From top: The Cruise Park housing estate in Tyrellstown in West Dublin, whose developers’ Ulster Bank loan was bought in 2014 by a Goldman Sachs vulture fund; Dr Rory Hearne

Homeowners and tenants need protection from vulture funds such as those owned by government advisors, Goldman Sachs.

Dr Rory Hearne writes:

There needs to be an immediate suspension of the sale of Irish housing loans to the vulture funds and emergency legislation to protect tenants and those in mortgage arrears from eviction.

There is also a need to investigate the role of Goldman Sachs, the vulture fund involved in evicting residents of Tyrrelstown, in advising the Irish government.

Goldman Sachs is a multi-billion dollar US multinational investment fund company. It is involved in more ways than we realise in Ireland. Beltany Property Finance is the Goldman company involved in the Tyrrelstown development and it bought the loans in 2014 from Ulster Bank.

Goldman also played a key role in advising successive Irish governments on the restructuring of the banks from 2008 to 2013 (for which it was paid €8million), and it is still contracted by the Department of Finance to advise it on the potential sale of AIB.

Surely there are potential issues of ‘conflict of interest’ and the profiting from ‘insider knowledge’ here?

Goldman could have gained intimate knowledge of the properties and assets held on the loan books by the Irish banks such as Ulster Bank. Goldman, as other vulture funds, tend to make significant profits from buying these ‘toxic’ or ‘distressed’ loans at discount prices and then selling them on when the markets rise – as is going on now in Ireland.

Questions need to be asked about why Goldman Sachs remains in such a prominent position advising the Irish government on the restructuring of the Irish banks. Especially given this clear conflict of interest where Goldman can profit from this intimate knowledge it gains of the restructuring of these very same Irish banks.

Is it because of the close relationship between Goldman Sachs and governments?

For example, Mario Draghi, President of the European Central Bank, is a former employee as was the Treasury Secretary in the US. And then there is Peter Sutherland, recently retired Chair of Goldman Sachs, who is a leading member of the political establishment in Ireland.

Haven’t we seen disastrous outcomes from this close relationship between politicians, financial institutions and property before?

Goldman Sachs was actually charged by the US Securities and Exchange Commission for its role in causing the 2008 financial crisis – directly linked to its role in the subprime housing mortgage market.

Goldman, profited from, and played a role in causing, the 2008 financial crash and the 2010 European debt crisis. Rolling Stone magazinehas called Goldman “the giant vampire squid” for its vampire like profit squeezing from economies and the devastating impact on ordinary people’s lives.

And yet it continues to hold huge influence over governments?

It begs the obvious question. Why would you ask a financial investment fund, who have consistently shown that they will always act in ways that are most profitable to them, for advice on an economic and social crisis like our banking and housing crash?

You only ask investment funds like those if you want to know how to maximise the interest from vulture funds in buying up distressed properties and assets.

And this is the heart of the explanation of the current situation in Tyrrlestown and our ever worsening housing crisis.

It is the thinking that underpinned the decisions taken when the Irish housing market and banks collapsed and the scale of the losses and mortgage arrears crisis became apparent.

Government and policy makers focused on removing the ‘problem’ of toxic housing loans from the bank’s balance sheets in order to save the banks and help them return to profitability and ‘healthy status’ as soon as possible.

This was the priority in policy decisions. The impacts on home owners and renters living in the houses and any future housing crisis, was a distant consideration.

Policymakers knew (thanks to the advice from the likes of Goldman) that the non-bank funds buying these loans (bundles of mortgages) would be mainly interested in high rates of profit and making that as quickly as possible by selling off the property as soon as the housing market would recover.

So the result was the ‘pillar’ Irish banks (and European financial system) were ‘saved’ by the taxpayer bailouts and the sale of distressed toxic loans (i.e. developer’s loans –land and thousands of houses like Tyrrlestown) to various vulture funds and subprime housing companies.

The price for this policy is now being paid by the families losing their homes in Tyrrelstown and the tens of thousands more who will face a similar situation in the coming months and years as receivers, banks and vulture funds all look to profit from a rising property market.

The other associated price for this approach is the escalation of rents and the homeless crisis which arises, in part, from the failure to introduce rent control. Rent control would have reduced the interest of vulture funds in buying up Irish distressed property and that explains the political coolness towards it.

