that the top 300 wealthiest Irish people doubled their wealth since 2010.

This increase in wealth at the top of society while we have growing numbers of homelessness and child poverty at the bottom is morally wrong and socially unjust. It is shameful and unethical.

Look at the stark contrast between this rising wealth for those at the top of Irish society and the reduction in wealth and income for those in the middle and at the bottom.

For example, in terms of deprivation, in the same period of time as covered by this increase in wealth, the number of children aged 0-6 suffering from deprivation in Ireland doubled from 55,000 in 2007 to 105,000 in 2014.

How is this right? How is it allowed to continue?

These ‘ultra high net worth’ (UNHW) individuals in Knight Frank’s Wealth Report 2016 are individuals who have a net worth of at least US$30 million (after accounting for shares in public and private companies, residential and passion investments such as art, planes and real estate). That is a massive holding of wealth.

The Wealth Report (you can read it here) also finds that the number of millionaires in Ireland is projected to increase from 66,000 in 2005 to reach 100,400 by 2025 (see Table above).

The Knight Frank Wealth Report also needs to be looked at in the context of our worsening housing crisis.

The Report highlights that property (residential housing and commercial real estate property) is a key aspect of wealth accumulation by the wealthy. The report explains how “super-normal returns” from residential property “helps underpin the net worth of the ultra-wealthy”.

Knight Frank, of course, benefit from this themselves as they are a global ‘property agent’ and property advisor, handling sales of very large properties. Clearly, promoting the role of property in wealth accumulation for UHNW individuals is an important aspect of their business model.

Their Report shows that housing property (primary residence and second homes) accounts for a quarter of UHNW’s investable wealth, while commercial property investments make up 11%. Thus, total property investment makes up almost 40% of the wealth of the UHNWs while financial investments (equities, bonds, etc) makes up a smaller proportion (28%).

And the importance of property as an asset has increased in recent years. The reason for the increasing importance of purchasing property was its role as an ‘investment to sell in the future’ and a ‘safe haven for funds’.

This is in contrast to how most of us see housing as a home rather than an investment asset.

The investment in property by the wealthy is playing a role in recent property price increases in ‘prime’ markets (like Dublin). The report highlights that “it has been the weight of money from wealthy investors looking to secure assets in leading world economic hubs that has propelled markets to record levels”.

I have shown here before the role of global wealth funds in worsening the housing affordability crisis in Ireland by driving up rents through the sale of property and land by NAMA to vulture funds.

So the vulture and wealth funds, the wealthy and banks increase their wealth by dispossessing the poorest of their homes and extracting ‘super profit’s from speculative sales of land and property, along with what they get from rental income.

This wealth isn’t ‘created’ from thin air – it is being paid for by the Irish taxpayer through the bank bailouts, austerity and NAMA, mortgage distress, homelessness and escalating rents and house prices.

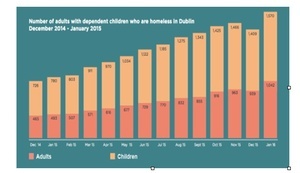

The result of this is most visible in our housing crisis –from the 37,000 still in mortgage arrears to the 1,570 children and their families who are now homeless in Dublin.

Source: Department of Environment

It is interesting to read in the Report that even the wealthy are realising that the growing concentration of wealth, particularly within the advanced economies, is a major problem.

There is a specific Chapter in the Report entitled ‘Wealth Inequality takes Centre Stage’ which highlights the ‘growing sense of disenfranchisement” that “is changing the political landscape globally”. They explain:

“wealth inequality has continued to climb the political agenda and is now one of the biggest issues facing politicians as they try to address those who feel disenfranchised”.

There is an increasing desire from ordinary people to see a stop to rising inequalities and for policies that will make society more fair.

One proposal that could make a fairer society is a wealth tax. Interestingly we had a wealth tax before in Ireland – it was introduced by a Fine Gael Labour government in 1975.

It was levied at 1 per cent of the value of assets in excess of £100,000, with family homes, bloodstock, livestock and pension rights exempt. But after the 1977 election Fianna Fáil abolished it.

It is time to look again at the merits of a wealth tax. A 1% wealth tax that would apply only to the top 1% of households (and would exclude homes, farm land and pension savings) in Ireland could raise up to €500 million.

That is a very large amount of money (but insignificant to the ultra wealthy) that could build housing for the homeless, fund our health service and provide school meals to address child poverty. Isn’t it time for a wealth tax?

Dr Rory Hearne is a policy analyst, academic & social justice campaigner. His column appears here every Wednesday. Rory is an independent candidate for the Seanad NUI Colleges Panel. He writes here in a personal capacity. Follow Rory on Twitter: @roryhearne

You are asking this of people who just voted FF back in, 5 yrs after wrecking the country through fiscal stupidity.

you gotta ask yourself how the blushirts screwed things up soo badly that they allowed mehole & friends back in..

Hey man, we all partied ;-)

Could the last person with a job to leave Commisar Rory’s workers paradise please turn out the lights.

