From top: Shane Colemen in the irish Independent; Michael Taft

The debate on the burden of the ‘squeezed middle’ is cynical and ill-informed

Michael Taft writes:

Newstalk presenter Shane Coleman asks:

‘So who’s representing those who earn €35,000-€75,000 – the squeezed middle?’

To be fair to Shane, he’s not the only person asking this question nor is he alone in posing this question in those income ranges. But, oh my.

The debate over the ‘squeezed middle’ is one of the more ill-informed and cynical you’ll come across. It is led in many cases by politicians and commentators who make assertions without substantiations, claims without facts; all of which leads to policy proposals that are at variance with equity and economic efficiency.

In many cases the numbers are just made up to rationalise a pre-determined policy preference.

In short, it’s a terrible debate.

The problem starts with the definition of the ‘squeezed middle’. This should be a relatively straight forward statistical issue.

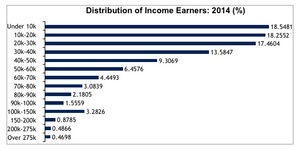

If we are looking at ‘income earners’ (PAYE employees or the self-employed) we can go to the Revenue Commissioners database for a rather crude but revealing headcount.

We can see there are a lot of low earners. 54 percent earn less than €30,000. From this we can estimate the median wage (the income level at which 50 percent earn above and 50 percent earn below) to be €27,550. Welcome to the squeezed middle. It’s a long ways off from €75,000.

There are a few problems with these Revenue numbers.First, ‘married couples with both spouses working’ are counted as one tax unit. Therefore, in this category, an income unit of €30,000 could actually mean that each spouse in the household earns €15,000 (or any other variant).

Second, these numbers include pensioners who have taxable income such as an occupational or personal pension, investment and property income. Most pensioners would be at the lower end of the table.

Third, the table includes churn. People who come into the tax net by taking up a job may do so only half-way through the year so the tax unit may refer to six months. Similarly, with people exiting the workforce.

We can try to adjust for some of this by disaggregating couples with two incomes. When this is done, we find the median wage falls to €25,200. We still have, though, the problem with pension income and churn.

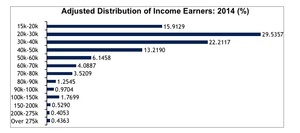

A number of commentators prefer to focus on ‘full-time’ workers. I’ve never been convinced of this approach as it excludes so many part-time or near-full time workers.

Nonetheless, let’s work this, adjusting for couples with two incomes and excluding all those earning below €15,000. Even doing this we will be including some part-time workers (e.g. someone on €20 per hour working 20 hours a week will be above this €15,000 threshold).

Even when excluding all income earners below €15,000 (about 27 percent of all income earners), we still find a significant number earning below €30,000 – over 45 percent.

From this we can estimate the median wage to be €32,050 with 50 percent earning below that amount. The middle is still very low.

So what is the squeezed middle?

The OECD uses a formula to define the broad middle: between one-third below to two-thirds above the average (median) wage.

Using the median wage for all income earners (the first table above) we find the squeezed middle to be between €18,500 and €46,000.

Using the median wage for adjusted income earners above €15,000, the squeezed middle is between €21,500 and €53,500.

This puts the issue of helping the squeezed middle in a new perspective.

We would have to look at things like the minimum wage and living wage, strengthening and extending Joint Labour Committees for all low-paid sectors, increasing social protection programmes such as the Family Income Supplement – in addition to affordable childcare, affordable rents and lower public transportation costs.

Note that most of this doesn’t even get mentioned in the debate over the squeezed middle.

But there is a big, big caveat in all this.

There are a lot of people in society who are not included in the Revenue database because they are not PAYE employees or self-employed: most pensioners, carers (mostly women working in the home), the ill and disabled who can’t work, and those out of work. They should count, too. If they did, the squeezed middle would be a lot, lot less.

For instance, in 2014 the median household income was €40,336. It should be remembered that this includes all income from all people in the household, including social protection income (e.g. Child Benefit, rent supplement, etc.).

And the figure above includes employers’ social insurance (an accounting convention). If you remove that the median household income is closer to €37,700. 50 percent of households earn below that amount.

