From left: Paul Murphy, Richard Boyd Barrett and Brid Smith outside Leinster House this morning

This morning.

Ahead of tomorrow’s budget, the Anti-Austerity Alliance/People Before Profit (AAP/PBP) released its alternative budget this morning.

Their three aims: “Close the Tax Haven, Redistribute the Wealth, Transform Society’

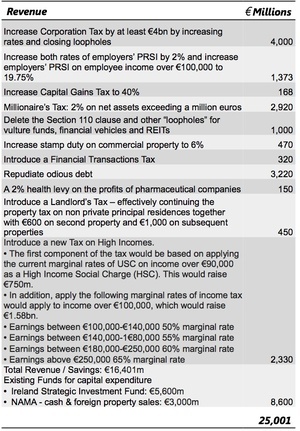

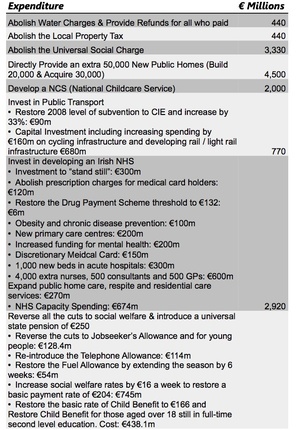

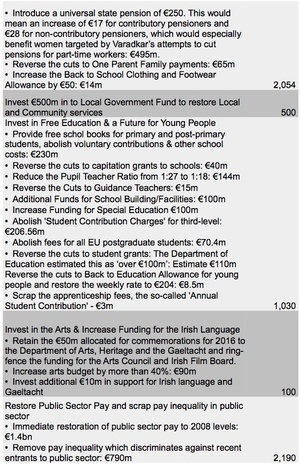

And they’ve done the sums:

Incomings:

Outgoings

FIGHT!

Alternative Budget Statement (AAA/PBP)

Rollingnews

Sponsored Link

And now the apologists for the rich will attack them…

So… Someone lives in a modest house, drives a decent car, pays all their taxes, made good decisions, etc.

Nope. 50% tax not enough.

We want €20k a year more cash off you. How dare you live in your “big house”, have a pension and drive a nice car.

The very worst type of Commie are those who reap all the benefits of capitalism and know that if being a Commie doesn’t work out, there’s always capitalism as a back up plan.

Lol, nice try…

On the Vulture Funds I’d have gone further and just ban them from operating here like the UK did.

http://news.bbc.co.uk/2/hi/programmes/newsnight/8610062.stm

So wheres the detail in how to actually do any of this. Its typical pie in the sky politics. I say give every adult €1,000,000 that’ll sort us all out, I can say these crazy things because like the three of them I’ll never ever have to implement the bloody thing. You can say what you want to appeal to people when you don’t actually have to follow it up.

Perhaps look at the images above, Revenue (broken down by source) pays for Expenditure (also broken down by source). Please try harder.

@Dave, While I’m sure they would have no problem spending their Expenditure, I suspect that balancing it with increased Revenue might be a little more tricky, what with anyone with a real job leaving the country.

Why would you say that? By real job do you mean people earning over €75,000 a year (like the type of people Mary Mitchel O’Conner wanted to give a 30% tax rate to if they would only come home?)

Whenever some one suggests some extra tax on wealth or high incomes the first response is always “you can’t do that” or “they’ll all leave” . It says a lot about how far the general discourse has moved to the right, When extra income or stealth taxes are pilled on the poor you don’t get the same objections. Even when it comes to extra welth type taxes on the poor like the “fair deal” nursing home scam that takes a big chunk of your income AND a big chunk of your house after you’ve died.

It really is a simple matter of finding the political will to tax wealth and high incomes appropriatly. They have no problem finding billions to bail out banks, I don’t think that was a good idea but it does show the reality of how Governments budget – you start from what you really want and then you plan on where you get the cash. The objections raised to taxing wealth implicitly call for the tax burden to remain where it is, on those with lower incomes. In any fair society you would take into account the share of wealth and income accruning to different groups and plan on taxing that on a proportional and progressive basis to fund services (like health and transport) that benefit everyone – even the extreamly wealthy.

“It really is a simple matter of finding the political will to tax wealth and high incomes appropriatly.”

Ireland already has the most “progressive” income tax regime in the EU. Too few are already supporting far too many.

http://www.publicpolicy.ie/ireland-has-the-most-progressive-income-tax-system-in-the-eu/

You clearly don’t know anything about how economics works in the real world. You cant just stick things on charts and print outs and say here’s what we’re going to do. HOW you actually do it is completely different to saying “this IS what we’ll do”

And now the eat the rich fantasists will applaud this modest proposal for economic hara kiri.

RBB, privately schooled and privileged hero!

and learned enough to recognise inequality and want to do something about it.. how about that?

So what school you go to should decide your politics for the rest of your life?

Can’t win,

Socialist from a well-off background = fantasist living out adolescent fantasies and playing the role of working class hero in rebellion against his background.

Socialist from working class background = jealous fantasist on the steal

Both true.

Get back in your box.

Hi, have we met? Oh sorry, of course not…

“RBB, privately schooled and privileged hero!”

Well at least he didn’t use his education to exploit others by setting up ‘pop-up’ restaurants by employing people on illegal rates to sell jumped up fast food to his fellow south side Leinster fans and then close down without paying suppliers, only to start up another ‘pop-up’ the next day.

