Average rents by county in the third quarter of 2018, according to the Residential Tenancies Board (RTB)

…Amid continuing unprecedented demand, the national average rent rose to €1,122 during the quarter, up 7% on the same period last year.

But a moderation in that pace of growth is also evident, with rental price inflation dropping to 1.9% compared to the previous quarter when it was 3.6%.

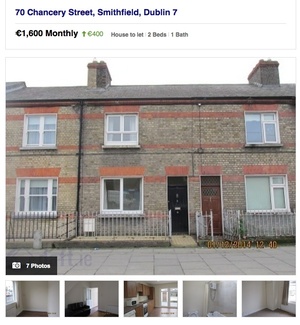

In Dublin, the rate of increase was higher than the national picture at almost 9%, bringing the average rent in the capital to €1,620.

The index also found that areas designated as Rent Pressure Zones are seeing a slower pace of rent inflation for people who already have a tenancy.

However, one concern for the future is that the number of landlords is falling, despite high rental prices and record demand.

Rents still rising, but number of landlords falling – RTB rent index (RTÉ)

Eoin writes:

This report, jointly produced by RTB and the ESRI [The Economic and Social Research Institute], is controversial. Ireland’s #1 landlord Kennedy Wilson (which has leapfrogged #2 IRES), disputes the figures and I agree with KW, the figures appear to be based on new tenancies only.

The report has been released for previous quarters, timed to boost Eoghan Murphy’s political status (eg published day after vote of no confidence, published on day Eoghan visited the ploughing championship to announce policy changes etc), this is the earliest the report has been published. It appears to have been given in advance to the Irish Times only…

Hmm

according to last week’s IT opinion piece by roisin shorthall, 79% of workers don’t earn enough to pay the to rate of tax. ergo less than 34500.

I do hope this 79% are on the social housing list. forming a q of thousands down Dame St would send a nice message of protest. HAP stravaganza

everyone over the age of 18 who do not own a home should get themselves on to the housing list

Wait, so people on less than 34,500 cant afford to pay the rate of tax, what rate exactly.

“… the number of landlords is falling, despite high rental prices and record demand.”

Hmm, I wonder why that could be…

are they selling at the sweet spot?

Some of it would be accidental landlords who were in negative equity, for whom it now makes sense to sell, certainly.

Another reason would be if a landlord has a non-paying tenant, it could take up to two years to get them out; I’d say many small-time landlords are leaving for that reason, too.

The stock of private rental units can increase even if the number of individual landlords falls.

You just need consolidation in the sector.

The tax, financial and regulatory landscape has tilted much in favour of institutional vs small-time landlords in recent years.

Private small-time landlords still supply the vast majority of rental units in the country; if they are leaving the sector in increasing numbers, for whatever reason, it will likely put an upward pressure on rental prices, in the short term at least.

Because being a landlord is not worth it anymore especially if your property is in positive equity. You are literally one bad tenant away from bankrupcy.

Your joking right? Anyone saying its not worth it knows nothing about the rental markets. Its a gold mine. This is directly from the revenue:

From January 2018, you will be able to deduct 85% of the interest paid on your mortgage on a rental property. For earlier years, the figure is 75% of the interest paid.

In certain situations, you may be able to claim 100% mortgage interest relief. To qualify you must:

rent out your property for three years to tenants receiving certain social housing supports.

And thats on top of the abundance of other things you claim.

It depends on when and where you bought.

Objectively, landlording in Ireland is not a bad investment in a low-yield world

If you are prepared to get your hands mucky (a portfolio of one-bed apartments in unfashionable places) you can get gross yields approaching ten per cent.

There’s lots of money to be made at the moment by selling. We may be near the height of the market.

Also increasingly landlords are large companies owning many properties.

I seriously hope so. Otherwise I don’t see myself being able to buy a house til I’m I my forties.

Country hasn’t been the same since the Dublin Kildare anschluss.

Sly. Lilywhites can feic off and win their own silverware.

Dubs must have seen the county flag, got the wrong idea, and marched across the border.

Yeah. In fairness the surrender monkeys weren’t putting up much of a defense with a few knives and forks from Newbridge and a vanload of Christy Moore tapes.

I am not a landlord but I do know a few (now former landlords) that have sold their rental properties over the past year or two.

Reasons: over taxed and too much red tape

Yep.

yep, part of the reason why landlords tend to jump onboard with raising rents when they can is because they don’t get much return on their profits. It’s also why the gov are slow to do anything about the high rents at the moment, because of all that juicy landlord tax money.

Why are people saying this, as I pointed out in a comment above, the rental sector is a gold mine for landlords. The amount of tax allowance you can claim, its like printing money.

i retract my comment. i think i bought in to others saying it. but they’re probably landlords tryna clear themselves of blame.

Given that there is so much profit to be made, why then: “…the number of landlords is falling, despite high rental prices and record demand”?

They won so much, they’re tired of winning (profits)

Same here.

All landlords I know (accidental and planned) have told me it’s not an earner. Still a way to store excess cash (the asset itself) but not an earner.

Perhaps there expectations are too high. Hedge fund managers would be happy with the kind of return on investment landlords get.

People are wont not to show their calculations. I blame poor schooling. Blithe anecdotal assertions with nothing to back it up.

