Apple’s European HQ in Cork

Bonkers writes:

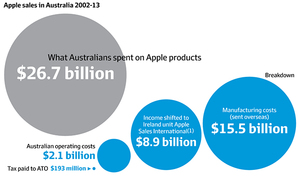

I was just reading about the Apple tax case whereby it looks like they owe Ireland a figure somewhere between €8bn and $19bn, depending on which source you use.

Then I read that if Apple gets landed with a bill for back taxes the Irish government intends to appeal the ruling. That means that taxpayers money will be spent on lawyers to go to Brussels to argue that Ireland should not receive this money. I’d like to say you couldn’t make it up but here we are and its very real.

So I ask what could Ireland do with (for example) €10 billion of Apple back taxes ?And how would Broadsheet readers spend it?

Here’s my attempt-

1. National Childrens Hospital -€1bn

2. Dart Underground and Metro North -€3bn

3. M25 Cork to Limerick motor way -€800m

4. Upgrading our water infrastructure -€500m

5. Investment in mental health services -€1bn

6. Closure of peat and coal fired power plants and replacement with greener energy -€1bn

7. Investment to help solve the homelessness crises -€500m

8. The remaining €2.2bn restored to the National Pension Reserve Fund before the looming pensions crises begin.

Anyone?/FIGHT!

Yesterday: Meanwhile At Davos

(Apple)

How much would it cost the country if a load of the mutlinationals just up and left?

Apple need a manufacturing base on EU soil so they can access the EU Common Market without their phones being subject to EU importation taxes and tariffs like a non-EU company importing to inside the EU would have to pay. So the question really is where else in the EU would Apple get a 12.5% tax deal? No-where is the answer, the next closest to us is Latvia at 15%.. Apple need the EU, make no mistake about that.

“How much would it cost the country if a load of the mutlinationals just up and left?”

This ranks alongside “great little country” “open for business” as the most used FG sayings!

ah the politics of fear, good blushirt strategy to make sure the irish stay on their knees and not raise a hand against their “betters”

looking forward to seeing one of your posts where you don’t say blueshirt :-)

I’m looking forward to a world without blueshirts, a facist free zone if you will

It is still a juicy deal and the country is full of english speaking IT savvy folks. Multinationals are run by money counting people, not resentful b&&ches (may be some).

There is still a massive return on investment. Look at Dell saga, ah, don’t they regret making a hasty move a few years ago :-)

Would it be enough to make people question the wisdom of focusing so much of our economic policy on multinational corporations who will use their size and wealth to bully, threaten and renege on us to the extent that any benefit we gain from their presence is fairly questionable, particularly in terms of long-term sustainability?

It’s called financial capture. A country cannot change it’s tax rates under threat from multinationals/industrial sectors.

If companies paid the 12.5% it would increase the tax take by 4 billion.

Yeah, financial and regulatory capture are SUCH economic winners.

Ireland will be a guinea pig for what large corporations will do if subjected to higher taxes (leave en masse to another country, relocate back home, reduce salaries which in turn reduces tax take, etc).

It’s not really Ireland bringing the court case, it’s those who control Ireland (see above). Politicians have no power. They exercise the power of their backers who are wealthy businesses and other countries (US) with interests in what political and financial policies we adopt.

Apple are probably the main employer in hollyhill. If apple were forced to pay out this money , you can bet yourself the lights would be off and theyd be moving operations elsewhere by the morning.

So let them go.

How would we pay for hospitals then? You volunteering to pay more tax?

Silly child.

What if EU punished Ireland with a fine for breaking the law (let’s face it, it’s Ireland that may have broken the law, not Apple)… let’s say €30 bln ?

So BS readers , How would apple spend Ireland 30bn , Ideas below.

Fizzy sherbets for everyone !

A Monorail, a popsicle stick skyscraper, a giant magnifying glass and an escalator to nowhere.

They’d give all their low-paid workers in developing economies a raise.

They wouldn’t.

I’m not too sure that they did break the law, is it not more a case of creative bookkeeping by apple? i.e. where they pay royalties to another subsidiary elsewhere multiple times.

haven’t heard anyone state how you can disprove or tackle that yet

Eh, no 2. would be 3bn on Dublin rail?

