Sean Whelan, on RTE, reports:

Research from the Central Bank shows that 44% of mortgages or just over 13,000 in long-term arrears are now more than five years past their due date.

That is up from 34% from a year previously.

The figures form part of a review of how bad loans have been handled in the Irish banking system.

The Central Bank thinks just over half of the mortgages in arrears of two years or more may end up with the borrower losing their homes.

…Of particular concern are the 39% of borrowers with long-term arrears who are not talking to their banks to try to sort out a solution. That is about 10,000 customers of the five main mortgage banks in Ireland.

Central Bank fears up to 10,000 homes face repossession over mortgage arrears (RTE)

Resolving Non-Performing Loans in Ireland: 2010-2018 (Central Bank)

Rollingnews

Useful blog post about how arrears cases are dealt with by county registrars:

http://economic-incentives.blogspot.ie/2015/04/cork-county-registrars-list-civil.html

That is nearly 3 years old. I wonder if things have changed much?

https://www.centralbank.ie/docs/default-source/statistics/data-and-analysis/credit-and-banking-statistics/mortgage-arrears/residential-mortgage-arrears-and-repossessions-statistics-december-2017.pdf?sfvrsn=4

Fantastic initiative from Princeton,any sign of the TCD ‘housing/economic’ experts actually doing anything useful ?

But if your looking for some color commentary from an armchair expert, on say a recent controversial court case,its leading economist/housing expert Ronan will have something…….

“That’s exactly where we’ve been with the topic of eviction: stumbling in the dark. The Eviction Lab wanted to change that. Over the past year, we set out to build the first-ever national database of evictions in America. We spoke with court clerks across the country, scraped data off websites, flew to cities to study eviction data, learned more about the intricacies of Maryland’s housing law than we’d like to admit, and mourned the loss of oil-soaked eviction records stored under the counter of a Texas service station.”

https://evictionlab.org/

How many are living in these properties?

I wonder if these are some peoples ‘investment’ properties, and they are still taking in massive rent and not paying a mortgage on them?

Would like to know the breakdown on size of arrears and mortgage – I remember not long after the crash hearing various stories that many of those from a higher social class were advised (by their solicitors) not to bother even engage as the banks would be powerless to do anything anyway.

It makes me ill to think that some of these arrears are ‘buy to let’ properties. No wonder we have such high mortgage interest rates. Society picking up the tab for the greedy.

so a landlord who can afford to buy a property and rent it to someone who cant afford to buy is “greedy”. you fool

No. They cant afford it. That’s the issue and why they’re in arrears but still likely taking the rent!

You might want to have a 2nd look at what I wrote.

This is the kind of silly thinking that made a lot of people think they’d be great landlords, get a tidy profit every month, cover the mortgage, cover taxes, and be set for life.

Far too many eejits who refuse to accept that renting our a property will, or should come at a net loss for some years after investment unless you are paying 50% or so upfront in cash on it.

Getting part of the mortgage paid, maybe 1/2 or 2/3 if lucky while retaining the equity is not that hard to get the head around, but far too many people think it’s 100% profit + 100% equity and helped get us into this little mess we’re in (my own former imbecile landlord as a case in point).

+ a billion!

In what world do people think they should be able to make a profit on rent AFTER mortgage, expenses and tax?

Why would anyone anywhere ever rent??

–Rant over–

Breathe.

+1

landlords are lobbying hard for lower taxes.. they want to have the mortgage in full written off as an expense. Shower of spongers.

And the solicitors were right, the banks were powerless for 10 years, which was plenty of time to live mortgage free and save a fortune in cash. you just have to look at the arrears these guys owe to know how much cash they at least have hidden, yet they claim they are poor , get 3 to 6 months stay on eviction to save even more cash and work on the next sob story to get another 6 months. . They should all be kicked out yesterday. If I didn’t pay my mortgage for ten years Id have at least 60000 cash or 100000 if I was really clever and if exploited unknowing tenants who knows how much more.

Jaykers, that’s some depressing reading.

Really kicks muck in the face of those who are trying desperately to pay off their mortgage and scrimp by each month.

More to add to the homeless figures, bravo blushirts

Not all of us live with our parents for free dav. Some of us actually got out in the real world and paid our way.

Free houses for everyone! Yay!!!!

