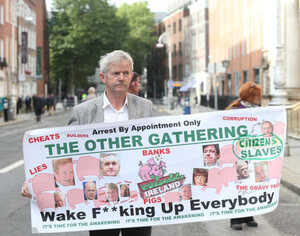

Scenes around Leinster House during Budget 2014 proceedings today.

Scenes around Leinster House during Budget 2014 proceedings today.

High income earner?

Today I am publishing the report of the Revenue Commissioners on their analysis of the high earner restriction in 2011, which covers the latest figures available and relates to measures to limit the use of certain tax reliefs and exemptions by high-income individuals. The yield is down when compared to the report for the tax year 2010 due to falls in the incomes of these individuals and the closure of tax reliefs such as the abolition of the patent and stallion fees exemptions and the capping of the artist exemption. This has resulted in many of these individuals’ moving into the regular income tax system. The report shows that the effective tax rates for different categories of high earner are around 30% to 40%. This confirms that the restriction is working to improve the balance between promoting tax equity with regard to those on high incomes while maintaining the incentive effect of the various tax reliefs introduced to achieve a particular public good.

Apart from the measures that I have just announced, Deputies will be pleased to hear that there will be no increases in income tax or the universal social charge in 2014; there will be no increases in the 9%, 13.5% or 23% VAT rates in 2014; and there will be no increases in excise duty on petrol, diesel or home heating oil and gas.”

Michael Noonan, today

Young, jobless on meds and like a smoke?

No one was spared as Michael Noonan reduced dole payments for under-25s, hiked student fees and prescription charges, axed the bereavement grant and slapped 10 cent on cigarettes and alcohol.

Full speech via KildareStreet.com here

Young, elderly and the old reliables hammered (Irish Independent)

(Sam Boal/Photocall Ireland)