From top: Oxfam warning 2014; Michael Taft

The recovery is benefiting one tiny group above all others.

Michael Taft writes:

The One Percenters are back in the news with an Oxfam study showing that the world’s richest 1 percent owns more wealth than all the rest of the planet put together.

So what about our own One percent? How are they doing? Let’s have a look at how that 1 percent and other top earners have been getting along in the crisis.

What follows is based on the EU’s Survey of Income and Living Conditions measurement of income. It is a different concept from what Oxfam used: wealth. Wealth ownership refers to assets – real estate (buildings, land) and financial property (shares, bonds, cash, equities, pension pots, etc.). Income refers to the annual flow, whether it is employee or self-employed earnings, investment income, pensions, etc.

Income is only one measure of economic power and influence in the economy. Profits levels, the relative strength of labour and capital, degree of financialisation, place in the production process, social status, ownership of assets – it could be argued that income is the result, not the cause, of unequal power relationships in the economy.

But it’s an informative measurement and can reveal something of what is happening around us or, in this case, above us.

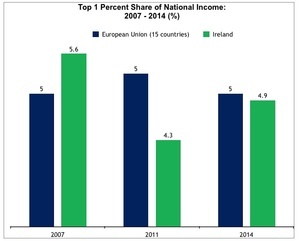

Prior to the crash the top 1 percent held nearly six percent of the share of national income, above the EU-15 average. This fell to 2011 – primarily due to losses in capital and self-employment income arising from property and speculative losses in the crash.

However, since 2011 (and the current government), things are on the mend with the 1 percent trending upwards. Still a ways to go to pre-crash levels but with a little time and a few tax cuts, normal business should be be resumed.

There are other ‘tops’ we can look at.

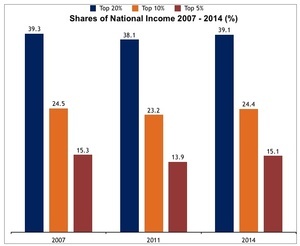

All the top percentages are experiencing a recovery and are returning to pre-crash levels.

Of course, the situation at the bottom is still pretty bottom.

The lowest 20 percent have only an 8.3 percent share (compared to 39.1 percent at the top)

The lowest 10 percent have only 3.2 percent share (compared to 24.4 percent at the top)

The lowest 5 percent have only a 1.1 percent share (compared to 15.1 at the top)

And the lowest 1 percent? It is so low that it is represented in the Eurostat tables as 0.0 percent.

There are many who would see these figures and the first thing they reach for is the tax axe. There’s something to that. Redistribute €250 million from high income groups to low income groups and watch consumer spending, business turnover and GDP rise.

But there is far more to inequality than just income. If there is affordable childcare, I may be able to take up a job or increase my working hours; otherwise I can’t afford the private fees. If I get sick, I may have to wait in a queue because I can’t afford queue-jumping insurance or private health fees. If public transport fees fall, I have more to spend. Public services are vital – not only in order that people can have access to services they might not otherwise, but that access doesn’t leave a further hole in the pocket.

There is also labour power. Giving people in the workplace stronger rights (right to collective bargain, part-time workers’ right to extra hours, statutory Sunday premium and overtime pay, extension of statutory collective bargaining) pushes up wages, especially the low-waged, and bridges the gap between the highest and the lowest by raising the floor.

Then there’s freedom of economic information to allow for a social monitoring of widening gaps. Full business accounts disclosure, including executive remuneration; and the gap between executive and average pay in the firm will allow society, consumers and investors to monitor enterprise performance and take decisions accordingly.

There are many strategies we can pursue to produce more egalitarian outcomes. Failure to do so will facilitate the acquisition of more power and resources at the top.

So, how’s the ol’ One percent doing? They went through a bit of a rocky patch but they’re back on the mend. Unless we take steps.

Michael Taft is Research with Unite the Union. His column will appear here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

OK, Michael, I’ll bite: what are these steps ‘we’ need to take?

Hmmm….murder them?

It’s certainly a bold move, Micko, but I can’t fault your initiative.

Good, I’m in the top 1% as a lot of you probably are. We’ve always had inequality and I’m just happy to be on the good side.

