*jitter*

Results of the most recent stress tests on the banks are released on Sunday.

In the meantime…

What Goes Up writes:

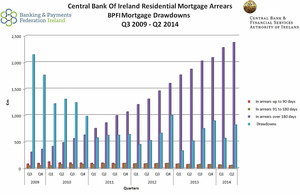

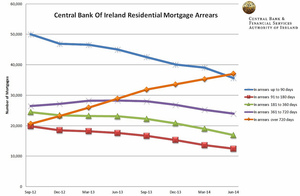

You posted a graph (about Ireland’s mortgage arrears reality) from me last June. I’ve updated it (top ) for the first half of 2014 – and the story continues not to be pretty: I’ve also charted the “Number of mortgages in arrears” figures from the Central Bank – as people assume that the amount of arrears of 180-days+ would simply grow without necessarily more people going into default – the second graph (above) shows that not to be the case..

I think it’s safe to say if any of the Irish banks pass the stress tests on Sunday – then either they have performed amazingly over the summer… or else the stress tests were less than rigorous!

Central Bank’s figures here:

BPFI figures here

The recent Central Bank guidelines on mortgage lending limits of 20% of the value & 3.5 times a person’s income are a good thing for first time buyers. They will cause this property bubble to burst & prices will drop. Yet, I see all the vested interests have been clamouring for changes and the mainstream media are banging on about a 10% mortgage insurance scheme, ie; paid for by the taxpayer. And yet we haven’t even sorted out the over 100,000 mortgages in default from the last bubble. Will we ever learn……?

My fiancee and I are aspiring first time buyers. We are both in permanent full-time employment, are on reasonable salaries and have no outstanding debts. We hope to buy a house in the €300,000 range. Although we are currently paying rent on an apartment in Dublin, we have been saving diligently for the past year and hope to be able to buy in the next 18 months.

Even if prices drop as you suggest, and houses currently in the €300,000 range become available for €250,000 (which I consider to be very optimistic), under the new regulations we would need to save €50,000, as opposed to €30,000. This would likely take us an additional 1.5-2 years, during which time we will have paid approximately €25,000 more in rent.

We, and many like us, can easily afford the payments on a mortgage of this size (our rent is in the order of what the mortgage repayments would be), but as any first time buyer knows, saving the down payment is the difficult part. Should these regulations be adopted, it will literally become twice as difficult. Please explain how you think these regulations can benefit first time buyers.

The benefit is medium and long-term, short-term less so, but right now some 35% of house buyers are paying in cash, they’re buying to let or asset speculating, if you make mortgages more restrictive, then long term you make asset speculation less valuable, because there’s less people able to buy and outbid each other based on how much debt they’re willing to take on, there’s 500 billion in debt in the Irish economy, BTW. Long-term this will hopefully mean less of the income of people in Ireland will be taken up with paying for a roof over their and their family’s) heads. It’s a very blunt tool, but with government being utterly unwilling to take on the banks, it’s at least some consolidation to see the Central Bank taking up the slack. Specifically what the central bank proposed is that no more than 15% of new mortgages for private selling homes should have a loan-to-value rate of 80%, meaning not everyone has to have 20%, hypothetically if you are an excellent credit prospect (ie. in the top 15% of private house buyers, and in this respect the banks really should be favouring first-time buyers, but I doubt it) you should be able to get a mortgage.

So how will this benefit first time buyers? It’ll mean long term lower house prices, assuming you want to have children it’ll benefit them, it’ll also benefit the economy as a whole as this will lower the default rate, it’ll mean when you do go to buy a house you’re not competing against people who are getting 90-100% mortgages and so the price is less likely to be jacked up cynically, for example during the boom my father, a site foreman would notice with amazement how week on week, prices were jacked up, if one row sold for €X one week the next would be sold for €X + 10,000. A ludicrous situation, a bubble economics that benefits no one in the long term, (except those favoured few who the government are will to throw a €90 billion life preserver in the direction of), that’s your benefit!

I appreciate the thorough reply but I disagree on a number of your points.