I have sympathy for the Dublin commuter, but that wouldn’t be no.2 on my list.

Methinks folks outside the M50 would like some money on their hospitals and health centres too.

I didn’t mean the list as a one to ten priority list, just as an example of what €10bn in Apple back taxes would do for the Irish economy. That’s if it is as low as €10bn, JP Morgan have estimated their tax bill to Ireland to be $19bn, which would convert to €17.5bn at todays rates. With that kind of cash there would be no need to argue about Dublin getting the badly needed Dart Underground and Metro North, sure whats €3bn between friends;=)

With €17.5bn we could have National Childrens Hospitals for all and miniature flags for Apple

Dublin is defo on my No2. Ill get my coat.

Allowances must be made to ensure [REDACTED] gets an appropriate cut of any windfall.

He already had his solicitors on the blower to see what they can do.

+1…Words out of my mouth. Nice article but there ain’t a hope in hell anything on the list will get done

nice one! let’s see if we can mention him in every article, regardless of the relevance!

then maybe we’ll be ready for a mass transition to the journal :-)

Nope , this would be a disaster , Apple basically threatening the 5.5K Jobs and expansions they have planned. Luxembourg and the Netherlands both appealed the decision as well.

Also the Idea of prematurely spending this money is ridiculous, It not like it’ll be available to spend anytime soon.

Is 5,000 jobs worth 10bn?

We could pay these workers 50k a year for nearly forty years with that.

It’s an honest question – what level of legitimate tax revenue for social services and infrastructure is Ireland willing to forgo for a few thousand jobs? If the tax is truly owed – we’ve paid 10bn to keep 5.5k thousand in jobs – in what world would the government actively agree to that exchange beforehand?

If you think it’s just 5,000 jobs at stake you’re deluded.

They’ve already invested hundreds of millions into the cork operations. Almost a billion into the Galway data center. They’ve been in Ireland since 1981. Their presence attracts all kinds of auxiliary services and other foreign investment.

But if they legally owe us billions – what you’re suggesting is that Ireland, recently out of a bailout and experiencing an increased level of deprivation – children living in hotel rooms – should provide state aid to the tune of billions to the richest corporation on the planet.

State aid suggested we gave them money. We did not.

Sophistry. If that was tax revenue foregone, rightfully owed, as much a gift/inducement as the tax treatment to developers around hotels.

The data centre would stay, and employs fupp all anyway.

I think they should kick you out oft he EU and saddle you with the 30 bn on top of what you already owe, you are worse than thieves in fairness.

Just to be clear this is not in relation to Apple paying the 12.5% tax on their profits that they funnel through Ireland this is because they paid 0% on them. The calculated fine is the 12.5% being applied to these profits on which they paid 0%. Luckily though our brave boys in governments will fight to the last for them to keep this money they avoided paying legally at our low rate of tax.

Money on that Vestager gets “reassigned” by EU mandarins and nobody gets to take another bite out of Apple

I thought Apple was here because we are magical special people?

+2.3%

I won’t be holding my breath waiting to hear this one being aired on RTE.

Ireland exists to host, train workers for, and generally appease multinational corporations.

That’s not even a lefty rant – that’s our actual economic policy. It infects everything. An Irish person starts a company and immediately sells it to one of the big boys. It’s depressing / humiliating.

Can you propose a better alternative – Ireland is a small, sparsely populated country, geographically isolated from a lot of major markets; having an open economy and targeting foreign investment has made us much richer than we would have been otherwise.

There’ll always be a place for FDI – but the balance is completely off. We hear about things like the Knowledge Box, further eroding the tax revenue from multinationals. There are income tax deals for them to bring foreign execs in. Pretty much every budget there’s a measure targetted at a minority of companies to dodge their obligations to this society.

You never hear of similar measures for domestic SME’s – designed to bring them to international level, to make it sweeter for them to remain Irish based than sell out.

I’m not an economic expert but you don’t have to be to see the imbalance in our outlook. There’s no such thing as geographically isolated in a lot of digital industries, and we’re not Tuvalu in the middle of nowhere in any case, were an hour from London.

