From top: funeral procession, Inisheer Island, Aran Islands, Co Galway, 1968; Michael Taft

Raising the inheritance tax threshold will have no impact on a significant majority of households.

Michael Taft writes”

The Programme for Government has provision for cutting inheritance tax. This is bleak business. Cutting inheritance tax will be a bonanza for high-income groups.

Welcome to the new politics, inseparable from the old politics.

The Government proposes to increase the tax-free threshold from the current €280,000 to €500,000. The regressive impact can be seen from this simple example. I inherit €500,000. Currently, I would pay 33 percent on the amount exceeding the threshold; that is €220,000.

My tax bill would be €72,600. That is an effective tax rate of 14.5 percent. That’s not a bad deal (and arguably already too generous): I inherit half-a-million Euros and keep 85 percent of it after tax.

Under the new proposals, I would pay nothing.

There are many arguments for cutting inheritance tax but the most unimpressive is that it would somehow benefit low and middle income earners.

The fact is that most people don’t have even the current threshold to give away in an inheritance.

The median net wealth (wealth after debts) for those aged over 64 years is €202,300. This means that 50 percent of this older-age group has net wealth less than this amount.

That includes both financial and real (property) wealth. It is reasonable to assume that a significant majority have net wealth holdings of less than the current threshold of €280,000. Of course, not all disponers come from the older-age group but probably a majority does.

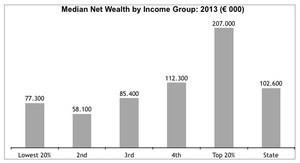

When we look at the national numbers we can get data on income distribution. The following table shows the median net wealth by quintile – or tranches of 20 percent.

The top 20 percent income earners have a median net wealth of €207,000 (again, meaning half of this group have a wealth of less than this amount). T

hroughout the state, half of all households have a net wealth holding of less than €103,000. [Note: the lowest income group has a median net wealth holding higher than the 2nd quintile; this can be explained by the fact the lowest group would contain older age groups reliant on state pensions but own their houses).

Based on this, it is reasonable to assume that raising the inheritance tax threshold will have no impact on a significant majority of households.

Even if a household has a much higher level of wealth than the average, raising the thresholds may have little impact. I may pass on €500,000 on an inheritance but if I divide it equally between my two children, then they won’t be liable to tax under the current threshold.

Some argue that the gift/inheritance shouldn’t be taxed because it has already been taxed. This is debateable for two reasons. First, it is taxed in the hands of the recipient who, by definition, is only receiving it for the first time. Second, income is subject to multiple taxes (or double/triple, etc. taxation). I pay income tax on my wage.

But I also pay USC on my wage; and PRSI. After tax, I continue to pay taxes – VAT, excise taxes, levies (ATM withdrawals, etc.). And the after-tax income that I spend in the shops is also subject to taxation; corporate tax for the business and income taxes for the employees. And so the cycle continues.

Still others have referred to the situation whereby a son/daughter inherits a house – but is forced to sell the ‘family home’ to pay the tax bill. Is this just anecdotal?

I receive a house in an inheritance. If I already own a home, I have inherited a second home (adding substantially to my wealth). I can either rent out the house, earning income; or I can sell it. Either way, I receive a substantial gain – even after the tax bill.

If I rent, I can move into the house with full equity and increase my income through reduced rent payments. The tax bill is a once-off, my rent reduction is permanent. This is not to say there are not issues regarding inheritances and payments – I look at some of them below. But gaining a house through inheritance is a gift of a substantial asset.

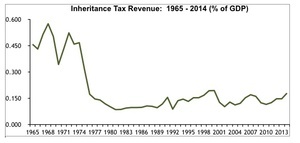

The cut in inheritance tax is estimated to cost €75 million, not a trifling sum. However, the real issue is that ever since estate duties were abolished and replaced by the Capital Acquisitions Tax, inheritance tax revenue has been subdued.

There is a strong argument for an increase in inheritance and gift taxes, especially give these tight fiscal times.

This argument gains force when we consider that this is a tax on unearned income. We tax unearned income so that we don’t have to impose that amount on earned income – a PAYE wage or the income of the self-employed or a business.

Economic efficiency would see higher, not lower, taxation on unearned income.

There are three issues that could be considered in the context of a more progressive inheritance tax regime.

First, is the issue of inheriting a house; currently, there is an implication that a child who is living in the ‘family home’ can only inherit tax-free if the parent is not living in the house (in other words, the parents have two houses).

There are exceptions for those caring for a parent. If there is a problem in this area it should be cleared – so that a child living in the house, with conditions, is not barred because they share the house with the parent.

Second, consideration should be given to extending the situations whereby the inheritance tax can be paid over 60 months.

Third, prior to 1999, there are varying rates for inheritances – ranging from 20 percent to 40 percent. This added a progressive element to the tax. Reintroducing a low rate and top rate could also be considered.

