Last year’s Dubai Irish Derby, Curragh, Co Kildare ; Michael Taft

The recovering economy will lift all boats, we are assured

But beneath the surface all is not well

Michael Taft writes:

The economy is in strong growth, but if polls are anything to go by most people are not feeling the breeze. As Goodbody economist Dermot O’Leary says:

‘While people broadly accept that the country is better off than a year ago, a large majority believe that it has not yet benefited them personally. One recent survey suggested that only 15pc of people feel that they have personally benefited. Trickle-down economics appears to be clogged up.’

For many this will change over the coming months. Employment is rising, wage increases are occurring. However, social protection payments, with the exception of pensions, have been largely frozen (that is, they have been cut in real terms) and there is some evidence that wage increases are primarily going to managers and professionals.

The CSO shows that in the last two years, weekly income for managers and professionals increased while all other employees (sales, clerical, service, production, building and transport workers) saw their weekly income fall.

Trying to nail down the ‘who is benefitting’ numbers from the data can be difficult, as in many cases it lags by a year or two and in other cases it doesn’t exist. So we have to go about connecting-the-dots.

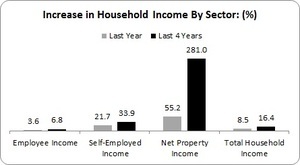

With the help of Seamus Coffey’s useful post on household income, we can make a start. This tracks the rise of household disposable income by comparing the first nine months in each of the last four years.

Seamus’s full table can be found here; what follows shows the increases in the main income categories.

Total household income rose by 16 percent over the last four years. Employee income rose by 7 percent, while total self-employed income rose by over a third.

Net property income – mostly dividend income according to Seamus – nearly trebled, though this is a small category.

Another way of looking at the data is:

In the last four years, employees received 32 percent of the total rise in household income (in the last year it made up 28 percent)

Self-employed took 46 percent of the rise in income (54 percent in the last year)

Net property income accounted for 22 percent of the rise in income (18 percent in the last year)

Clearly, it is self-employed income that has been the main beneficiary of the rise in total income. Who accounts for this? Farmers, professionals (doctors, lawyers, consultants), craft workers? The data is silent. Nor, from this table, do we know how the increases are distributed among different income groups.

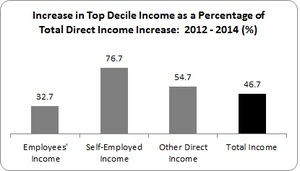

Let’s turn to another dataset – the Survey of Income and Living Conditions (SILC). This cannot be overlaid on the above data which is taken from the national accounts – different methodologies, slightly different categories. The data from SILC refers to equivalised income – that is, it takes account of how many people are living in the household.

However, we can get a sense of who is benefitting (the CSO didn’t publish the 2011 data, and 2015 will come on stream later this year).

What is this table telling us?

Of the increase in all direct income (direct income excludes social transfers), the top 10 percent income group took nearly 47 percent.

Of the increase in employees’ income (wages and salaries), the top 10 percent took nearly a third of the total increase in employee income.

Regarding self-employed income, the top 10 percent took 77 percent of the rise.

And 55 percent of the total increase in Other Direct Income (in SILC this refers to interest, dividends, rent and private pensions) went to the top 10 percent. It would be reasonable to assume that increases in employee income are more widely distributed among different income groups; less so for self-employed and other direct income.

So let’s summarise:

Household income is increasing. In the last year it jumped by 8.5 percent. However, over 50 percent of this rise was taken up by the self-employed with another 18 percent going on net property income.

Within the self-employed, SILC shows that the main beneficiaries are the top 10 percent; ditto for other direct income like dividends and rent.

So we have a clear and substantial rise in overall household income. However, when we look below the surface we find evidence (not necessarily conclusive evidence but certainly persuasive) that most of it is landing in the pockets of the self-employed and capital/private pension income – and most of that is landing in the pockets of the top 10 percent.

Maybe that’s why people are not feeling it. Because the money is not heading in their direction; nor is there any uplift in social transfers.

In any recovery boats lift at different times and at different rates. That’s why in the upcoming election it’s not enough to learn about what parties will do about growing the economy.