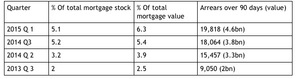

The scale of the increase in ownership of Irish housing, particularly mortgages in arrears, by non-bank vulture funds is staggering. My analysis of central bank figures shown in the table below reveals that these ‘non-bank entities’ (vulture funds) now hold 47,461 mortgage accounts.

And of these 19,818 are in arrears of more than 90 days, with 13,050 of these in arrears over 720 days. Therefore, these funds hold almost 25 per cent of all mortgage accounts in arrears of more than 720 days.

Their increasing role is shown by the fact that they have doubled their holding of the total Irish mortgage stock in just two years from just 2% of the total stock in 2013 to 5% in 2015 (6.3% in value terms).

The growth in Non-bank entities (vulture funds) in holding Irish housing 2013-2015

The growth in Non-bank entities (vulture funds) in holding Irish housing 2013-2015

Something can be done to change this and protect people in their homes from the vulture funds. It requires the government temporarily suspending all further sales and repossessions of housing and loan books including Irish residential property by either NAMA or the banks.

A new housing and homes agency should be immediately set up to purchase these distressed properties and work on solutions that protect the tenants and homeowners in their homes.

Furthermore, emergency legislation is needed to strengthen tenant’s rights to enable them stay in their home, and rent control is required to avoid economic evictions of tenants.

Finally, the Department of Finance and other government contracts with vampire vulture squid, Goldman Sachs, should be ended immediately.

Dr Rory Hearne is a policy analyst, academic & social justice campaigner. His column appears here every Wednesday. Rory is an independent candidate for the Seanad NUI Colleges Panel. He writes here in a personal capacity. Follow Rory on Twitter: @roryhearne

Rory’s got “fancy new profile picture taking” money!

Did you mix up Wednesday pills with Tuesday’s again?

Regarding insider information.. We’re told there’s Chinese Walls shur.. tis grand like.

NUI seat eh? nice little earner !

What’s the most of money you can earn before you’re no longer allowed an opinion about unethical business practices that make people homeless?

It amazes me how Goldman Sachs’ influence goes completely unchecked and unquestioned…by anyone in the media up until now. They’ve had their agents running the finance departments of Canada, the US, the UK AND the EU. They are the ones who cooked Greeces books to get them accepted into the Eurozone. They use their lobbying influence to warp the law and they are also responsible in part for the huge crisis in 2008 that continues to this day. We are long over due some laws to prevent the likes of Goldman from doing what they do to people. But I’ve a feeling the first nation to stand up to them will be made an example of by Goldman and it’s cronies.

….”vampire vulture squid”………..LOL. They have tablets now for rampant paranoia, “Dr” Rory.

What’s do you think he’s paranoid about?

Why only those damned pesky camouflaged multi-limbed blood sucking flying cephalopods that feed off of the dead… of course!

Cephalopod/acciptor hybrid invaders.

it’s paranoia to think goldman sachs is an incredibly dangerous organisation?

It’s not a bit paranoid. They are embedded in Governments and Central Banks around the world. When something happens they don’t agree with, they can mobilise some very unsavoury tactics. They’ll know your entire personal history if they are working with you in Government or business.

It’s far more dangerous to willingly believe that GoldmanSachs and their ilk are a force for good in society and not nefarious…

No it’s not… ffs.

I beg to differ

https://en.wikipedia.org/wiki/Goldman_Sachs#Controversies

“Rent control would have reduced the interest of vulture funds in buying up Irish distressed property and that explains the political coolness towards it.”

There you have it.

It would also have the effect of reducing the number of people renting out property.

If you think there is a lack of rental houses now, with rents as high as they are, it would be lot worse if rent controls were in place.

Will the owners move in themselves or something? Use it as a 2nd, 3rd, 4th, 100th home?

Cue the comments from the usual capitalist rentboys.. ‘this is how sh*t works man’. ‘they’re not breaking any laws dude’. ‘can you prove there’s insider information dr. rory, no you can’t’.. ‘this isn’t nama dude, this is ulster bank’. ‘They won’t kick everyone out of their homes dude… but you can’t expect them to act like a charity dude’ ‘Nama’s aim is to make a profit to pay back the ECB, man’. And other assorted trolls.

I’d say that’ll save everyone reading the comments from the usual suspects.

You’re suggesting you can’t sell property if it has tenants. Even if given notice. You would be saying similar if the tenants weren’t paying rent – and we know they weren’t paying market rent.