No, the squeezed middle does not go up to €75,000 or anything like it. If you earn €75,000 you are in the top 10 percent earning bracket. If you earn €50,000 you are in the top 22 percent earning bracket.

This is not to say there are not issues in these above average households. There may be a number of children, high debts from a Celtic Tiger mortgage, etc. But we need to keep a perspective. And to do that is by first getting a robust handle on what we are talking about.

IF we do that, we will have a better chance of getting the policy right.

Michael Taft is Research Officer with Unite the Union. His column appears here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

Michael – you are totally correct on the terminology. When Coleman writes about the ‘squeezed middle’ he is really talking about the fourth quintile of the income distribution. Households between about 60% and 80% of average earnings.

He does have a point, however. Many of these households need to pay urban housing costs to work in jobs that pay above average. It is very hard to earn a high income working part time so many of these households have large childcare costs as well. Public transport is poor quality and expensive and a second car is often essential for a second income.

Compared to other countries, this group pays very high MARGINAL tax rates and quite high AVERAGE tax rates on personal income. In addition they face high out-of-pocket costs for things like healthcare and relatively high indirect taxes too. Compared to high-income earners in most European countries they do not get much back in terms of subsidised childcare, healthcare or decent public transport.

The number of jobless households in Ireland is high in comparative terms (and thankfully falling). The tax and transfer system is the most re distributive in Europe. If you are working and on a high income in Ireland you are not getting a huge amount in public services and you are supporting a lot of working-age adults through the benefit system.

I am not making a value judgement on this phenomenon. But we should not imply that it does not exist.

“and you are supporting a lot of working-age adults through the benefit system” – I’d imagine quite a bit less than supporting maltese or dutch tax residents.

Fact Checker – you raise a number of points. First, the quirk of the Irish tax system is that while average income earners face the third highest marginal tax rate, they experience the lowest average tax take in the EU-15 (these are headline figures). As one moves up the income scale, Irish income earners don’t pay a higher average tax rate compared to other Europeans.

Second, I agree that most income earners don’t benefit from the kind of in-work benefits that other Europeans do while services like transport, childcare and health are relatively poor quality. It’s not that employees don’t pay enough tax – the Irish effective tax rate is average or a little below average by EU standards, depending on how you measure it. A major contributing factor is the ultra low-level of the ‘social wage’ or employers’ social insurance. We have little appreciation of the role social insurance plays in paying for benefits and services in other European countries. This is not to suggest that money alone will solve their problems (think the health system), but under-funding in many areas doesn’t help.

Third, Ireland’s redistribution system does work – it should given that we have one of the highest levels of market inequality. However, what’s rarely mentioned is that after redistribution, lower decile groups have less resources than in our peer group countries.

Two things here – if we want affordable childcare, lower public transport fares, affordable housing (rents) then we need to invest. Tax cuts will not address these issues.

But most important, we need a fact-based debate. Supposition and pre-conceptions will only maintain the fog that is the Irish debate.

Some links re: comparative taxation. http://www.nerinstitute.net/blog/2016/10/01/tax-heresies-and-halfbaked-truths/

http://notesonthefront.typepad.com/politicaleconomy/2016/09/tax-lies-and-statistical-tape.html

Thanks Michael for the links.

I stand corrected on the average tax rate on high-income workers. It is not particularly high in comparative terms.

There is a broader debate needed on PRSI (maybe for your next column?) and in particular what its purpose is. A number of issues:

-Rates (employer and employee) are very low in Ireland but the base is broad

-The social insurance fund is not really a fund in anything but name

-Very few benefits for those in work since optical and dental were cut

-Contributions can vary wildly over a lifetime but contributory and non-contributory benefits are extremely close

We could do a few things:

1) Simply roll PRSI into USC and acknowledge that we have a PAYG benefits and pension system with poverty alleviation as its target

2) Direct PRSI into individual personal pension funds (very low fees, passive investment strategy done by the NTMA)

3) Raise the rates and use it as a purchase fund for medical benefits, link benefits closer to contributions, etc.

As it currently stands PRSI is just another tax. There are plenty of ways you can go on this and a good public debate is needed.