Actually, these are people who have been allowed stay in their homes for years without paying under successive FG governments; you should be saying “huzzah for the blushirts”, if anything.

or you could say that if it hadnt been for policies implemented by successive FG governments, there wouldn’t be so many people struggling to meet their repayments

BOOM right there

BB

which policies are you talking about?

what could they (realistically) have done differently? what probable side-affects may this different have caused?

for starters, FG’s decision to kowtow to the ECB in direct contravention of its 2011 commitment to burn senior bondholders (in its banking strategy policy document, “Credit Where Credit is Due”, 2011) was clearly a policy decision driven by ideology, a lack of backbone and a lack of honesty. if FG had honoured this commitment to the irish people, taxation would be far, far lower than it is today. lower taxation would have meant higher household income, which would enable more people to pay their mortgages etc etc etc

would there have been negative effects? nobody knows for sure. but FG didn’t think so when it drew up this policy document

If we stopped paying our debts, how would we have been able to continue to borrow money to meet current expenditure, as we needed to do from 2009 to 2014? No-one would have lent money to us.

(Not that everything that FG did was stellar, particularly in relation to housing, but a sovereign default is a serious, serious business).

I don’t know the details but the whole “burn the bondholder” wasn’t something that Ireland could do unilaterally – we needed buy-in from the rest of Europe – which it wasn’t going to do. Greece tried to do that – how did that turn out?.

We have been borrowing in the international markets at rates a lot closer to Germany than the rest of the PIIGS for the last 3-4 years.

We’re selling 10year bonds at ~1%; Greece is running at ~4%.

@Rob – while that’s certainly true, it’s also true that we wouldn’t have had such a need to borrow.

@Cian – true, too. but that didn’t just become apparent after the election. either FG knew it beforehand (yet still gave the contrary commitment), making Leo et al massively dishonest, or didn’t know it, making them massively incompetent. i’m not sure which of those two is more comforting.

And, yes, we’re well regarded on the bond market internationally, which is just as well when you consider that we now have a debt burden of c €200 billion, with €50 billion of that due in the next two years – so we’re going to have borrow to pay that. i estimate that my share of the €50 billion is around €60,000. it doesn’t make me feel any better knowing than we can repay that debt with cheap borrowing.

BB, I’m nit-picking but

a. The said they would attempt to do it with the buy-in of the EU. The EU didn’t buy-in. So what can you do?

b. “Leo et al massively dishonest” – should be “Kenny et al massively dishonest” – in 2011 it was Enda in charge.

c. debt is €50bn by the end of 2021 [http://www.ntma.ie/business-areas/funding-and-debt-management/debt-profile/maturity-profile/]; and a lot of this 50bn is high interest, we should be able to replace it at a lower rate.

And it should make you feel better to repay debt at 1% rather than 5% – it’s a lot cheaper.

We are better off with 200bn debt (at 1% interest rates) and the availability to borrow at our leisure, an unemployment at 6% than to ‘only’ have 150bn debt (at higher interest rates); sovereign default; and no option to borrow money; and much higher unemployment. [on the positive side we wouldn’t have a housing crisis as emigration would be super-high]

Uti possidetis

They were allowed by the banks to stay ,because the property was occupied looked after and until the time is that these properties provide a return when sold off these people will be allowed to stay

I would say soon evictions will be a hourly occurrence

You mean the party that stood back and allowed the country to be raped and colluded in the process?

homeless buy to let landlords?

The worst kind

if you’re in arrears for 2 years you should have to move out of the banks house to allow it to be sold to somebody who can pay their mortgage

Yes. Me please. There’s fupp all to buy and people queuing up at viewings to outbid each other. It’s not fair that these people can stay in their homes.

“In arrears” can mean you’ve missed a single payment, but.

That’s why the article talks about long term arrears. And over two year in arrears.

But

Is it possible to setup then transfer a property into a limited company and continue to pay the mortgage? The reason I ask I know someone who appears to have done just that with not one but four buy to lets.

Buy to let being the operative word, a limited company cannot own a house you (as a director) reside in

But it is possible to stick your buy to lets into a company then? Does that not affect the mortgages? I mean it is the company not the individual who is then responsible surely?

you couldn’t transfer ownership of a property if there’s an outstanding mortgage on it, could you? would be a bit silly on the lender’s part

Interesting subject. What if these landlords set up the company beforehand? Then bought with a bank loan, but as a limited company?

you’d be taking out a business loan rather than a mortgag, which would be at least twice the rate and at most half the term.

What is the benefit of a limited company?

Would the bank be aware of the benefits?

Would they lend the company money for houses? And at what interest rate?