But if we entering into an era of ‘new politics’ then the Government should bring forward evidence as to the distributional impact of cutting inheritance tax – who will gain and by how much?

Is this a transfer to high-income groups from the rest of us?

In any event it will be interesting to see how the Government squares this commitment to cut inheritance tax with a commitment in the Government programme to poverty-proofing new policies.

I suspect it can’t be done.

Michael Taft is Research Officer with Unite the Union. His column appears here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

Pic: James Sugar/National Geographic

Great picture!

Maybe it should refer to the family home – otherwise, people living in this home can be hit by the death of a parent, sibling or partner with whom they live, and then have to sell the home and move to a worse one because of tax.

I don’t know if I agree – I’m not sure if it is fair that a sibling or a son or daughter are able to inherit a house that could be worth €500,000 tax-free, whereas someone actually working to earn their money will have to pay 42% on anything that they earn over a certain (relatively low) threshold.

Doesn’t really strike me as fair.

In any event, it seems fairly OK that if you inherit a home worth half a million and sell it, pay a paltry amount of tax on it, you’re still very well positioned to buy another home if you need to sell to pay that tax. It’s not a heartbreaking consequence – it’s still a massive, massive boon of the type that the vast majority will never see.

The trouble with all this is that people say lightly “half a million”, forgetting that house prices are now at that stupid level again. If house prices were forced down to a realistic level there would be less of a problem.

If you earn €280k in a given year you will pay 40-ish% tax on the full amount. You will probably be working a lot if you earn this btw.

If you inherit €280k in a given year you will pay 0% tax on it. It is completely independent of your employment status.

You will not pay 40% on the whole amount.

That’s what I’m saying: work very hard, in the process earning €280k = pay 40% in tax

Do nothing, and inherit €280k = pay no tax

It’s inequitable, IMO.

40-ish%?! What kind of facts are you checking?

My apologies. I thought I was erring on the low side.

According to taxcalc.ie a PAYE worker will pay about 48% on the whole amount in 2016, self-employed about 50%.

The loss of €75m would fund a fair amount of public services. Disappointing move from the gov, this kind of stuff should be far down the list of priorities given housing / health etc.

But political realities, it’s a vote getter for the whole country and one that will sail through the New Oireachtas. Nobody will oppose it except for AAA. Doubt even labour will. It helps out dubs and farmers in equal amount. A win win.

It’s a higher threshold than UK (about €420k) but the US….well the US is mad – €4.8m – God Bless GWB

RBB in favour so not sure why AAA would oppose it?

Yeah Michael sorry didn’t see the IT link or your post below. I stand corrected!

Strange position from RBB, would have to agree with rob G and orthodox position.

It’s gonna sail through the New Oireachtas so

Probably because RBB will benefit greatly form the move. Champagne socialism at its best.

“YOU try painting a castle orange on a TD’s salary. It ain’t easy! Try it sometime.”

Thanks for this post, most informative.

Excellent analysis.

Inherited wealth is key to maintaining inequality.

Certainly deal with any anomaly re child resident in family home, although there is already some provision there.

Surprised to see RBB supporting it.

Surprised also not to see him criticized for this position.

http://www.irishtimes.com/news/politics/mixed-response-over-plan-to-cut-inheritance-tax-bills-1.2648419

While not being in any way ideologically orthodox, RBB has been consistent in his opposition to progressive taxes on wealth (property taxes, wealth taxes).

sorry – that should have read ‘property taxes, inheritance taxes’.

= The Irish “Left” being gauche.

These would all effect his constituents who, while may not be wealth in wages term, hold expensive assets just due to where they live and would therefore pay more on the likes of property taxes, inheritance taxes, etc.

These are speculative conclusions, unfortunately.

The CSO only publishes estimates of household income by county. This is not a particularly useful unit of analysis, and has not been for 50 years.

No estimates are provided between different areas of the four Dublin local authority areas (combined population >1m), yet estimates are made of the differences between Leitrim (pop 30k) and Roscommon (pop 70k).

Yes how are the rich supposed to get even richer if we allow this dangerous nonsense to spread?

A quick note on who pays Irish personal taxes.

Income taxes (PAYE, PRSI, USC, etc): highly progressive*.

Indirect taxes (excise, VAT, etc): somewhat regressive*.

Wealth tax system (LPT, CAT, CGT): hard to say as the data are patchy. But this change would make it more regressive.

*Progressive: high-income/wealth people pay proportionately more

Regressive: low-income/wealth people pay proportionately more.

Tax on earnings other than salary…. from 0% (using all the loopholes available) to 15%, I think…. happy to be corrected.

Lower taxes. Sounds good to me, considering the appalling quality of public services (e.g the court system) that we get for the extortionate rates we pay now.