Not unless you’ve got about €20m in your bank account, otherwise you’re just deluded.

Frida you’re completely wrong. €100k annual household income will put you in the top 1% globally.

Never challenge me again.

lol “never challenge me again” :)

he’s a gas craythur

€32,000 will do that.

Or 3 people each on €33k in the one house = €100k household income.

The median household income in Ireland is around 22,000 US Dollars (it’s used as a baseline for comparisons across nations). So there’s a very good chance most, if not all people posting here fall well short of the 100K mark.

Joni, do you make over 350k a year?

http://www.thejournal.ie/top-1-in-ireland-1940955-Feb2015/

If not, you’re not in the top 1% in Ireland – which is after all, the point of this thread.

BOOM! Another man takes his shot at the king and loses badly.

When will you all realise that I do not make mistakes. That’s why I’m paid the big bucks.

Anyway the point of this post is clearly about the world’s richest 1%, not Ireland’s. Read it again and read my post. Good bye.

boom? you’re that overweight moron on salvage hunters, aren’t you?

http://rationalwiki.org/wiki/Danth%27s_Law

Danth’s Law states::

If you have to insist that you’ve won an Internet argument, you’ve probably lost badly.

@Lorcan Nagle

http://rationalwiki.org/wiki/Poncho%27s_Law

Poncho’s Law states::

If you have to state something on the internet, you’ve definitely said nothing (unless you are quoting Poncho’s Law).

Very nice

actually, most of joni 3-cap’s claims are up there:

Corollaries

In the process of the debate a person might make claims about themselves, to bolster their argument, but mostly their ego, that are unverifiable due to the anonymous nature of the internet. However, it is more than likely they are false. These exist as corollaries to Danth’s Law and many examples that are easily found on the internet include:

If someone claims to have a large penis on the internet, the converse is most likely true.

If a person claims to be strong enough to kick your ass online, they are most likely to be a pathetic weakling.

Anyone on a forum saying they sleep with models/strippers/”hotter chicks than that [picture of attractive woman]” most likely has not had a date in over a year, and may well still be a virgin.

Anyone who lists their annual income on MySpace or Facebook at over $250,000 is unemployed and living with their mother.

If someone claims that there is a great deal of evidence that supports their cause, there likely isn’t nearly as much as they claim.

If someone claims that they had used ‘fair and balanced’ arguments in a debate, they most likely did not.

I’ll see your Danth & Poncho’s laws, & raise you the Dunning Kruger effect. Poor Joni.

Nonsense Joni2015, into the dunce’s corner with you. €100K a year will not do it. It’s based on accumulated assets.

I don’t think he read the article, to be fair. Nonetheless, I’ll fetch the dunce hat for him.

joni2015. or Jonotti as he used to be. I’ll bite. I remember you leaving these pages as a snivelling wreck , promising to never return. Why did you come back? Get lonely in fg media office?

i want to know why his affair ended it with him. small langer or insufferable pomposity?

I was running too many at the same time and I took my eye off the real prize.

so you now take solace in the sin of onan.

i understand.

The glorious pyramid of marketing and media driven delusion is shored up and protected from any meaningful societal resistance with the infinite fallacy that anyone can become a 1%er, so don’t rock the boat, commie lentil smelling hippy..

Most people aspire to be a member of that 1%. Ultimately it comes down to the accumulation of wealth being an indicator of three things

a) How successful someone is

b)How powerful they are

c) How happy they will be with more money.

Materialism rules the roost in modern society. As you said its all reinforced by media and marketing…

Bill Hicks said I should kill myself….

@Clampers: You know, I’m old enough to see have seen Bill Hicks live in 1992 and he was wrong about that. Right about Vanilla Ice, tho’.

:0)

Yay!

Most people aspire to a reasonable income, a roof over their heads and live in a state where the citizen is the priority over overly-powerful private corporations – I don’t think most people, when they think about it long enough, would want to be 1%ers, just a reasonable life and health.

‘To be rich is not what you have in your bank account’.