Those days have gone, George.

You’ll get a 5% gross yield today. Deduct maintenance, repairs, service charges on a shared scheme like an apartment block, voids and non-payment, and you’re looking at 3%.

You would have been looking at 20% capital appreciation a couple of years ago. That’s now 5% in Dublin and 10% elsewhere, and falling. While prices are still increasing, they’re no longer exceptional.

In Dublin, you’ll see a 8% return and declining. Not bad, but hedge funds can do better.

You can get higher yields – think apartments in Waterford.

yeah..mucky..

I am a landlord. I think a lot of other landlords forget that, even if you’re not pulling in a lot of liquid cash, you’re comfortably paying off the mortgage on the gaf while writing off most (all?) of the interest against tax. You end up with a house that you didn’t have to pay interest on plus whatever appreciation it has accrued over the years. THAT’S the payout, not the monthly rent money.

Exactly. A friend of mine bought his apartment in June of 2009. Paid next to nothing for it, compared to what I paid in 2008(same apartment block). His mortgage is just below €600 a month, he’s currently getting €1300. If you bought at the right time you’ve effectively got a property free. If you’ve any financial discipline you could pay your 25year mortgage off in under 10years, which is what my friend is about to do.

Your friend bought a property a year after the biggest financial/banking meltdown of a lifetime. Well done to him but for most buying property in 2009/10/11 was not possible

Very possible. Up until around 2012 prices were still very reasonable.

Yes……but did you try get a mortgage during that time? The whole banking crisis thing? Remember that? Unless you had a stack of money in the bank or you could pull it from your backside buying a property was near impossible.

From the RTB’s release today

“Standardised average rent for new tenancies was €1,208 a month and for existing tenancies was €956”

“the Irish rental market is experiencing unprecedented demand, the number of landlords is falling with a decline of 8,829 tenancies and 1,778 fewer landlords than in 2015.”

I don’t trust the RTB or the ESRI for producing rent statistics, especially because they have a political impact. I also don’t trust an organisation which has a former Garda commissioner on its board. The compilation of these statistics should be transferred to the CSO.

They are not average rents for all tenancies. They are average rents for NEW tenancies registered with the RTB.

EXISTING tenancies are impacted by rent caps brought in since 2016. The RTB does not collect data on rents in payment (nor does CSO or Daft either).

Legally, no one who signed a tenancy in 2015 in Dublin can experience more than a 4% increase in annual rent.

Average rents paid by all tenants are increasing at about half this reported rate I would think.

The near 33% difference between existing and new tenancies tells you rent pressure zones aren’t working properly. It also underlines the power landlords have. If they void your tenancy because of sale, family member occupying or substantial renovation, they might be able to get 33% more if they rent it to fresh tenants (because, alas, sale fell through, family member decided to stay for a fortnight, renovation involved a lick of paint). And, if you’re a tenant, that should scare you.

Simple economics says that if you are in a rent-protected tenancy you are less likely to move out, even if the property isn’t quite suited to your needs anymore. This, all else equal, will push up asking rents as there is less supply on the market.

Rent controls have losers (new tenants) and winners (existing tenants).

It’s never been clear to me why policy should prefer one group at the expense of another.

There’s no supply so people don’t move, which pushes up rents because there’s no supply.. is that it?

you’d give anyone a headache

The CSO has today published the inflation figures for November 2018.

Annual inflation is running at 0.6%

However, rent inflation is running at 7%, says the CSO.

In a separate report, the CSO says wage inflation is running at 3%.

These are based on a survey of new tenancies only, not rents in payment.

Other rents are going up by 4% every year. I don’t know anyone who’s landlord isn’t approaching the limit as a reccomendation.

In case anyone is interested about the white bit of the map above, the average rent in the most expensive part of Northern Ireland (Belfast) is £663 (€740) per month. The median might be a better reflection, that’s £595 (€660).

https://www.home.co.uk/for_rent/belfast/current_rents?location=belfast

Acute demand fails to accelerate supply, in the most business minded country in Europe – ? Weird times, like someone cancelled capitalism and forgot to send us a memo.

No mystery at all Nelly.

Cost of building a new home [land, VAT biggest culprits] > Price people are willing or able to pay [Central Bank rules biggest culprit]

Obviously that rule isn’t 100%. There are some builders sitting on or getting cheap land. There are some people with big salaries or deposits. But in general, that equation above is keeping supply at a fraction (<50%) of demand.

The banks stopped lending money to developers to build houses in 2008. They have been very slow to start lending again. If the developers can’t get the money to build – then nothing is built.

But why would they loan money to do that?

The banks, PTSB (71%), AIB(71%), BOI (14%) are owned to that extent by the government who also own NAMA. They loan out money to flood the market -> they plummet the price of all the property they already have on their balance sheet.

The only option available is to re-inflate the 2007 bubble and screw the last ones through the door, the under 40s, although it’s been going on so long now I’d say the under 50s have been reasonable screwed too.

it was meant tongue n cheek – on warped economic ‘system’

Isn’t it amazing. The law is enforced & constantly updated, whevever it suits..like new driving penalties, but the likes of landlords can flout the law with impunity… the rent pressure measures were made a joke of.