The mortgage owners are irrelevant, the apartments are for sale and hardworking families can buy and move in. Hopefully the previous tenants managed to save enough to get their own place or will go somewhere more insde their budget. May I suggest any of the numberous towns within an hour of Dublin, get more bang for your buck and some great places for kids.

Yeah, of course they can sell the properties… they’re in the business of making as much profit as possible.

Yeah, the tenants can buy if they want, if they can’t they can go elsewhere.. sure thing man.

Glad we’re agreed Anneen.

You have to have sympathy though, it’s a crap situation. And one I’m fairly sure I’ll find myself in before the end of the year.

Yeah Harry that is all grand and I tend to agree on may of your points…. but the main message in this is the conflict of interest in that they now swoop to make money out of distressed properties when they were also instrumental in them getting into that state in the first place. And although I am mostly irritated by these Rory posts, I give him kudos there. Something stinks a bit…..

Fine attitude towards human beings that. ‘Hi mate. I know you’ve been living here for 19 years and your kids are in the local school and you’ve built a life here but there’s some American billionaires who need to make a couple of million dollars they don’t need so kindly get out…..Yes I know there are only 23 available properties to rent in the whole of Dublin 15 so, I dunno, move to Dunboyne or something. Not my problem.’

*10 years.

Everything you said is true though, it’s just bloody so wrong that it is true. Vulture Funds should have been barred from all sales.

Goldman Sachs buying up water companies around the globe. KPMG being allowed to investigate themselves in Anglo/IBRC and Clerys workers being told that the way they were disgracefully treated was legal according to A & L Goodbody. Ireland badly needs decent Journalists and investigators immediately.

Is anyone really surprised about any of this?

The incorporation of NAMA in itself as clandestine property dealers, largely accountable to no one, was just another public to private wealth conduit. We all know how honest and forthright estate agents are by their very nature.

Keeping families in their homes as a government policy was a holding pattern to keep you morons quiet while property prices rose enough. The only thing that’s delayed more mass-evictions is the ECB’s negative interest rates and quantitative easing. That can can only be kicked so far down the road.

Wouldn’t be surprised if the term Black Swan Event wasn’t originally coined in the Goldman Sachs mission statement.

Once whatever shambolic government eventually gets formed here, expect the very very worst. This is only a beginning…

Ah don’t be hysterical

You’re not the hysteria boss of me!

Society is more important than Capitalism. People are more important than money. Humanity can flourish without money. It did so for hundreds of thousands of years before some selfish lazy creep invented usury.

Ah look more hysteria.

Just messin’.. :)

Yeah, things were fab. Life expectancy was about 22 and the average punter survived on a diet of muddy turnips.

Does no one do any fact checking around here anymore?

http://finance.gov.ie/news-centre/press-releases/agreement-aib-capital-reorganisation-and-tender-independent-financial

“The completion of AIB’s capital reorganisation will bring to an end the current engagement of Goldman Sachs International as advisor to the Department.”

Also:

“Goldman could have gained intimate knowledge of the properties and assets held on the loan books by the Irish banks such as Ulster Bank.”

He’s aware that Ulster Bank is not Irish-state-owned and Goldman’s engagement with the DoF would not have granted them any “intimate knowledge” of Ulster, right?

How’s this for fact checking (first result in Google)…

Those appointed to the first panel on capital markets, strategic M&A and restructuring advice, include Bank of America Merrill Lynch, Barclays, Citi, Deutsche Bank and DUH DUH DUUUUHHHH …. Goldman Sachs.

http://www.independent.ie/business/irish/advisors-appointed-for-privatisation-of-bailedout-banks-30636576.html

That article is from 2014. Mine is from 2015. Mine is the up-to-date information.

What’s more up-to-date?

The same companies are still on Panel 1 who will only be invited to tender for the same work.

Goldman Sachs have been removed from all of the panels. The Dept website “list” was updated in October. Goldman was removed in November.

Link?

Owen C doesn’t do links shur you don’t Owen C. You just have to take his word for it I suppose..

I asked him for a link here too..no response

https://www.broadsheet.ie/2016/03/15/meanwhile-in-cork-52/#comment-1571614

“But cmere Owen, could you substantiate that yourself? That 10% of the market is owned by US vulture funds? You’re talking about residential properties only is it? Not development sites – that houses will have to be built on?

Any links at all, to say it’s only 10%..”

“Goldman could have gained intimate knowledge of the properties and assets held on the loan books by the Irish banks such as Ulster Bank”

FACT FAIL. RBS own Ulster Bank. They have no connection with NAMA.