Fact Checker – yes, yes, yes to your three suggestions. I have written a fair bit on this subject on my blog. We need to move to a strong insurance system to promote social security, increase resources and ensure that our social protection is not just about poverty but truly protects the social; namely, to redistribute benefits to those in work, whether cash transfers, in-kind benefits or low-cost (or free) access to public services.

“I am not making a value judgement on this phenomenon.”

You totally are.

A lot of those high-income individuals had cause to fall back on that same benefit system they’re single-handedly suffering and sweating and killing themselves to fund like heroes of song during the downturn.

Poorer people than them pay the same transport and childcare costs.

They may not get much by way of a public health system, but they get no more than anyone else when it comes to acute care – and crucially can afford to skip the queues should they need to.

There are people finding it tough with mortgages and high legacy overheads in every income bracket. But it’s perverse to pretend that somehow hardest up in our society in need for billions of relief are the people earning above average salaries. Lets make sure everyone has a roof over their head before we give relief on luxury cars, yeah?

Priorities, basically.

Where is there a suggestion that there was to be relief on luxury cars?

It is hard to find anywhere in Europe where it is more expensive to purchase and run a luxury car. Denmark maybe.

My point was that because public transport is so poor in Ireland it is often necessary to have two cars in a family to have two incomes.

Interesting how some posters are happy to engage up a grown-up conversation about taxation and inequality while others are more interested in snide sarcasm and jumping up and down about how right they are.

+1

That was a fascinating little back and forth from Michael and Fact Checker there, with mutual respect and willingness to see the other’s side. And then… well.

And then…well – What? If you have something to say, then say it. Jaysus, the curse of this country, many are prepared to snipe, or damn with faint praise, but fence sit as if their lives depended on it. This is an internet forum Yeah OK. the powers that be won’t give out to ye – g’wan, take a risk and give us your actual opinion on this article – if you have one.

Interesting data there, couple of observations:

Pensioners: ” taxable income such as an occupational or personal pension, investment and property income.” “Most pensioners would be at the lower end of the table”.

Pensioners are not a homogeneous group. There are those who live on state pension only but there are others who are among the wealthiest people in the country. They have had a lifetime to build wealth, acquire assets. They include retired teachers, civil servants, politicians, bankers etc who are very well to do.Even in the middle, the kids a reared, house aid off no debts and medical expenses covered. If we think all pensioners are poor, we need to think again.

Michael is right. Pensioners tend to be found in the third decile of the income distribution (20% to 30%). Very few >65s have high incomes in cash terms.

What the vast majority of over-65s DO have is an owner-occupied house or a low social rent. This is not the case even for 35-year olds. So in practical terms a pensioner on €x is likely better off than a 35-year old worker on the same amount.

Agreed.

So RTE’s news and current affairs audience is even smaller than I thought.

There is one a theory that in order to combat low pay is to expand the economy.

Tax breaks have no effect on low paid, as many are outside of the tax net.

If you are just about surviving, any money you have is going on absolute basics – housing, utilities, food.

If say, USC is reduced, more money in pocket of workers without rising wages. More money is spent, cash injection into the economy, more jobs created and economic engine cranked up. As economy improves, more job options so pay needs to improve to keep people taking them out of low pay. More tax paid, so those who can’t work (pensioners, carers, disabled) can have better rates. People who are part time go full time.

Why USC though?

Why not income tax or PRSI? USC is great because it’s un-get-roundable for the big wigs.

And wouldn’t a chunky reduction in VAT be more equitable than an income tax cut considering the poorer you are the higher percentage of your income you pay in that tax?

Because USC particularly inconveniences the better paid, there being no way they can avoid it. Hence all the thundering against it whilst PRSI, which confers no entitlement worth having, is relatively unchallenged.

The more franchises you get, the more low paid workers you get. Franchises kill off some local businesses and replace them with transient workers on minimum wage wheres the previous business may have made less profits but put local money back into local workers.

Franchises do have their benefits (defined standards, economy of scale) but they have no local loyalty at all.