Yeah. An hour away from a place companies could go instead.

You’re tedious enough for your own column, but there are about four others already rabbiting the same nonsense.

9. A Free iPhone and iPad for everyone in the country

Can I change mine for an android phone?

iPhones are rubbish

That’s my time for you evaporated with that comment. Sad, you should join all the commenters on The Journal whenever an Apple clickbait story is posted. Funnily enough its usually the anti-Apple crowd there in droves generating revenue for that rag.

Where does this principle of, “well sure Apple employ people in Ireland. You can’t be expecting them to pay ALL their taxes” actually get us? Apple needs its European market, so we need everyone to stand up to them, and other large multinational corporations.

I know that one reason Intel came here was due to stable plate tectonics. We don’t suffer from earth quakes. When an earthquake hits a factory with sensitive, calibrated machinery it costs the company a fortune in lost revenue due to the time they have to spend re-calibrating everything. I think this has to be part of Apples reasons for being here. It might not be enough to keep them here after being hit with a back tax bill but it is probably a factor. So let me get this straight? They’ve been charged 12.5% tax but haven’t paid it? So they owe the state billions? And the state is fighting this out of fear Apple will pull out? I don’t think they’ll go if this is the case. And if they do? So what? Few hundred jobs gone and no great loss in terms of tax take cos they’re not paying.

Also, it’s just come out that children as young as 7 are being forced to work in cobalt mines to provide cobalt for smartphones. So maybe we’d be better off without these child abusers.

that’s interesting, never heard that one. there’s no doubt that such risk management in relation to business continuity is a massive consideration to such companies

Apple are here because of “stable plate tectonics”….Ahahaahahahaahahhhhaahahahahahahaah.

If we went ahead with the Ruling and took the 8 billion, it would be a disaster. Apple would be gone before you’d blink. Then again, this government have made some head scratching, illogical and stupid decisions it wouldn’t surprise if they did

Where would they go? They need to have a plant on EU soil to access the EU Common Market. So they base themselves in Ireland which has a tax rate of 12.5%. The Irish government gives them a sweetheart deal and they only paid 2.3% in 2013. Where else in the EU are they going to get a deal where they only pay 2.3%? If they up sticks and leave the EU then their phones become subject to EU importation taxes and tarriffs, why would they even consider that? Their phones are alreadyamong the most expensive on the market, leaving the EU would make them even more expensive to the 450 million people who live in the EU Common Market and who Apple wish to sell phones to. The EU is the Apples single biggest market that can actually afford their phones, leaving it would be a disaster for the company.

Apple have over $200billion in cash reserves. If they had to pay the back taxes and then pay taxes at a rate that complies with the law, it would negligibly dent their cash reserves and barely dent their future profitability. Moving would cost a lot of money. Who is to say that a cost-benefit analysis wouldn’t add up to staying being by far the better option?

Taxes are for the little staff of these very, very profitable companies. The current government sees itself as the buffer between the big corporates and overly-powerful banks and the powerless, hilariously easily placated citizen.

100% Immoral.

I’d spend it on lobbying for enforceable penalties on corporate and political corruption and the reopening of Spike Island for those prosecuted.

And I’d build an underground monorail that circles the country in an inward spiral.

Monorails should only be built overground. No solar power underground.

My mono rail will run off the earths magnetism, or something :)

Feck the monorail, for €10bn we could stick a roof on the country and sell the rainwater to the Arabs. Cha-Ching!

I like it !

We have no natural resources bar “renewable” energy.

We have possible geothermal options which no one seems to care about.

So what do you expect Ireland to do to provide jobs if we turf out the multinationals?

Paying tax on the massiveprofits does not equal turfing out, it means not being a leach on the rest of us.

+1

And it’s not like they’re looking for the full 12.5% either. €8bn is a lot, but it wont bankrupt Apple by any stretch.

This article begs to differ.

They’ll sign the cheque and the order to close shop in the same sitting. They are here for tax breaks, nothing else.

In 2013 4.5% of workers were employed by multinationals. That’s probably fallen as domestic employers are hiring at a faster and faster rate as we recover. So please stop perpetuating the idea that we’re all going to hell in a handbasket if we displease our masters in Silicon Valley.

