Spanish Yields Surges as Greek Vote Fails to Damp Concern (Bloomberg)

Tag Archives: Euro Crisis

Uh Oh

atDavid Cameron appeared to cast doubt on the future of the euro during prime minister’s questions when he said the eurozone “either has to make up or it is looking at a potential breakup”. He told MPs: “That’s the choice they have to make and it is a choice they can’t long put off.” His aides said later he had not made a mistake with his remarks, which Labour immediately pounced on, accusing the prime minister of stoking fears of a breakup.

…Cameron’s words followed a stark warning from the governor of the Bank of England, Mervyn King, who said Britain’s recovery was being hampered by a eurozone that was “tearing itself apart” and referred to a “storm heading our way from the continent”.

David Cameron Raises Possibility Of Euro Breakup (Patrick Wintour, Guardian)

Drat-ma

athttpv://www.youtube.com/watch?v=HANouuHrdVI&feature=player_embedded

“In 2007, our debt to GNP ratio was approximately 30%. By 2014, it will have ballooned to 145% – no developed economy can survive those levels of debt. Ireland has just about survived four years of austerity. Our debt levels directly linked to bailing out banks in Ireland and in Europe are now simply unsustainable.

Yet we are told that more of the same without any commitment to Eurobonds, Redemption Funds, or debt restructuring will solve our problems. It will not, and cannot and, given that our access to the ESM is tied into ratification of the Treaty, it is little short of blackmail.”

Marian Harkin MEP, today.

Ireland West MEP Marian Harkin Accuses European Council Of Blackmailing Ireland Over Fiscal Treaty (Politics.ie)

The Government, in signing the Fiscal Treaty, has effectively committed itself to introducing up to €6 billion more in tax increases and spending cuts in the medium-term, over and above what it has already planned…The reason why we will have to endure another round of cuts can be found in the section of the text entitled ‘Fiscal Compact’:

‘The Contracting Parties shall apply the following rules, in addition and without prejudice to the obligations derived from European Union law:

The budgetary position of the general government shall be balanced or in surplus.

The rule shall be deemed to be respected if the annual structural balance of the general government is at its country-specific medium-term objective as defined in the revised Stability and Growth Pact with a lower limit of a structural deficit of 0.5 % of the gross domestic product at market prices.’

She also called for the eventual creation of a European political union, with many more national powers ceded to a central government, a strengthened bicameral European parliament, and the ECJ assuming the role of Europe’s supreme court.

Gulp.

So It Begins

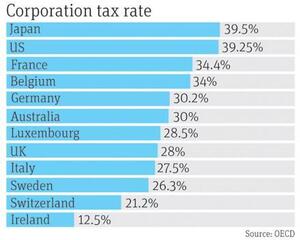

atThe Government is facing a new threat to its corporate tax regime as Germany and France push for the acceleration of moves to create a pan-European business tax system.

The two powers [Germany and France] say in a private submission to European Council president Herman Van Rompuy that urgent measures are required to secure economic growth.

In a paper seen by The Irish Times , they highlight “tax co-ordination” as being among the policies required to bring this about. These include a quickening of moves to create a common consolidated corporate tax base (CCCTB), an initiative once dismissed by Taoiseach Enda Kenny as tax harmonisation by the “back door”.

The CCCTB would not harmonise tax rates but it would create a pan-European tax system for firms operating in more than one country.

.

Pressure Mounts On Ireland Over Corporation Tax Rate (Arthur Beesley, Irish Times)

This is how desperate European investors are for a safe-haven: They’re paying Germany to “borrow” money.

Germany just held a 3.9 billion EUR auction of 6 month bills. The interest rate: -0.0122%.

Essentially Germany is a bank, where the depositor pays to warehouse money. If you’re worried that no other institution will stay solvent during that time, it obviously makes tremendous sense to pay Germany.

Germany Is Now Officially Getting Paid To Borrow Money (Business Insider)

“IN recent days, both David McWilliams and Bruce Arnold have been arguing with some force that Ireland should leave the euro and establish its own currency. They are not alone in their opinions. I believe that people who advocate this line of action are in effect supporting car-crash economics.

If we crash a car and are lucky enough to survive, we will be taken to hospital, put into intensive care and at some stage we will start to get better. And getting better is good, of course. But would anybody crash a car in order to feel better at some later stage? Not very likely.”

Seriously.

Who writes this crap?

Leaving The Euro Would Be Car-Crash Economics (Brian Hayes, Irish Independent)