It actually has very little to do with people aspiring to be in the 1% and more to do with power, accountability and the protection of public services and spaces and the environment from the depredations of extremely rich people with a global reach and no ethical and few legal constraints. In other words, it’s about the rise of an oligarchy.

great little country to do business….. and to move your money about without paying taxes, thanks blushirts!

I think you could be onto something with this blue shirts idea, Dav. They are very popular, classic, good in summer and winter, wear well. Screw it, I’m in, we’ll be in the top 1 in 5 years.

Mikey…

whatever happens, promise me you’ll never wear the ones with a white collar and cuffs.

If Broadsheet generated a word cloud would ‘blueshirts’ top the word frequency scale or would ‘Bono’?

The top words would be so sensitive, they’d be [REDACTED]

It’s blu. BLU. Get it right.

the amount of blushirt apologists/sympathisers on this site is sickening.

“Of course, the situation at the bottom is still pretty bottom.”

Who walked past you while you were typing that bit?

Noleen from accounts.

“it could be argued that income is the result, not the cause, of unequal power relationships in the economy.”

A couple of years ago after being made redundant, I tried my hand at an entry level IT sales job. I was on 22k a year and 6 months in, everyone had a contract plonked on their desk with a non compete clause in it. The boss reckoned he was entitled to legal protection from phone monkeys on 22k a year. He didn’t think he had any obligation to give his employees a reason to stay, no, he needed contracts because it’s *his* company and we’re all just assets and not human beings who are helping him make money.

Money is a measurement of value like Celsius is a measurement of temperature. We live in a time where people want to put ‘The Producers’ on a pedestal. That attitude is seen at all levels of society. It’s *their* company. *They* created the company and so they created the jobs and are responsible for money being created. The rest of us are lucky he gave us a chance to pay our rent. If we can somehow introduce an attitude into society where people believe in supply side economics and recognise that a company owner *needs* help from employees and social infrastructure to make money, the wealth gap should take care of itself.

“If we can somehow introduce an attitude into society where people believe in supply side economics”

Oops. I meant the opposite of that. Supply side economics is nonsense.

He certainly had nothing to fear from you leaving

I’m not sure the point you are trying to get across with the story above.

“If we can somehow introduce an attitude into society where people [don’t ]believe in supply side economics and recognise that a company owner *needs* help from employees and social infrastructure to make money, the wealth gap should take care of itself.”

– I think that companies do recognise that they need help from their employees; they just recognise that the skills required by some roles are scarcer than others, and are renumerated as such (I’m sure that the people who are very good at IT sales end up making multiples of 22k each year).

Nice personal jibe at the end. That was the base. The most anyone could earn was 26k.

“I’m not sure the point you are trying to get across with the story above.”

That a lot of employers see their employees as a necessary evil and this attitude is reflected in pay and conditions. He gave entry level staff a non compete clause. Entry level. Instead of thinking ‘How can I make this company an attractive proposition for prospective staff and, in turn, incentivise my staff to stay here?’. No, he thought ‘I’m going to get these students and foreigners to sign a contract to limit their employment options so I can protect my business.’ Attitudes like that are why the wealth gap exist.

It’s pretty simple really, no employees – no revenue – no business. Unless it’s a one man show like solo trader. Cooperatives and partnership are (so far) the best in including employees into decision making and profit distribution.

Look at John Lewis. You can call it “left”, “communists” or whatever, but they do own Waitrose and business going well.

If that were the case, then surely every company should go out and hire loads of employees in order to be the most successful?

Waitrose are successful because they offer a service that is valuable to their customers. I’m sure that the cooperative element is part of their appeal, but not all of it – there are plenty of cooperatives that have failed, too.

I work in a ‘partnership’ & there are lots of downsides too.

One example is in the world of Irish food producing. Kerry Group has wiped the floor with most of the agricultural coops around thecompany (including companies which were originally bigger & more powerful such as Dairygold) and sadly a big part of the reason is that the coops have struggled to be nimble enough, savvy enough compared to a plc.