No one is suggesting turfing them out – we’re suggesting they pay the same corporate tax rate as the local cafe or salon – a tax rate half that of our nearest neighbour. A tax rate that supports the training and education of their future staff, the health services used by their employees, the roads and lighting that gets people to the office.

Exactly. Or as Democratic Senator Elizabeth Warren put it:

““There is nobody in this country who got rich on their own. Nobody. You built a factory out there – good for you. But I want to be clear. You moved your goods to market on roads the rest of us paid for. You hired workers the rest of us paid to educate. You were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory… Now look. You built a factory and it turned into something terrific or a great idea – God bless! Keep a hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.”

Apple have been here longer than I can remember. Their ‘accountants’ and our govts ‘accountants’ know what they did tax wise, they’ve discussed it together and worked out together how to avoid paying the €8bn tax potentially now owed, so it’s not like Apple are going to turn around and say, “well Ireland, you fupped that up, we’re leaving”.

They dodged it together, if they do have to pay, I don’t believe they’ll leave. For one thing, there’s going to be a lot more of this going on. Did I mention that I’m an optimist :)

The point has been made above that the nearest corporate tax rate to us is 15% this is true if you believe the headline rates however there are mitigations allowed in countries which reduces this rate for instance the rate Apple would pay in France would probably wind up being 8% and it is far from alone in that.

Our point of difference is that our mitigations along with rules in other EU countries allows for the double Irish where it is possible to reduce tax to 0%

Also the largest banks in the UK paid almost 0% last year.

Until Euro zone gets it’s act together to create a base rate allowable within the Euro zone this will continue.

Apple could start by building one of their stores in the European base. To be fair.

Although I really don’t need to buy anything of theirs. My iPad 3 is still rock solid.

Its frightening that people are arguing that Apple et al should pay and its not a big deal if they left. All the multinationals can be up and gone in 6 weeks to 6 months if such a decision was landed. Its common that all regions are fully backed up in others for fail over, both infrastructure and staff. A huge percentage of our economy is employed by these companies and the companies are not here for the staff, they are here for the tax. We are not by any stretch of the imagination prime candidates for these jobs, don’t kid yourselves. We’ve carved ourselves a nice niche and really should not be rocking the boat. Why? Well, there ain’t much left to do around here if the IT crowd pulls out of significantly downsizes.

Google alone employs 5000 people. Those employed contribute a minimum of 48 million in PAYE. That’s before those people spend the rest of their wage directly in the economy. Repeat this for every multinational and the country does just fine out of these companies. Let’s be honest, we’d just waste it if we had it anyway I’d rather see it in the hands of competent business men and women who can actually improve the world.

I really can’t say I have the best grasp of economics or taxes, but the maths there seem a bit off.

If we say that each of the Google staff pay as much PAYE as the Apple staff (€9,600 / year in your example) that means that total PAYE tax take from Apple staff would be €52.8m (using the 5.5k staff figure Paps used above). At a flat rate, it’d take 151 years for Apple staff to contribute the €8bn that’s currently owed.

Even if we were to put some sort of scalable figure for growth in salaries / staff numbers, would they contribute that much in say, 50 years? If so, would we not actually be fine for 50 years if we enforced the correct level of taxation?

I assume there are tonnes of additional direct and indirect contributions to the national economy as well that’d bring the timelines down or tax take up, but how shagged would we really be if they upped sticks?

Paying Ms.Doyle style: https://www.youtube.com/watch?v=pk3ds-VFKBs

Did anyone see that show on BBC the other night about the town in Wales where the businesses all clubbed together and initiated the same tax arrangements as Starbucks? That gave me hope. Apple should not be treated with kid gloves and aided by Revenue to avoid taxes when the local cafe is chased for every cent. It’s immoral, unfair and anticompetitive.

Super work and I approve of your investment plan.

Vote for Bonkers.

Is the tax rate 12.5 or 0%, or some other rate in between, can I pick a tax rate for myself then, I thought the law of the land applied to all?