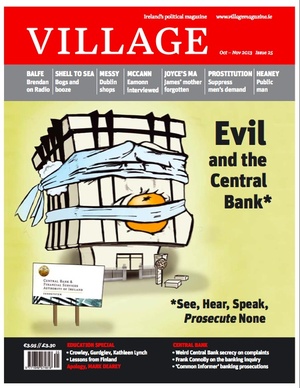

the paper is rubbish as is the RTE reporting,the fact is the central bank and the national broadcaster continue to absolve themselves of any responsibility for this mess.

its a review by the central bank staff of the failed efforts by the central bank staff!

rte contributed in many ways,and has selectively lifted pieces to further pit borrowers,with arrears issues against new borrowers,by repeating the claim (which is NOT factually based) that borrowers with arrears on the banks books lead to high rates.

who at the central bank commissioned this ‘absolution’ and why ?

to distract from more awful numbers!

this is the sound off TCD tenured prof Philip Lane (who’s entire career has been spent in academia) washing his hands off Irish borrowers,hey Philip why don’t you regulate offshore buyers of large NPL portfolios ?

“Finally, in the context of supervisory guidance

around the reduction of NPL ratios, Irish banks

may act to sell portfolios of distressed loans

as one of the several options available to

them. However, they also present important

consumer protection issues which must be

taken into consideration. Therefore, it is

important that any conduct risk associated

with such sales be mitigated by having a clear

consumer protection framework in place. The

Credit Servicing Act ensures that borrowers

whose loans are sold to unregulated third

parties are afforded the regulatory protections

they had prior to the sale, including those

protections provided by the Central Bank’s

Consumer Protection Code, the Code of

Conduct on Mortgage Arrears and the SME

Regulations. Under the Credit Servicing Act, if

an unregulated firm buys loans from an original

lender, then the loans must be serviced by a

‘credit servicing firm’ who is authorised and

regulated by the Central Bank, thereby bringing

such firms within the Central Bank’s regulatory

remit.

However, the underlying resolution strategies

determined by the unregulated loan owners

may be different to those adopted by banks

due to differences in the nature of the

underlying loan portfolios and variation in

business models across the different types

of institutions holding these loans. The

Central Bank will continue to engage with this

new category of regulated firm in order to

ensure compliance with the CCMA and other

regulatory requirements. ”

https://www.centralbank.ie/about/who-we-are/our-senior-team-bios/bios#Governor

If buy to let, I’d have a lower tolerance, and would expect the houses to be sold. However, with the proviso that sitting tenants get 12 months guaranteed tenancy afterwards.

But if these are the actual house owners living there, then that begs the question as to this whole ‘recovery’ thing that FG push.

I think this type of story to be clickbait or scare mongering. The rates of reposession in this country are incredibly low, a result of our legal system and the Irish attitude toward reposession. The purchasing of our loan books by so called Vulture Funds will have very little impact on this. The banks have an enormous backlog of cases due be heard in court already. I don’t have the numbers to hand for Civil Bills of possession submitted in the last 5 years throughout the country, however Im sure it would be interesting to see how many have ended up in reposession.

No goverment, past preaent or future, will legislate for faster reposessions…especially with close to 10,000 people registered as homeless. This problem will last decades.

the funds are here for one reason,incredibly high leveraged returns or IRR’s,Irish homeowners are merely collateral damage to that objective.

there are many ways to obtain vacant possession,the courts isn’t the only route,cash for keys,short sales…

the housing crisis will get crisiser.

“Non-bank entities now hold 61,446 mortgage accounts for principle dwelling houses and buy to lets combined. Of this number, 47,820 relate to PDH mortgage accounts, representing 7 per cent of all PDH mortgage accounts outstanding; 5 per cent are held by regulated retail credit firms with the remaining 2 per cent held by unregulated loan owners. Table 1 below further displays the breakdown of PDH mortgages and the arrears profile held by banks and non-bank entities.”

https://www.centralbank.ie/docs/default-source/statistics/data-and-analysis/credit-and-banking-statistics/mortgage-arrears/residential-mortgage-arrears-and-repossessions-statistics-december-2017.pdf?sfvrsn=4

Thanks for the stats Johnny. I agree things will become very murky and the crisis will deepen. However, I get the impression people thought the opportunity to offload NPLs to Vulture Funds was unthinkable or the Banks had some kind of moral obligation because of the bailouts. It was only a matter of time before they would sell and it’s a business decision to get the best price. Hard and cold but a reality. I believe the article being discussed is the possibility that 10000 homes will be reposessed…which suggests legal intervention. The stats provided show those who either refuse to leave, handback or sell and are not paying. Therefore an order for possession is the only route.

well there’s two articles-1 Whelan’s (economics expert) cut and paste job

2-Resolving Non-Performing Loans in Ireland

1-RTE/Whelan

“Research from the Central Bank shows that 44% of mortgages or just over 13,000 in long-term arrears are now more than five years past their due date.

