From top: The proposed development of the new National Maternity Hospital at St Vincent’s University Hospital Campus; Social Democrats TD Róisín Shortall and Fine Gael TD Heather Humphreys in the Dáil yesterday

Yesterday afternoon.

Róisín Shortall TD, Social Democrats co-leader, called on the Government to ‘come clean’ on the position between the Vatican and the State on the New National Maternity hospital, and to halt further spending until ownership is resolved. She said:

“Despite commitments given by Minister Harris in the Dáil a year ago, we’re still waiting to see if the State will own the new hospital, despite being continuously promised that it was to be sorted out and legally secure months ago”, she said.

“It is reckless of the Government to spend €43m on the first phase of the National Maternity Hospital before any resolution of the ownership of the new hospital.

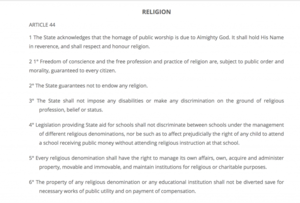

“The new National Maternity Hospital must be fully in public ownership and must operate with a non-denominational ethos. However, this is now dependent on approval from the Vatican.

“It is a shameful position for a Republic to be in that our badly-needed new National Maternity Hospital is waiting for Vatican permission before we can proceed.

“It is not clear when or if the Vatican will give their approval for the disposal of the site.

This Government must stop putting further public monies at risk until ownership and ethos is legally secure. As it stands, the delivery date of 2024 is very unlikely to be met, but without clarity on legal ownership, it is a huge risk to continue to pour money into something that is still in private hands.”

Meanwhile…

Earlier yesterday, during Leaders’ Questions, Ms Shortall had the following exchange with Fine Gael TD Heather Humphreys…

Róisín Shortall: “It is over seven years since the move of the National Maternity Hospital, Holles Street, to St. Vincent’s was first announced. While we know that the care in Holles Street is excellent, the building is antiquated and the conditions are unacceptable for patients and staff. Progress on the new hospital has been painfully slow, though.

“It is over two years since a row broke out between Holles Street and St. Vincent’s about governance structures and the Minister for Health appointed Mr. Kieran Mulvey to hammer out an agreement between them.

“In the meantime, the public was alerted to the fact that a secret deal had been brokered between the two hospitals without any reference whatsoever to the public interest.

“It amounted to the gifting of an asset with an estimated value of approximately €350 million to private religious interests and the new hospital’s ethos being dictated by those interests.

“Is it not the case that the Minister for Health misjudged the situation as being only a tiff between two hospitals? Did he not misjudge the extent of public concern that the new maternity hospital must be fully publicly owned and operated and operate with a non-denominational ethos?

“The Minister was forced to halt the deal and respond to public concern. The Religious Sisters of Charity subsequently announced their intention to withdraw from St. Vincent’s and divest themselves of Elm Park.

“They gave undertakings that the new maternity hospital would be fully public and independent. Despite assurances from St. Vincent’s, the Religious Sisters of Charity and the Minister, however, that has not happened yet.

“Last December, the Minister for Health announced that agreement had been reached with St. Vincent’s and the new maternity hospital would be fully publicly owned. He also said that the legal documents giving effect to this would be available early in the new year, but they have not materialised as yet.

“The Government, however, proceeded to allocate €43 million of public money to phase one of the hospital.

“Does the Minister, Deputy Humphreys, accept that the Government was reckless in doing that before it had title to the site concerned? Will she give an undertaking that no further public money will be allocated to the project and, therefore, put at risk of being lost to the public purse?”

Heather Humphreys: “I thank the Deputy for raising this matter. The project is an important one and the Government is anxious that it proceed. The Government is fully committed to the National Maternity Hospital, which involves the development of a new maternity hospital on the campus of St. Vincent’s University Hospital at Elm Park.

“The governance arrangements for the new hospital will be based on the provisions of the Mulvey agreement, which was an agreement finalised in late 2016 between the National Maternity Hospital and the St. Vincent’s Healthcare Group, SVHG, following extensive mediation.

“The terms of the Mulvey agreement provide for the establishment of a new company that will have clinical, operational, financial and budgetary independence in the provision of maternity and neonatal services.

“This independence will be assured by the reserved powers set out in the agreement and be copper-fastened by the golden share to be held by the Minister for Health. It is important to note that the reserved powers can only be amended with the unanimous written approval of the directors and the approval of the Minister.

“The religious ethos will not interfere with the provision of medical care. I am advised that the agreement ensures that a full range of health services will be available at the new hospital without religious, ethnic or other distinction.”

Micheál Martin: “Who will own the hospital?”

Humphreys: “I welcome the confirmation by the SVHG board that any medical procedure that is in accordance with the laws of the State will be carried out at the new hospital.

“I understand that the Religious Sisters of Charity resigned from the board of the SVHG some time ago and are currently finalising the process of transferring their shareholding in SVHG to a new company, St. Vincent’s Holdings CLG. I am informed that the Department of Health receives regular updates from the SVHG in respect of that share transfer.

“I understand that the Department’s Secretary General will meet the group’s chair this week to discuss a range of issues relating to the National Maternity Hospital project. Engagement is ongoing between the Department, the HSE, the SVHG and the National Maternity Hospital as regards the legal framework to be put in place to protect the State’s investment in the new hospital.

“The SVHG will provide the State with a 99-year lease of the land on which the new maternity hospital will be built, which will allow the State to retain ownership of the new facility. The State will provide an operating licence to the National Maternity Hospital DAC and the SVHG to enable the provision of health services in the newly constructed building.”

Shortall: “I do not know where the Minister got that reply, but it is at least 12 months out of date, having been overtaken by events. It is a disgrace that anyone gave her that reply to read out.

“What she described might have applied more than 12 months ago, but it certainly does not now. We are in a situation where the disposal of the site for the new maternity hospital cannot go ahead without the approval of the Vatican.

“In fairness to the Deputies present, the Minister should have had that information available to her. It has been made clear that we are waiting for the Vatican’s approval before we can proceed with the provision of a new national maternity hospital.

“Does the Minister accept that, as a republic, this is an outrageous situation to be in for the State? The new national maternity hospital’s estimated completion date was 2024, but there is no prospect of that being met.

“Does the Minister accept that it was reckless for the Government to allocate public money to this project without having title to the site? Does she accept that it is shameful that we are waiting for the approval of the Vatican in order to provide a decent national maternity hospital?”

Humphreys: “I have not had a chance to speak to the Minister on this matter, but the intent has not changed.”

Brendan Howlin: “What is meant by the phrase “the intent has not changed”?”

Humphreys: “There will be no interference in the provision of medical care in the new hospital. I want to be very clear on that intent. Doctors will carry out their duties—–”

Martin: “Who will own the hospital?”

Humphreys: “—–and a full range of health services will be available without religious, ethnic or other distinction.”

Shortall: “Will the Minister answer the questions? Will she get with the game?”

Humphreys: “The other issue—–”

Shortall: “It is a waste of time for people to come in here to ask questions only for Ministers to read out incomplete responses.”

An Ceann Comhairle: “Deputy, please.”

Humphreys: “I will ask the Minister for Health to contact the Deputy directly about the other issue she raised.”

Previously: National Maternity Hospital on Broadsheet

Transcript via Oireachtas.ie