Indeed. Here’s a radical solution: spend less, tax less or maintain the burden at manageable levels. Wealth tax, me Nat. It’ll end up crippling widows in expensive, all but empty houses in ‘nice’ areas of our towns and cities while holders of land/equity/bloodstock will find a way to avoid same.

How many fifty pence pieces did Doctor Rory’s doctorate cost?

Well, it’s amazing how fast one can get through them playing pool.

Rory’s usually rather to the left of my views usually but this is a very good idea. Some hope of seeing it implemented by an FG/FF government though.

I’m hoping to god we go through a recession 10 times worst than the last. People in this country deserve what they get with those election results. Do the idiots and I mean irish people not realise what ever pain they felt was a direct result of FF policies and corruption. Yet the IDIOTS blame everything on labour and FG. FF always wreck the country then the others guys get in make hard choices, get voted out and the cycle happens again.

Rory and Gavin Titley are step brothers or lovers. Tedious pair…

Well said. They’re both Maynooth socialists aren’t they?

I think so. Certainly the most righteous and sanctimonious tweedle dumbs you’ll come across. It’s no wonder Ireland’s academics are not very well regarded internationally .You could almost guess their views on the Middle East without hearing them utter a word.

Unfortunately, the vast majority of people are more invested in who wins Strictly, X Factor etc. Vacuous does not even describe it!

Yes, the politicians are the answer to your problems. Maybe the next time we will get it right, until then let’s drink pints and eat chips and ignore reality.

It’s easier.

“The Wealth Report (you can read it here) also finds that the number of millionaires in Ireland is projected to increase from 66,000 in 2005 to reach 100,400 by 2025”.

– I wonder what the rate of inflation would be between 2005 and 2025; I’m surprised that there would not be an even greater increase, given that a million in 2025 would be worth a lot less than a million in 2005.

“This follows on from the recent Sunday Independent Rich List which showed that the top 300 wealthiest Irish people doubled their wealth since 2010.”

– as was pointed out to Rory by several posters, many of the people on that list reside outside the state, so any proposed wealth tax would not apply to them.

Having failed to come up with any new ideas, Dr Hearne rehashes his stale, ill-thought out ones from previous weeks.

“It is time to look again at the merits of a wealth tax. A 1% wealth tax that would apply only to the top 1% of households (and would exclude homes, farm land and pension savings) in Ireland could raise up to €500 million.”

Not abundantly clear how you would suggest doing this. A huge portion of the assets are presumably overseas or international in nature, so would be difficult to find/value etc, as well as double tax treatment issues. I’m not against the idea, just think €500mn is naive in the extreme. If u managed to gain even 50-100mm with this i’d be both surprised and impressed.

15k Cerberus paid in taxes here last year. 15 measly thousand.

http://www.irishtimes.com/opinion/time-to-wrestle-mysterious-cerberus-out-into-the-light-1.2564860

“It uses a series of Dublin-registered subsidiary companies to hold property loans that it bought in Ireland, Britain and other European countries. They are in turn controlled by another set of Dutch-based Cerberus subsidiaries. These lent the Irish firms money at high interest rates to buy the debts. The repayments are so high that they eat up most of the profits.

Tax affairs

Their figures show that six of those companies generated income of about €350 million in 2014 and repaid €245 million in interest.

After taking out their costs, they paid a total of €15,500 in tax, less than most working people. Cerberus will not answer questions about its tax affairs, but does say that its operations stimulate activity and help to create jobs.”

They’re lending themselves money at very high interest rates..

Reminds me of Clearys charging themselves huge rents for the building.

15 fupping thousand euros, on billions..

Great article from Rory… dismal fupping comments though.

They live outside the state, can’t be taxed.. great contribution altogether.

It’s like lets not talk about the inequality.. It’s like a dogmatic belief in capitalism. Every man for himself attitude. It’s not the politicians fault you’re out on the streets when you can’t pay your rent.. tough titty for you.

It’s gas that this even needs stating, but it clearly does for some –

“This increase in wealth at the top of society while we have growing numbers of homelessness and child poverty at the bottom is morally wrong and socially unjust. It is shameful and unethical.”

Our ancestors in caves, who knew instinctively that if we grouped and worked together we’d have a better chance at survival, know more than the bozos on these threads. The cave man probably had more empathy for their vulnerable too than some around here.

We live in a country that allows free movement of people/capital; much as it may seem fair to not allow rich people to leave and so that they will have to pay the same rate of taxes as PAYE workers, that isn’t compatible with us remaining within the EU, for one thing.

Countries within the E.U each have their own tax rates and rules.

The U.K for instance recently clamped down on tax exiles on non doms.

http://blogs.telegraph.co.uk/finance/ianmcowie/100010602/treasury-to-clamp-down-on-tax-exiles-and-non-doms/

Just as aside, it’s good to differentiate between the values we would want in a society, as opposed to stating the current rules and restating the status quo. There seems to be a confusion between the two.

*And non doms..