The whole article is worthless after this basic error.

Good. RBS are sound as a pound

News that nearly 450 investment bankers at RBS will be losing their jobs also led investors to assume the restructuring of the business was taking shape.

Phew! Finally!

“FACT FAIL. RBS own Ulster Bank. They have no connection with NAMA.”

Read it again. Slowlier.

Here’s a hink: the connection is goldman sachs..

What makes something a Vulture Fund and how do you ban them. Is one person buying a house and selling it on a vulture fund. If you cant legally define it you cant ban it.

It’s a reactionary, nationalistic attitude that implies ‘dem foridners’ turfing ordinary decent Irish people out on the streets, like a hangover from the 1800s. Throw in the ‘always evil bankster’ GS, a dose of tinfoil-hattery, a squeeze of paranoia, and you’re done.

Those are reasonable, thoughtful questions. I’d leave them at the door of this discussion, if I were you. You’ll just get abuse.

Ooh that’s easy

People I don’t like = Vulture Fund

People in my own family who own property etc and raise rents are just trying to get their kids through college

“People in my own family who own property etc and raise rents are just trying to get their kids through college”

What do you mean ect?

Lots of people are trying to get their kids through college, some even without extra properties have to pay for it themselves, or students you know take part time jobs to help put themselves through college. Lots of people have lots of expenses in life, like accommodation costs while attending college…. ah fupp it, I can’t be ars*d.

Here’s what a vulture fund is “a fund which invests in companies or properties which are performing poorly and may therefore be undervalued.”

Here’s what a vulture is “a large bird of prey with the head and neck more or less bare of feathers, feeding chiefly on carrion and reputed to gather with others in anticipation of the death of a sick or injured animal or person.”

You’re mansplaining again

Someone has to shur, some of ye aren’t the sharpest tools in the toolbox like

Peter Sutherland (FG) Former Attorney General

Simon Coveney TD (FG)

Owen C, so they kill all communication then?

Never an exchange email or xmas card?

Sure what good is it living on an ‘…its who you know’ island if you can’t speak to them?

Thats fine so, nothing to worry my little head about, can rest easy now

know that all these cynical, brass bollocked, 1 ft in the grave advisors have the best interests of their bedfellows at NAMA at heart, so they (NAMA) may be able to get the best return possible for the Irish tax payer

So Goldman advising the Dept Finance on the restructuring of Irish Banks (AIB, BOI, INBS, PTSB, IBRC) is somehow conflicted when buying discreet loans from Ulster Bank. Ulster Bank being a UK owned bank though it’s parent RBS which was bailed out & restructured by the UK government/taxpayer……

This is childish nonsense.

Let’s connect the dots for you.

What they’re doing here is an example of how they operate.. just because the loans were sold on from Ulster bank, doesn’t mean there isn’t a conflict of interest in them advising the Irish Gov on Irish banks, with them buying on mass distressed mortgages/properties from Irish banks/nama. It doesn’t matter that it’s Ulster bank.. This is how they operate.

Ja get it now?

No. Mansplain it to me.

You’re an awful twirp.. you’ll like a drunk obnoxious guy in a pub who doesn’t get the hint even though you’re looking at him with disdain due to the stink of booze and BO from him, but he keeps sniffing around you and your friends, thinking he’s somehow endearing.. Eh, you’re not. Jog on like. I can’t say it any nicer.

Lol

Go on – mansplain it a bit more

I still don’t get it

Is asked to clarify their vague assertion, resorts to childish insults instead

– classic Anne.

You just have to laugh at some of the twits on here

Rory is skating very close to conspiracy theories here. There is no doubt but that Goldman Sachs are a very powerful organisation and there is also no doubt but there is a conflict of interests between their business interests in Ireland but whiter it goes any further than that is up for debate.

One thing is for certain. Mainly for historical reason but also because of an inherent sense of decency, Irish people are very uncomfortable with the idea of others being thrown onto the streets. The new government needs pay attention to that unease because otherwise, it will come back and bite them very quickly.

How about the Chairman of GS Intl, Peter Sutherland advising (influencing?) Lenihan at the time of the bank guarantee in spite of his then unknown conflict of interests as GSI was a large Anglo bondholder?

Irish people are very uncomfortable with the idea of others being thrown onto the streets. Most of those doing the trowing are Irish, including particular members of Sinn Féin.

Do not exteralise the problem?

How much Anglo debt did GSI hold? Have you a link?

Debt? like they had a few loans is it?

