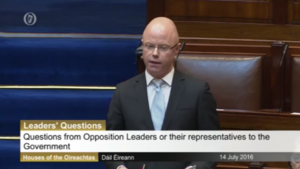

You may recall how, last week, Social Democrats TD Stephen Donnelly told how a family in Kilkenny – Sarah and Dominic and their two children – were being evicted.

He explained that the eviction was taking place after the Government sold the family’s mortgage to a US investment firm called, Mars Capital.

Earlier today, during Leaders’ Questions, Mr Donnelly returned to the matter and explained that Mars Capital is owned by The Matheson Foundation, a registered charity.

From the debate:

Stephen Donnelly: “Last week I outlined how a US vulture fund structured its Irish subsidiary, Mars Capital, to avoid paying taxes in Ireland on its Irish profits. I believe these vulture funds are about to pull off the largest avoidance of tax on Irish profits in the history of the State. The scale is likely to be in the tens of billions of euro in missed taxes. These are taxes being avoided by Irish companies on Irish domestic profits earned off the backs of distressed Irish families.”

“Irish charities are being used to play a key part in this tax avoidance. Mars Capital is owned by a registered charity, the Matheson Foundation. The stated mission of the charity is to help Irish children to fulfil their potential. It contributes to causes such as the Irish Society for the Prevention of Cruelty to Children, ISPCC, Barnardos and Temple Street Children’s University Hospital. The charity does not mention its ownership of Mars Capital.”

“One reporter I spoke to believes that the charity might own more than 200 companies. At a time when public faith in the charity sector has been rocked yet again, a children’s charity is being used to help a vulture fund avoid paying taxes to the Irish State on its Irish profits.”

“It is very effective. In spite of annual revenues in year one of over €14 million, Mars Capital paid total corporation tax to the Irish State of €250. Companies such as Mars Capital are known as section 110 companies. Section 110 was introduced in 1997 to allow the International Financial Services Centre, IFSC, win global securitisation deals. These involve global companies structuring global assets in Ireland. Their profits were not earned here, so section 110 helps these companies avoid paying taxes here on those profits. The vulture funds are now using section 110 companies to avoid paying taxes in Ireland on Irish profits. Section 110 companies were not created to re-route Irish domestic profits to offshore locations. However, my understanding is that almost all of the vulture funds whose profits are generated in Ireland have section 110 status.”

“How big is the scale of the tax avoidance by these vulture funds? Irish companies typically pay approximately 30% tax on their profits, between corporation tax and dividends tax. Vulture funds typically target minimum returns on their Irish investments of 15% to 20% per year over seven to ten years. That means a €100 million investment by a vulture fund should generate €100 million in taxes for the Irish State.”

“To be clear, the level of taxes being missed by the Irish State is likely to be well over half of the total value of all of the distressed loan books sold by NAMA, IBRC and private banks.”

“Will the Government direct Revenue to cancel section 110 status for all vulture funds in Ireland? Will it provide Revenue with the extra resources to execute this quickly and to reclaim back taxes? Will it direct the Charities Regulator to pull charity status where that status is being used to help avoid Irish tax on Irish profits? Will it direct NAMA to not sell assets to vulture funds if these funds are structured to avoid Irish taxes on Irish profits?”

Tánaiste Frances Fitzgerald: I thank the Deputy. Section 110 of the Taxes Consolidation Act 1997 sets out the taxation regime for securitisation and other structured finance transactions. Under the Taxes Consolidation Act, a qualifying section 110 company is chargeable to tax at 25% but has its profits computed by reference to the rules available to trading companies. As a result, the companies are generally structured in such a way that they are effectively tax-neutral. A company must notify the Office of the Revenue Commissioners in advance of its intention to fall within the scope of section 110. The companies are required to pay their taxes and file their tax returns in the same way as all other companies and are subject to the same monitoring by the Revenue Commissioners, an important point to note.”