Just as importantly, we need to learn how they are going to spread that growth around, how they are going to ensure that all boats are lifted; and what special attention they will give to the many, many small boats that are in bad need of repair.

Otherwise the economic pond will be dominated by a few big boats which will sail right over the rest of us.

Michael Taft is Research with Unite the Union. His column will appear here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

“We’re going to need a bigger boat!” – Apologies in advance.

You know things are good when people pay to go to things like taste of Dublin and get sloshed on champagne.

You know things are ok when you meet a pal in a pub once a month for a few pints and talk about not having been to the pub in a month.

You know things are bad when you bump into people from foxrock in the Lidl in Liffey valley just so their neighbours won’t see them there.

Of course things are better now. Look at the amount of people who appear to be able to afford living in hotels. Incredible!

And don’t forget the increase in the tourist industry. we seemed to have tapped into a new market in the middle east.

I still can’t believe people ever thought trickle down economics in an individualist society based on capitalism would ever work.

the elites are creaming it thanks to their loyal blushirt/labour serfs

Top 10% are people who earn over 75,000 per year.

Source: http://www.irishtimes.com/opinion/super-rich-or-super-angry-where-are-you-on-ireland-s-income-pyramid-1.2104861

If you have more disposable income, you are more likely to be in a position to invest it in other income generating activities such as pension or property investments.

If you are on social welfare, you can’t do that, you are surviving week to week.

So the rich get richer and the poor don’t.

Here’s the question, what should the weekly rate of unemployment assistance be?

not sure, but corporation tax should be 15%

How did you get to that 15% figure?

The trickle down expected from quantitative easing has not occurred. That money has gone towards buying high end investments and stocks. It’s been a handout to the rich who. And even though it has not worked, Mario Draghi thinks more of the same is the solution. And why is inflation seen as something desirable by the likes of Draghi? The inflation he can create is just a result of a devaluing currency as it’s value gets eroded away via the printing press. Deliberate central bank induced inflation is a deliberate tax on anyone holding that currency. The major currencies are competing to devalue in the war fro trade. Might be time to get out of fiat currency and into stuff. Sticking money in a bank is pointless too.

“Might be time to get out of fiat currency and into stuff.”

Gold is just a rock. It only has value because people want it, just like fiat/paper.

Gold has intrinsic value. A €100 banknote has none, other than as kindling.

I’m not sure if I understand this correctly.

Say we have two people John and Mary. John earned €10 per hour; Mary €90 per hour;

They both got pay rises. John got 15% extra (an extra €1.50) Mary got 5% (an extra €4.50).

So even though John got three times more of an increase (in percentage terms) Mary got three times the actual increase. (Of the €6 pay rise, John got 25% and Mary got 75%.)

So is this not a reflection on the base inequalities in pay rather than who is benefitting from the increase?

Good piece, I would be very interested to know why CSO didn’t release the 2011 SILC data, has the transparency agenda not reached the emerald isle yet?

H – no, it is more prosaic than that. They discovered a sampling error the year before and combined two years together. Some items didn’t feature for space reasons. However, they are very helpful and will provide information if requested. Their contact email is available on the website.

I wish those collating public opinion would bear in mind they’re analysing the thoughts of Irish people. The question of whether an Irish person feels good about the country, the economy, the outlook of the nation, any of it will pretty much always be negative. Try to imagine the scenario where the average Irish person would answer, in all seriousness, that they’re happy with how things are going with the country. It just wouldn’t happen.

Also bear in mind that those same Irish people would have denied things were any better during the “Celtic Tiger” years either; there was no acceptance of any kind of improved situation amongst the people of Ireland until we were absolutely certain it had disimproved, at which point the only logical position is to accept things were indeed better between 1996 and 2007.

Totally agree!

Complaining is a national pastime.

in summation .. “this info is from irish people. all irish people are negative.” … that’s some general sweep there. The (first) irony is, the negative people all seem to be broadsheet commenters, and yet they always come on here saying we’re a nation of begrudgers. the other ironic thing is your comment is incredibly negative.