That is up from 34% from a year previously. ”

i really have no idea what to make of this,or what he’s tying to say,yes its one year on and…

the piece just goes downhill from there,he uses economic terms like ‘thinks’ frequently !

“The Central Bank thinks just over half of the mortgages in arrears of two years or more may end up with the borrower losing their homes.”

the report absolutely DOES NOT say this…its says ‘the potential for loss’

“Having bad loans on their books reduces the amount of money banks can lend and pushes up the cost of borrowing to consumers and businesses.”

and then there’s this…

“Of particular concern are the 39% of borrowers with long-term arrears who are not talking to their banks to try to sort out a solution. That is about 10,000 customers of the five main mortgage banks in Ireland.”

so from this RTE/Whelan ended up with scaremongering and clickbait !

“Central Bank fears up to 10,000 homes face repossession over mortgage arrears”

2)Resolving Non-Performing Loans in Ireland:

this is basically an ‘advertisement’ off the ahem great work done by the central bank,before RTE cuts to families,sitting in threadbare clothing roadside with their belongings,probably with a 3 legged dog or a blind cat;)

its effectively a pointles paper,devoid off any critical thinking or reflection,its staff at the CB reviewing and applauding work done by other staff at the CB. this is typically know as a ‘cover your a**’ piece before the political fallout happens.

here is the key takeaway,which is pretty common knowledge,except clearly at RTE !

“One issue that warrants further research in this area relates to non-linearities in the relationship: if the capital channel is in operation, the effect of NPLs on lending should be more pronounced for banks that are close to binding regulatory capital constraints.

Financial markets may perceive banks with higher NPL ratios as more risky, with a knock on effect on funding costs, which may in turn act as an additional channel through which NPLs distort credit allocation”

and again….

“While the literature has begun to tackle the question, estimates of the causal effect of NPLs on lending can be difficult to identify empirically.”

FURTHER RESEARCH

MAY

DIFFICULT TO IDENTIFY

i could go on but i hope you’ve got the picture….

now we get to REPO’S

“Over half of the cases progressing to long-term arrears are classified as involving the potential or loss of ownership outcomes. It is important to understand that loss of ownership may take place in two main ways for PDH accounts: voluntary or enforcement. Voluntary actions include situations whereby the borrower voluntarily surrenders the property back to the bank. Other examples of voluntary actions are through a voluntary sale where a borrower agrees to sell as part of settling their debts with a bank or utilisation of a mortgage-torent scheme. Enforcement is through legal proceedings that result in a repossession order being sought and granted. At present, over two thirds of loss of ownership outcomes that have been concluded are related to a voluntary surrender and one third to repossession.”

from this it was extrapolated that…that its just best not to read or listen to RTE :)

Ha! I agree Johnny… just Google ‘How did Economists get it so wrong?’ and a myriad of depressing reads will pop up.

Whats even more depressing is the obvious ‘kick the can’ mantality of progressive governments in relation to our financial woes. There really havent been any cohesive plans in relation to mortgage arrears. Just wondered myself the other day…our banks were taken over and yet there has been very little intervention by our Government. The sale of NPL loan books should never be a surprise! and yet thats how it was sold to the general public.

Its also depressing that house prices have skyrocketed in 18 months and there are queues for new builds again. We have really learned nothing.

there’s a constant refrain that people in arrears are ‘bad’ who cost new buyers/borrowers via hoarding homes they cant afford,higher rates,free houses,etc.

maybe,just maybe the simply awful management that facilitated the large NPL’s,are being penalized in the market,with higher rates !

selling NPL’s due to the political climate,poor management at banks, in Irl is probably the best solution,but given the size off offshore funds in the secondary Irish mtg market,why aren’t they regulated ?

https://theintercept.com/2018/01/20/you-think-your-landlord-is-bad-try-renting-from-wall-street/

The majority of these 47, 820 PHDs are normal mortgages that are being paid fully.

Only about 10,000 are in arrears