“I understand that officials from the Department of Finance and the Revenue Commissioners are currently examining recent media coverage concerning the use of certain physical vehicles for property investments – indeed, Deputy Donnelly has raised this issue before, as has Deputy Pearse Doherty. Should these investigations uncover tax avoidance schemes or abuses which erode the tax base and cause reputational issues for the State, then appropriate action will be taken and any necessary legislative tax changes that may be required will be put forward for the consideration of the Minister for Finance. Therefore, I can confirm that the Department of Finance and the Revenue Commissioners are examining this issue with a view to taking action.”

“I would also respond to the Deputy’s point in regard to charitable status. Clearly, this issue needs examination by the Charities Regulator. I have been in contact with the Charities Regulator and asked him to examine the particular issues which the Deputy has raised about the granting of charitable status and how it is being used by certain companies at present.”

Donnelly: “I thank the Tánaiste for her reply. I am very glad to see the Government is taking this seriously. We could be looking at missed taxes to the Irish State to the tune of €1 billion to €2 billion a year, or even more. If it is €1 billion a year, that equates to some €20 million a week in missed taxes. The section 110 structures were set up for a legitimate reason in 1997 under the Taxes Consolidation Act. They are now being used by nearly all of the vulture funds to take profits generated in Ireland and, very frustratingly, to take profits generated in Ireland by ordinary, decent families trying to pay their way out of negative equity and distressed mortgages. Section 110 was never intended to be used to pull Irish-generated profits out of the country. This is happening on a scale that is potentially worth tens of billions of euro.”

“I acknowledge what the Tánaiste said about the Revenue Commissioners. Will she come back to the House on this issue as a matter of urgency, ideally before the recess? What we should be doing in the finance Bill which is coming up with the budget, or even before that, is shutting this down.”

Fitzgerald: “I repeat that officials from the Department of Finance and the Revenue Commissioners are currently examining this issue, in particular the use of certain vehicles for property investments. This is clearly an issue of concern, particularly the point the Deputy raised yesterday in regard to the use of charitable status, which I believe needs investigation. The Minister for Finance will take note of the outcome of the investigations that Revenue and the Department of Finance are undertaking at present on this issue. There is no doubt that, if it needs to be addressed, he will address it in a comprehensive way in the budget. It is important that we first have a full analysis to have the entire picture put on the table and see what the results of the investigations are to determine whether changes are necessary.

Transcript via Oireachtas.ie

Previously: The Story Of Sarah And Dominic

Look at the size of his head

Can you post a picture of your own mug. I’m sure your no oil painting.

I never said he was ugly.

Just craniumly advantaged

I keep expecting to see a young Jane Curtain sitting beside him.

It’s not the size that counts.. it’s what you do with it, as the saying goes.

Nonsense.

http://images.halloweencostumes.com/products/9220/1-1/egg-cap.jpg

Gravy.

Lovely warm, flowing gravy.

Have you got your gravy?

Who are the people at Mars Capital again? Two directors worked at IRBC and KPMG previously it’s been reported..

Follow the money…

I heard the vultures were evicting the guards now..

Looking at Matheson’s website in there ‘Our People’ section, they sure do have a lot of tax people employed , but Im sure thats normal enough for a children’s charity….

If you have anything to report, go to the guards.. Thanking you.

I dont… but if I did I would be a little paranoid or maybe cynical in thinking my complaint would go straight in the bin, and my name would be added to some list of potential patsy’s ala that guy who was wrongfully arrested in the Mary Boyle case.

That doesn’t work.

no doubt thrusting young buck Noonan will be working night and day on this scandal.his palpable energy will infect the department of finance with an unquenchable zeal to protect the taxpayer against these unscrupulous vulture funds .

In an alternate universe this is happening right now! This universe, not so much

250 euro of a tax bill though.. on how many millions

I’ve paid more in a week myself..

250 fupping euros.

I welcome this entire scheme.

Mars Capital, we come from another Galaxy far far away, where no tax is paid.

Mars is part of our solar system.. 4th planet from the sun, after earth..Same galaxy.