Did Apple and the State collude to avoid paying tax, is it creative book keeping or plain old corruption, and who, on the states end, profited from this and how much did they receive?

If so, this is illegal and some persons would need jailing then?

Is it possible that Apple are just chancing their arm on this based on their observation that the Irish are the greatest bunch of sheep in the world and it’s possible they could walk with the billions?

Are other companies doing this and if so what is the total shortfall, keeping in mind we have a health, housing and justice crises that are hurting everybody?

Also we have a National Debt of over E200B, maybe that needs paying, its costing roughly E8B a year to service this debt?

How much do Apple make a year, considering they sell phones that cost 200 to make and sell for 650, also how long before someone else beats them at their game and the Apple hype is over, then what?

Finally, good comment from Bonkers up there re: Senator Warren – Apple safe in their factory because of our police force, workers they hired were educated by the taxpayers, roads they ship their goods on etc – perfectly valid point, you have to wonder is Apple here for the “good times” and when the standard of staff or roads or policing deteriorate they will be off and we will be left looking more than a little stupid.

Noonan will say that Multinationals pay their taxes, that the effective tax rate is around 11%

Noonan’s numbers are based of a report done years ago. The business used as an example was a Pottery in the midlands that employed 60 people and did not export.

Does that sound like a Facebook or Apple or Microsoft? Not to mind the IFSC brass plate companies.

Seriously

Who da’ûck

From Davos to Bundoran

Thinks 12.5% off Profit

Profit. Now.

Not dividends. Or Directors Remunerations

Or stuff like that

Profits

Is unreasonable

Tell ya.

Tis the “Big” crew again

Aside from the fact that cork airport would be very busy, for a short time at least…

Your estimate of costs to replace the power stations is way under budget.

And by replacement with “greener alternatives” i trust you mean lets get edf to build us a nuclear power station somewhere in leitrim.

Yes, really.

190’000 units of purely Social Housing @ €100’000 rer unit & let Landlords survive on Temp Min Wage Workers & Tourists !! Developers can also just move up a Grade & try Hoodwink genuine Cash Buyers & they can go Hang along with Pro Landlords & Vultures abouts Essex or similar !!

The crowd in Europe are excised about Apple, but its not about the revenue

loss to the Irish economy, its about the loss of jobs and prestige.

What have they done, where is their transfer of a segment of indusrial manufacturing in the Auto and Aero industries, we should do other deals with the Asian Auto manufactuers, the VW.s and the rest of them would soon get the message, they want acess to the Irish Market but they won’t transfer manufacture.

No wonder that the Irish economic sector went haywire building house’s.

An awful lot of ignorance on display here.

Have a read of Seamus Coffeey’s (UCC Lecture) comments on this subject.

There will be no “windfall” to the irish state anytime soon. The EU is out to get the US MNCs one way or another. The Germans, the Brits and the French are pi55ed off that they’re not getting any tax from MNCs selling stuff in their countries. This will be appealed and appealed and appealed and this EU case seems largely political and not based on the facts and applicable tax laws.

The issue is not the tax rate but what is classed as taxable profits. The EU wants to class income from outside Ireland as taxable profits on the basis the Irish operations provide more value add than what Apple & Ireland agreed. Once the politically motivated ruling is issued Ireland has 30 days to appeal and when this fails they then can appeal it to the European courts where proper stuff gets decided based on law and legislation and not by political motivations.

And where would Apple go if this fine was laid down and the Irish state didn’t back them up? France for a start – headline rate might be 33% but it’s effective rate is about 10%. The Netherlands is an alternative which is a similarly tax efficient location with plenty of English speaking graduates. Brussels has special financial centers with reduced taxes (similar to the IFSC). Then the Germans would start pitching for it and then the Brits. They’d all be tripping over themselves to get Apple’s EMEA Headquarters -it’d be a coup for any country to have that in their FDI pitch books.

How about we use the non-existent money to pay down the national debt that everyone seems to be so worried about?

Good to hear that Google came to an “arrangement” with Her Majesty’s Revenue and Customs yesterday to settle the issue of past tax avoidance.

A similar announcement will be made soon by our own revenue authorities I’m sure.

Right guys?