Less people being able to afford to buy their first home will likely result in inflation of the totally unregulated rental market, particularly in Dublin, raising rental prices and making it even more difficult for prospective buyers to save a deposit. A vicious cycle. Granted, the long term lowering of house prices will mean a lesser percentage of peoples income will go into their mortgages, but this will not benefit people who are paying inflated rent. It will only exacerbate their problems.

Without doubt, the 15% of new mortgages that have a loan-to-value rate of greater than 80%, will be given to the least risky applicants, who are unlikely to be first time buyers.

I agree that some tightening up of the regulations is prudent and I am glad to see the Central Bank taking some measures but I think that 20% is totally over the top. 15% would be far more reasonable, as evidenced by the UK Central Bank who have adopted this figure.

Why do you want the rental market regulated? Why do people want the ‘government’ and all of its inefficiencies in every aspect of their lives. “0% deposit or €50k in your case sounds reasonable to me, there is no given right to own a property or for someone to take a risk to lend you money to buy a property. Having skin in the game is essential. It may take you longer to save but that’s life. I can’t afford a Ferrari right now so I don’t have one, dramatic example but it’s the real world.

If you got the original mortgage of €270K @4% for 25 years your total payments would be €427,547.84

If you get the new mortgage of €200K @4% for 25 years your total payments would be €316,702.10

Savings over 25 years – €110,845.74

Less extra rent – €25,000

Total savings – €85,000 approximately.

Mortgage calculator here – https://www.drcalculator.com/mortgage/ie/

With or without the new regulations, anyone can save themselves huge amounts on their mortgage by saving a larger deposit. No offence, but that’s not exactly ground-breaking stuff. And yet, every day people apply for mortgages with the minimum deposit. Why? Because saving a huge sum of money over a sustained period of time is extremely difficult, particularly when you are also paying rent.

Under the current regulations, once I have a 10% deposit, I can decide whether to continue saving to put together a larger down payment and lower my overall mortgage cost, or buy now and pay a larger amount overall, which may not be so difficult 10 or 20 years down the line when I am likely to be making more money and inflation has reduced the effect of the payments. With the new regulation, I have no choice but to continue saving and deal with the associated impact on my lifestyle for twice as long.

Like I said, I agree with some tightening of the regulations but I think this is too much and I disagree entirely with the suggestion that this is a good thing for first-time buyers, particularly in the short to medium term.

Because saving a large amount of money over a sustained period of time is difficult and requires you to amend your lifestyle, perhaps dramatically. That is the reason people don’t want to do it. The sense of entitlement is amazing in Ireland.

Your original question was “Please explain how you think these regulations can benefit first time buyers.”

I showed you how you’ll end up saving €85,000 in the long run by having a lower purchase price with a larger deposit.

If you seem to think this is of no benefit to you then fair enough.

The regulation isn’t about protecting FTBs though. It’s about protecting the banks.

It means that the first 20% drop in property prices will be borne by the mortgage holder.

There is an inverse relationship between interest rates and property prices.

Interest rates are at historic lows. At some stage over the next 25 years they will rise. Which means prices will fall.

This is all about protecting the banks.

Time value of money makes this pretty irrelevant.

Is this correct, close on 38,000 in arrears over 720 Days

Seems a worrying statistic.

Are the value of the assets in the banks stress test based on the latest dublin house prices or an average over the last three years.

What’s the number of perfectly performing mortgages? Find that out to ease your worries.

The difference in payments for a 35 year mortgage for 270,000 vs a 35 year mortgage for 200,000 would be 148,680 over the lifetime of the mortgage (based on AIB’s mortgage calculator and current rates – there is a theory that rates would be lower than they would otherwise be if the CB’s proposals were not adopted, as the banks would be able to package the mortgages as a more low risk product when obtaining their finance for them). The saving would be a less eyewatering 71,400 for a €240,000 mortgage. In my view there would also be non-financial benefits: as the repayments would not make up such a large percentage of your income, you would be able to spend the money saved on nice things, … living and stuff, as opposed to giving the money to the bank. Plus there would be some peace of mind in knowing that you had some breathing space if rates do start to rise.

the most amazing thing about any of this is the lack of repossessions occurring given the amount of arrears

Shhh with your logic, the communists will hear you!

How dare you take away the family home that people aren’t paying for, etc etc.