Just sayin…

If there was any justice in this country Stephen Donnelly would be Taoiseach. Instead we have a wooden plank without any courage, or testicals

and if I missed a couple of VAT periods they’d be on me within weeks…

Revenue will do nothing

Noonan will do nothing in the lifetime of this fake govt never mind before the oul holliers

wonder what sort of stuff these fellas discuss at Davos all the same?

a great little country to do business via

Matheson reminds me of the Little Lebowski Urban Achievers. Total selfless philanthropy man

“Matheson reminds me of the Little Lebowski Urban Achievers.”

Coming form “The Dude” this statement carries extra weight!

room for one more ?

Yeah, well, that’s just, like, your opinion, man!

This Government is a complete joke! They have turned Ireland into Americas secret wallet. F****** disgrace! We are paying tax and Billionaire US companies are not. These vulture funds are pretending to be involed in a childrens charity, while they make Irish children homeless by selling off their tax paying parents houses! Insanity!

I’m about to Explode!!! Aaarrrrgghh!

+1

http://www.davidmcwilliams.ie/2016/03/14/namas-actions-have-enslaved-us

It is thought that between 1645 and 1660, 40,000 Irish captives were sold into Caribbean slavery from Ireland, via Liverpool and Bristol to Barbados and beyond. As with all slave trades, the people were sold via middlemen. They didn’t walk willingly to Waterford port. They were traded. They were driven off their land in Ireland, huge tracts of which were given to Cromwell’s victorious NCOs, and then sold by the gombeen men to slave traders.

As I considered the future of this tiny Irish tribe, the ‘assets’ Cromwell’s middlemen traded for pennies, the words Colm O’Rourke declared last year came to mind: “The reality is that Nama is, with official blessing, overseeing the greatest plundering of Irish assets since the Cromwellian plantations. ”

‘with official blessing’ i.e. they’re the middlemen. follow the money.

My God! I never knew that. Interesting article

slavery and sugar trade business indeed….

a few angles to it and we weren’t always the victims out in the Caribbean…some good documentaries around this subject e.g.

http://www.rte.ie/radio1/doconone/2013/0719/647482-documentary-sugar-blue-eyed-slave-montserrat-slaves/

was a great documentary (on Newstalk I think) around Christmastime about the Irish roots in Barbados?! ……think they were called the “Red Legs”…..some mad accents and surnames you wouldn’t remotely associate

and one gaff you defo need to go to see next time you’re in London….free and well worth the effort, down in the docklands, found it by accident, they don’t exactly plaster the place with advertisements for it and when you go you’ll see why…not proud stuff atall:

https://www.museumoflondon.org.uk/museum-london-docklands/permanent-galleries/london-sugar-slavery

Donnelly really does have an awesome egg head. And I don’t mean that disrespectfully. It really is quite wonderful.

He’s also one of the only smart politicians in the Dail exposing corruption.

It’s not a coincidence that these revelations always come from Independent and non mainstream party TD’s.

It seems like the Social Democrats are the only party in the Dail exposing corruption and trying to actually improve this mess of a country. Lets hope the Irish people use their brains next time they vote and not go along with a traditional vote for FG or FF (ie:corruption)

Wooden top turnip heads, greasy paws, fat bellies , and crinkled brown envelopes and wind bags .

Urge to kill rising…

Vultures pick over the dead or dying, that it is what they do. But if the zealot like adherence to the free market ideology within FG and FF means people are tossed out on the streets while those same evictors use charity tax avoidance then who is to blame? Definitely not the vultures because that is what they do.

One in the net for SD.

Fair play to Donnelly.

Amazing and maddening scheme. If the government had any sense, they’d have a new tax investigation the way they did with offshore accounts years back.

Where companies can find a way to get profits the will go to any lengths….

http://www.snopes.com/politics/business/deadpeasant.asp

If new legislation is required, I hope to God they make it restrospective so “avoidance” can be reclassified as “evasion”.