Bonds Andy.. Bonds.. like a gamble, that lost, but we, the taxpayer paid out anyway.

They advised the Irish government it was in the best interests of the bank system that they get state funded welfare for their gambles. The capitalists are all for social welfare, when it suits.

“Rory is skating very close to conspiracy theories here”

I don’t think so..

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/7608325/Goldman-Sachs-a-history-of-controversy.html

Here’s what the Chinese had to say abut them –

“One client that has gone public with its accusations is the Chinese government. Last year, the State-owned Assets Supervision and Administration Commission (SASAC) accused Goldman, among other banks, of peddling “complex products … with evil intentions..

The complaint related to a series of oil price hedges a number of investment banks, but predominantly Goldman, structured for Chinese airlines and energy companies. Li Wei, SASAC vice president, claimed the companies lost 11.4bn yuan (£1.1bn) on 125bn yuan worth of derivative contracts.

SASAC barred the companies from paying up on the grounds that Goldman and the others had taken advantage of the companies’ financial naivety. ”

The UK gov also told them to get lost..

No comment on the hipster parents in the photo then? dissapointing

The sole cause of the last worldwise economic depression was the buying of sub-prime mortgages in the US.

The US banks Fannie Mae (Federal National Mortgage Association aka FNMA) and Freddie Mac (Federal Home Loan Mortgage Corporation FHLM)

Freddie Mac buys mortgages on the secondary(resold) market, gathers them into “buckets”, and resells them as a mortgage-backed security to investors on the open market. This idea behind that was that the secondary mortgage market was supposed to increase the supply of money available for mortgage lending.

HOWEVER, if you have an organisation like GS who are buying these buckets of secondary mortgages without any idea of responsibility to the mortgage owners or fiscal liability in the event of an economic downturn, you have the reasons for the crash of 2008.

The buckets were sold, re-sold and re-sold, increasing in superficial value each time. To the point where the “market” value of the bucket far exceeded the ground value of the properties in that bucket. The result was that each successive investor expected more of a return on their investment, one which the property owners had no way of paying. As a result hundreds of thousands of mortgages holders from these buckets handed their keys in at the bank and walked away from their payments schedule.

The cumulative effect of their refusal to pay and the resulting down turning economy caused the crash 8 years ago.

Now GS are in Ireland, determined to repeat the pattern again. Here is what happened last time:

Increased fiscal demands on the mortgages holders

The holders walked away from the increasing affordable debt because that option exists in the US

Massive worldwide economic crash

The bankruptcy of some of the banks that traded in these toxic loans

As Ireland has no walk away option from mortgages, the debt increase from the anonymous buckets of investments will be passed to the mortgage holders who will forever be saddled with the dept so from the perspective of bloodsuckers like GS, it is a good investment. They get their money and fupp you,

David McWilliams wrote an excellent piece on Nama there a few days ago –

http://www.davidmcwilliams.ie/2016/03/14/namas-actions-have-enslaved-us

Nama’s actions have enslaved us

As I considered the future of this tiny Irish tribe, the ‘assets’ Cromwell’s middlemen traded for pennies, the words Colm O’Rourke declared last year came to mind: “The reality is that Nama is, with official blessing, overseeing the greatest plundering of Irish assets since the Cromwellian plantations.”

Deep inside the financial entrails are the loans of small and medium-sized businesses, the property loans of petrol station owners, publicans and undertakers. The vultures love this type of soft tissue.

The strategy of the funds is to buy as cheaply as possible and sweat the asset until the yield on the property rises.

In the next few months, the courts will decide how many of Ireland’s small businesses will be handed over to these funds. This transfer of assets is taking place right under our nose. It is a disaster for the country, for the society and for the capital base of the economy, and yet it is legal.

But then again, so too was slavery – once.

As with all slave trades, the people were sold via middlemen. They didn’t walk willingly to Waterford port. They were traded.

Remember Nama – an agent of the state – was supposed to get credit going? Well, it is getting credit going all right – but it is foreign credit. We are middlemen in the global credit cycle. The vulture capitalists know this, but are too clever to admit it and the Irish political class are too stupid to realise it.

the Irish political class are too stupid to realise it.

Not all of us Anne, not all of us.

However, we are too powerless to do anything about it without the will of the people behind us….

“” Homeowners and tenants need protection from vulture funds “”

For sure, but neither FG, Labour or Fianna Fail are capable of delivering that protection. They’ve been bought already and sold on.