That doesn’t mean that co-ops are a bad idea. It just means that certain people in certain co-ops aren’t effective. The mindset of co-ops are a very good thing and should be used by more companies. A company is a group of people. That company produces something that people want and thus they create money. Everyone helped make that money so everyone should have a fair share of the pie. Right now, that pie is getting bigger but the people who helped make it are getting smaller slices because people think supply side economics is a thing. Demand creates wealth, not business owners.

Rob-G & Classter, thanx! Co-ops aren’t ideal, agree, but they don’t lock you out of profit sharing because of business structure. If there was one in my industry, I’d try it for a few years. To see what it’s capable of. I do like the idea…

I’m sorry that you thought I was making a personal jibe, I did not mean it in that way. The point I was making is that some people selling software make a lot of money, and there is nothing stopping anyone who makes 22k per annum doing this job getting a similar job and earning 80k or 100k. The ‘inequality’ between the salaries is what makes people strive to succeed.

The ‘wealth gap’ exists because some people’s skills are considered very valuable, and others’ are not. I don’t think that the solution to this is to pay everyone the same; rather, the solution should be to make the same educational opportunities available ot everyone so that they have a fair shot at ending up as the person with the valuable skills.

“The ‘wealth gap’ exists because some people’s skills are considered very valuable”

And a lot of people’s contributions are not valued highly enough because business owners give themselves way too much credit for the success of their business and society, in general, agrees with them.

“I don’t think that the solution to this is to pay everyone the same”

Who said that was the solution?

I work in IT sales and the base is 33k, one chap on my team has made a quarter of a million this year.

“The ‘wealth gap’ exists because some people’s skills are considered very valuable, and others’ are not.”

Eh.. I don’t think so.

Unless you considering bribing and corruption a skill.

The wealth gap exists because there are individuals who are in the back pocket of politicians and are funded by and large by the public.

It’s called welfare when we fund the poor. When we fund the rich, giving them public contracts, preferential interest rates, writes off of debt funded by the taxpayer… they’re just extra smart and skilled. Go way out of it.

Except the Oxfam study has been rubbished by serious economists

http://blogs.ft.com/ftdata/2016/01/18/three-reasons-to-question-oxfams-inequality-figures/

So, no one should take the Oxfam numbers too seriously. But if you are inclined to, here are three additional reasons for caution.

1. The Oxfam numbers are made up

Every global economic statistic is made up to a certain extent; Oxfam’s are more than most. The charity splices together data on the richest individuals from Forbes, designed to sell magazines, with data on the rest of the world from Credit Suisse, which itself is compiled from a host of incompatible sources.

So, the authors have a responsibility to be careful with it and refrain from big claims when using it. Oxfam is a little lax, particularly making a big deal of changes in made up numbers.

2. The wealth measure is problematic

Lots of people have pointed this out, but the Credit Suisse measure of wealth is one of net worth (assets minus liabilities), so it treats a recent US graduate on a huge income, but with student debt as poorer than a subsistence farmer in China. This explains why North America appears so unequal in this chart from the Credit Suisse report.

Just so people have a sense of what you need to be in different parts of the global wealth distribution in this chart: $500 total wealth – an iPhone say – will put you in the third decile; $10,000 total wealth – an aged car say – will put you in the eighth decile; $70,000 will put you on the far right of this chart, the 10th decile; and most people owning a London property will have more than $760,000 wealth and put you in the supposed plutocrat zone of the global top 1 per cent. All these figures come from the Credit Suisse tables. Footnote 31 of the Oxfam report gets closest to reporting these useful figures, but doesn’t quite nail it.

3. The rising US dollar mucks up all the numbers

Seemingly the most interesting finding in the 2015 Oxfam press release is what it found to be a “dramatic fall in wealth of the poorest half of the world“. This comes straight from the Credit Suisse report and the reason is obvious. For a reason I do not understand, Credit Suisse aggregates domestic estimates of wealth via market exchange rates rather than Purchasing Power Parity rates, used the International Monetary Fund and others to do similar sorts of comparisons.