Considering that much of the wealth of the wealthiest Irish is accumulated through tax evasion and not paying their suppliers (making your business bust and restarted under a new name, etc) I think they should be taxed to their underpants to stop them using trickery like paying for children’s weddings, cars, holidays and house extensions to avoid paying inheritance tax.

You’re a bitter posting-bot, Tish. Ever try working to better yourself?

He works in a crematorium

See also Fintan O’Toole’s column today

“A huge tax break for comfortable people”

http://www.irishtimes.com/opinion/fintan-o-toole-a-huge-tax-break-for-comfortable-people-1.2649613

If you live in the house for 3 years prior to death, then the inheritance tax won’t affect you. So the eviction due to tax scenario not a reality.

I agree with Taft on inheritence tax. I believe this will be the one and only occasion on which I do.

There’s too many exemptions, thresholds, etc in our tax system, many of which are purported to look after ‘de family’ etc but disproportionately help the well off. We need to simply the tax code and stop cutting the effective tax rate by stealth.

Tough shoite if you’re living at home with your mother at 45. You didn’t work to buy the gaff, your parents did, so grow up, sell it, pay your tax bill like an adult and buy a home with the rest of your inheritence. Too sad to think about it? Fine, give people until the next October + 12 months to pay under special rules. That gives you a minimum of 12 months from bereavement to handing the keys over or cobbling together cash or a mortgage to discharge your tax bill.

33% is generous as it is, nevermind giving large thresholds to temper the effective rate.

Think about it. In the case of a dependent child.

The son/daughter is living in their parents’ house, defined as the “family home”, well into the adult years. Their parents die, they can’t cover the CAT from liquid resources – they’re forced to sell the house and move somewhere else.

Now, why should those people be forced to move rather than

(i) those in mortgage default, and

(ii) social housing applicants wanting to be near their family etc?

Most people would think you wouldn’t be inheriting 500k on your own, I.e you have brothers and sisters that make it into the will!! Say there are three in the family and we lived in an equal world. €165k each tax free, it would defo make ye comfortable, pay off mortgage etc. but I doubt it’s a vehicle to maintaining societal inequality.

Looked at census 2011 results. There are around 1.2m family units in Ireland. 340k have one child , 285k with two and 144k with three…1592 with seven or more…jimminy jillickers

But interesting . biggest grouping is family unit with no children – 344k. Houses where kids have flown the nest or couples with no kids (yet)???

“it would defo make ye comfortable, pay off mortgage etc. but I doubt it’s a vehicle to maintaining societal inequality.”

You just contradicted yourself there.

Ah come on ye know what I mean. Paying off the rest of the mortgage on a house in knocklyon doesn’t mean Residence is going to be offering ye lifetime membership :)

You plebs don’t get it. This is a tax cut for people with nice houses not some sad little three bed out in the commuter belt. No this is a cut for people who have two or three brothers or sisters and a nice family home overlooking the sea in Dalky. If we sell it for €2m and split it four ways at least now all of us will be able to get 500k tax free. We are job producers and are entitled to the money my father earned. I don’t want to have to work with you plebs. I already suffered enough during the recession sometimes being reduced to drinking non vintage champagne.

I wonder how many people have inherited 3 bed semis.

I’d say quite a few and more to happen over coming years as our aging population starts to shuffle off.

LOLz

Can I just correct you there LL. Surely you only have one sibling, a brother. And also a thing called a ‘sister’ to keep your mother amused.

+1

“Family home” frequently refers to the home and the farm that goes with it. Its a highly emotive word that has us clutching hankies and wailing won’t some one think of the children.

Provision is made for children <21 yrs.

As adults, its a free gift for being lucky enough to have a parent with assets to pass on.

Inherited wealth should be seen as an economic inequality issue. Taxes raised could go from those who inherited wealth to housing the homeless.

how can SBB stand behind this type of poo? Socialist me bum part…..

Don’t tell me that Sean Bán has jumped on this bandwagon as well!

Agree. Why should the offsping of the more well -off get something for nothing . ( also note that the largest asset amongst middle -income families (ie the family home) is CGT exempt.

This is a daft idea.

Even though I stand to inherit nothing I think it’s an absolute disgusting travesty that the state gets to get involved in any way with inheritance. I think it’s insane that your parents may die, leave you the house and you have to sell it because you can’t afford the tax? Absolutely insane. The state has no right and no business taxing inheritance. And we really have failed to be vigilant in our duties as citizens in preventing them from taxing it. We’ve failed in preventing a lot of unfair and unjust taxes.

“We’ve failed in preventing a lot of unfair and unjust taxes.”

– inheritance is basically money for nothing; if there were higher inheritance taxes, we could lower or abolish some of these other ‘unjust taxes’.

Bullcrap

Inheritance taxes are tax on already taxed money. Why should people be prevented from giving money that has already been fairly taxed to their children – or to anyone else for that matter.