Cool story, bro.

The contempt shown for businesses is apparent

how about the contempt businesses have for their employees? or their customers? or our government?

are those not apparent enough for you?

+1 It’s telling when people frame attempts to get business to operate fairly as being contempt for business.

Poor treatment is reprehensible and what employment law is for. But that’s a different subject entirely.

no, it isn’t.

Bootlicker

They seem to have forgotten a new tax on oxygen.

you mean the licence fee that must be paid by all those capable of receiving transmissions?

Will the last person etc. Why, it’s almost as if they want to repel voters,

So, cut the broadened tax based, tax employment and spend like no tomorrow – with what? How many millionaires do they think are in this country?

All non govt parties have produced alternative budgets. Would be interested in doing a side by side comparison.

in 2014 there were 90,000 in Ireland..

http://www.irishtimes.com/business/personal-finance/number-of-irish-millionaires-hits-90-000-as-property-prices-surge-1.1971419

this year there were 32,000 in Dublin

http://www.thejournal.ie/dublin-millionaires-2-2899556-Jul2016/

does that answer your question? for more information, please re-read.

Mainly based on property values, not exactly liquid asset.

3,700 or so taxpayers report more than Euro500k income annually to the Revenue.

The thousands of “millionaires” are mainly grannies with red brick houses in Dublin 6.

Should be no problem.

AAA/PBB oppose property taxes, so that rules out most of those millionaires.

Tax INCOME from employment.

Employment creates wealth, otherwise known as work, or LABOUR. The state takes a percentage so we get things like Civilisation.

When did Labour decide the whole ‘pay in accordance with what you earn’ thing was over?

I look forward to seeing the 500 hospital consultants they are going to hire to that tax regimen!

and the 4000 nurses that are going to magically appear looking to work for very low pay.

If they restore the public sector pay, those nurses would be better paid than currently

And watch all the millionaires leave or pay accountants even more to avoid tax. This thing is pure lunacy and completely unrealistic.

we should, then, kowtow to the interests of the millionaires. that’s unlooney and realistic.

Water infrastructure 400m – oh dear god!

It costs a billion a year as it it, let alone the extra 25bn needed to bring it up to scratch.

For a group of people who have been out with the loudhailers, they know sod all about the actual real water infrastructure.

The 50% marginal rate on incomes of €100,000-€140,000 – does this apply to married couples? A couple on €50,000 each with a mortgage and childcare costs in Dublin are not particularly well off.

That’s not how tax credits currently work, no reason to think it would

Are pooing me. A couple earning €100,000 a year is not well off. Your clearly disillusion or very wealthy.

No problem with any of this, but repudiating odious debt is a one time winner, as is selling off NAMA properties. That’s a 6220m gap for AAA budget 2017.

@Steve. That can easily be fixed by raising income tax rates to 246% on anyone left employed in the country after AAA/PBP Budget 2016 has worked it’s magic.

Is the idea not that we pay that amount currently *every* year?

You missed emptying the remains of the NTPF (ISIF now) – 5bn once off. So 11bn to magic out of nowhere in 2017; from a much reduced population after everyone with any form of cash has buggered off.

Taxing landlords sufficiently to make many sell up is really going to help the housing crisis too…

it isn’t meant to be feasible, it is a ‘transitional demand’

Got it in one, brownbull

Yawn!

Nonsense. They would destroy the country in 5 years.

Just like FF did. You have a short memory.

5 years? 5 minutes of that budget speech.

– Immediate pay restoration to 2008 levels for Public Sector workers!!!!

Beans?

Magic beans!

The millionaire tax is interesting: are they actually going to means test everyone in the country? Presume that will require circa 10k new civil servants on DB pensions to administer. Then they propose to tax people’s assets rather than income? It’s a pretty big step to say they want a political system that has a 2% / annum levy on ownership. It’s immediately going to be reflected in growth rates, anything under 2% growth a year would be recessionary.

Obviously those with accountants will have no problem getting around it. Will the same asset tax apply to companies I wonder?

The Landlord tax is hardly going to reduce rents either. Every landlord will be hit by it so every landlord will pass the costs on to the consumer.

It doesn’t really matter as they only have to say this crap to get elected without ever having to attempt to implement as they will never compromise and so never sit in government

Lots of bootlickers here doing the bidding of their masters.

Some of the incomings are a bit sketchy but fair play to them for coming up with a plan. Anyone who disagrees with the AAA-PBP should at least engage with them on the facts, and not just moaning about ‘populism’.

I wouldn’t be a traditional PBP supporter but most of that looks quite reasonable. Steve’s point about the one-time windfall payments of approx 6bn is the only actual fact-based criticism I’ve seen in the comments that would seem to be a problem.

All of the temporarily embarrassed millionaires here feeling sorry for those poor souls earning €250k/pa+ are disappointing, though.

Wow – will be interesting to see how shutting down most of the SMEs in the the country will create more employment

Never use ‘wow – ‘ love, it suggests that you are an over sized skinny jeans wearer from south Dublin? With cheap brand runners obviously.

What are “runners”.

They are like ‘trainers’ except you can only buy them in Newry?

And every sports shop in Ireland.

The clue was ‘old’

I’d love to know how and where they’re planning on “acquiring” 50,000 houses at 90k a pop.