The effect is that wealth in every country which has depreciated against the dollar (most countries in 2015) is likely to fall unless it has grown domestically more than the depreciation. Credit Suisse wrote this in its first sentence: “Global wealth somewhat dropped in 2015 due to the strong US dollar, according to the “Global Wealth Report 2015″. Oxfam did not think this was a relevant fact to mention. As the following chart from Credit Suisse shows, the change in national wealth is almost entirely linked to the size of last year’s depreciation against the US dollar.

Thanks for posting Mr Mayor

+1, very illuminating

That 1%, they never waste a good financial disaster. In fact they’re the ones helping to blow the bubbles in order to create financial disasters (which they can then apparently benefit from). They were the bank chiefs who engaged in reckless lending knowing full well they were stoking a bubble that would have to pop some day. Just make sure you are well positioned to capitalise on that.

Unless income is equal across the board, the bottom 20% will always have a lower share of income than the top 20% of earners. It’s a tautology.

Unless we start paying more welfare, the share of income of the bottom 20% will be stagnant. This is also a tautology. There may be some push in this quintile as a result of minimum wage increases, but you simply cannot compare unskilled and non-working people against those with scalable jobs. As per Ronan Lyons in 2012 (http://www.ronanlyons.com/2012/04/10/paying-tax-in-ireland-where-the-richest-and-poorest-pay/), we see that the majority of income in this sector is transfers [NB, I’m not him, we simply share a first name]

By and large I support controlled increases in minimum wage, but not welfare. As per the CSO graph included in Lyons’s article, the 3rd and 4th decile still have a majority of income as transfers. If we can target these underemployed and working poor with training and wage increases, we can encourage workforce participation in the 1st and 2nd deciles.

For me, the answer isn’t more social transfers, it’s more pay and better services. As a household in the 10th decile, I think it’s ridiculous that we will pay 1700 less tax this year while services remain poor. I’d much rather that tax was used to restore necessary services. That money could be used to provide a few days of care for a child/adult with intellectual or physical disabilities, allowing the parent some freedom and time to do part time work. That might get that 2 person household out of the 1st/2nd decile and into the 3rd/4th. Some education for that carer might even massively improve their situation in a 4-5 year time frame and allow full time work with a combined public grant and some fees for care.

Some people (e.g. the carers example above) are genuinely locked into that welfare trap. Others need encouragement – not by cuts but by seeing the 3rd/4th/5th deciles growing in prosperity.

Alas, the last time we attempted to improve conditions, we backed a housing boom, hopefully a more sensible and sustainable approach can be taken in future.

I like this.

It’s not about just income though.. read it again.

More like this, please!

Capital Gains needs to be included in income calculations. Until then, the real balancing of wealth in a fair society is a pointless exercise. The see-saw won’t work if the child on the other side has a gold bar in their pocket weighing them down.

How did the 1%ers make their money? Ignoring royalty for the sake of this discussion.

If you are Bill Gates, you came from comfortable circumstances, got into good college, met the right people and had a good idea at the right time and ruthlessly pursued its success.

Warren Buffet was the son of a politician, so also from comfortable back ground. But who had a serious knack for investment.

Donald Trump got a $1 million loan from his Dad.

Our own guys?

Quinn, inherited the family farm that was turned into a gravel making business.

DOB ‘s Dad was in business, he attended fee paying school etc etc

Michael O’Learly, Clongowes, Trinity College but at least famously pays taxes here.

Point is, money comes from money. Comfortable middle class, private education.

No wonder the Blackrock old boys put up such a fight when Quinn tried to change school admission policy.

The question is, do you want to stop the creation of business and wealth? Or just limit its benefits to the generation who created it and stop excessive inheritance?

It’s demand that creates money. Giving more people a chance to meet or even create demand is not going to stop the creation of business and wealth, it will enhance it.

fir every example you gave of someone from a comfortable background doing well, there is aother example of someone coming from nothing.

The one thing they all have in common is that they work their feckin asses off. Much harder than you or me or, probably, anyone reading broadsheet right now when they should be working.

That’s all rather convenient.

A lot of people inherited a family farm. Very few of them did what Quinn did.

Very few of DOB’s or MOL’s classmates have made as much money as they have.

How do you explain people like Tony Ryan, Eugene Murtagh, Ray O’Rourke, etc.?