From what I can see, the problem with the Squeezed Middle debate isn’t the definition of the middle but who is to blame for the squeezing. A poster on this thread, as have plenty others in different contexts, is trying to apportion blame to the poor; it’s somehow the fault of some depressed alcoholic who never leaves his bedsit that some marketing manager isn’t getting full value from his wage. Pat Kenny tried to blame ‘irresponsible water users’ while interviewing someone whose organisation traditionally gets their support from the working class.

54% being on less than 30k tells its own story. We are the American dream; A nation of delusional lackies with aspirations of social mobility so strong that we’ll completely ignore the transgressions and crime being perpetrated by society’s elite and focus solely on people under us on the ladder so we can subconsciously tell ourselves we have the approval of any onlooking elitist and have a chance of joining them.

Millionaires get break after favour after unfair advantage but most people will ignore that and snipe at tram drivers on 32k a year instead. The middle will continue to get squeezed if we ignore the real reason.

Absolutely spot on, Moyest, and thanks to Michael Taft again for this excellent article.

Yup. In a nutshell, Redacted is laughing at the Newstalk Audience, sharpening their pitchforks to have a go at ‘scroungers’…

We do need to look at low pay as a problem in itself. there are people who are in low pay partime jobs in retail becase the hours suit childcare arrangements. Having a proper childcare structure would help alleviate that.

There are others who don’t have skills or education to move up the jobs ladder. How to we upskill working poor.

And we need to implement #LivingWage so that anyone who is working has a realistic expectation that working = progress not a dead end.

Any company making millions should not have employees who need FIS to supplement wages. Corporate welfare needs to be tackled.

Again, well said Dublooney. However. can we have some realism also? Looking at all the fora it appears that EVERYBODY should be working in IT, Financial Services or entertainment to be worthy of consideration. If EVERYBODY does that – who grows /rears /processes our food? Who manufactures the thousand and one things which are so essential for a comfortable life? Who mans the baby farms and granny’s farms so beloved of “investors”? Who builds the infrastructure? I am so tired of the attitude of some posters who denigrate all of these things which are so essential for their smug, comfortable lives.

“I am so tired of the attitude of some posters who denigrate all of these things which are so essential for their smug, comfortable lives.”

Aye. Irish Labour is very British New Labour these days; as in not actually Labour anymore.

If it is income per household then a couple on €75k will take home €4,951 net a month (assuming that they have no pension deductions). if they live in Dublin and have two children their childcare costs can modestly be estimated at €1,800 (it could be a lot more in some creches) and if they are lucky enough to own a home with a mortgage of €300,000 they will be paying around €1400 a month to the bank (if they are not, they could be paying even more in rent). That means outgoings of €3,200 and a remaining €1,751 for food, bills, transport, heating, pensions, healthcare, clothes etc between them. I’d call that pretty squeezed. Dublin should be considered separately from the rest of the country where €75k between a couple would allow for a very comfortable standard of living

A couple with a family on 75k living in most parts of Dublin might consider themselves squeezed.They can pay their bills and have something left over.

A couple with a family on 40k by comparison, should be considered squashed. And have been for sometime.

Keep in mind, when FG speakers talk about the “squeezed middle”, they often include single people on 60-75k or couples on 150k.

I recently moved to the UK and even with the lower Sterling rate it’s unbelievable how far further your money goes. Taxes are lower across the board, rent is reasonable, groceries are good value, car tax doesn’t kill you. A pint costs £2.50. In Ireland everywhere I turned it was a rip off to the point where the fun was taken out of doing anything. Over here you can have a reasonable standard of life and save at the same time. I’m simply too tired paying so much money for everything and having nothing to show at the end of the month. It’s just my anecdotal evidence but instead of taking aim at each other in class warfare, we should be attacking our government to determine where all these losses are happening and hold them accountable.

Believe me DRC I am MORE than ready to attack this Government and every rotten structure which supports the status quo. Our comfortable, pampered politicos believe revolution is a century old and could never happen again – they should think on.

Are you insane? Rents reasonable? You’re obviously not living in London.

And taxes lower? Are you exempt from council taxes, water charges and the like?

Is that Northern Ireland?

Because you must be about 500 miles from London.

What decade did you move to??