All of them came from varying backgrounds – but in all cases they are relatively speaking far wealthier than their backgrounds.

What are Michael Taft’s qualifications? Idle curiosity .

Well, as a relatively senior white collar professional in a rich country, Michael Taft is probably among the top 10% richest people in the world, definitely in the top 20%. So, will Michael Taft give away all of his money for free to poorer people in Africa and Asia? Of course he won’t, he would rather keep it, as I imagine the ‘1%’ that he is talking about do, too.

Chomsky was born into a middle class Jewish family…. yet no one is questioning his motives.

Have you a point to make at all…. or are ya just having a go at someone?

Also, have a read… http://www.theguardian.com/commentisfree/2016/jan/06/born-into-privilege-still-want-change-world

I look forward to the day when the 1%arrange for a law to pass that says that anyone who critices inequality must immediately give all their possessions away. Don’t you think that sounds like a good idea?

Well, he seems to be saying that people with who have worked hard and earned lots of money should have it taken off them and redistributed to ‘low-income groups’ (presumably regardless of whether they have earned this money or not); I was merely pointing out that that Michael Taft would himself be part of this ‘high-income group’ in global terms, and that he should lead by example by divesting himself of any excess wealth.

“he seems to be saying that people with who have worked hard and earned lots of money should have it taken off them and redistributed to ‘low-income groups’”

And THAT is why the wealth gap exists. Exactly because of beliefs like that. He didn’t earn that money on his own. He had lots of people in his company help him. Someone paid for and built the roads to transport his products. Someone paid for and built the shops his products are stocked in. Someone paid for the education and training of the staff in those shops that stock his products. Someone paid for the busses and trains that got them to work. That’s not all his money.

“Well, he seems to be saying that people with who have worked hard and earned lots of money should have it taken off them and redistributed to ‘low-income groups”

Yeah, the 1% that own most everything, just work extra extra hard.. all day and all night.. They’re like vampires or something working around the clock..

These people don’t work, their assets and money works for them.. they’re in a position to lobby politicians for policies/contracts that enable them to acquire more.

Come on ffs.. they don’t work in the same sense you and I work.

Exactly. Better we live at the whims of our oligarchs and their passing fancies rather than structured laws and systems of taxation and public services!

The concern I have with these rich people is once they have succeeded and get bored they tend to spen their money on causes, and they can have more power and wealth than some governments.

Thats all well and good when someone like Elon Musk wants to spen his money on electric cars and going to space.

but people like George Soros , just look at what he spends his money on and the trouble that has caused …

Increasing standards of living at the same time as increasing “inequality”. Difficult to say that a more equal world, where everyone’s standard of living was lower (ie if we went back 20 years) would be a better place. This isn’t to say we shouldn’t seek to balance out equality better, but perhaps its not as black and white as good vs bad. A billion or so Chinese and Indians have gone from very poor to middle class in this period, remember.

and this is why it’s smoke and mirrors to try to blame “welfare scroungers” etc for the state of our economy.

eat the rich.

Heh heh heh. Taft, you old dog.

the current government have shown numerous times in their tenure that theyre very supportive of the 1%. I don’t see that changing, no matter what party are in power next. There seems to be a template in the Dail, constructed over years by FF. FG came in and just followed it.

this Government are desperate to join the 1%.. by fair means or foul….

no……by foul means totally!!!

So Ireland is more equitable now than before the crash.

Yikes, that first bar-chart is awful – the blue EU values are wrong – either they are not all 5, or the middle bar is too high. And bar charts should start at zero – we are only seeing the top of the charts… we’re missing the bottom 3.5 on the bars. 4/10

Pitchforks people….the pitchforks are coming.

https://www.ted.com/talks/nick_hanauer_beware_fellow_plutocrats_the_pitchforks_are_coming?language=en

Problem is guys the recovery is an illusion. We are heading straight into another recession. the policies enacted have not worked. We have not dealt with the underlying issue which is debt.

Commodiities griding to a halt, oil in particularly. China slowing down. Spain and Italy are in a very precarious position.

House of cards.

There’s a lot of it about

These types of articles are far too erudite for the

Diseased Badgers on here