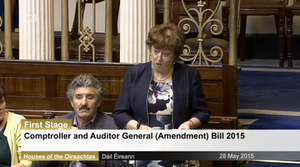

From top: Former IBRC chairmen Alan Dukes (left) and CEO Mike Aynsley in 2010, Denis O’Brien and Siteserv logo

You may recall how Kildare North Independent TD Catherine Murphy has been asking questions of Finance Minister Michael Noonan about the sale of Siteserv to Denis O’Brien’s company Millington.

Well. She’s received another reply.

But, first, to recap…

Siteserv – of water meter fame – was founded in 2004 by chief executive, Brian Harvey, with backing from Niall McFadden of Boundary Capital.

In October 2009, McFadden – who at that point owned 6.7% of Siteserv – quit Boundary, as he battled to repay loans to Anglo Irish Bank.

In March 2012, Denis O’Brien, who owed hundreds of millions of euro to Anglo, bought Siteserv for €45.4million from IBRC, formerly known as Anglo Irish Bank, while Siteserv owed Anglo €150million.

Arthur Cox represented both sides of the sale.

The sale involved IBRC writing off €100million of Siteserv’s debt, and the distribution of €5million to Siteserv’s shareholders, including Harvey, Chris Neate and John Neal, with Harvey remaining in the business.

At the time of the sale, the Sunday Business Post reported that Australian hedge fund Anchorage Capital had offered a higher price for the company.

It reported:

“Sources said that Australian hedge fund Anchorage Capital had put more money on the table, but elements of the offer were considered less attractive then the O’Brien bid. O’Brien was chosen as the preferred bidder, with Anchorage in second place. Some ten companies were involved in the initial bidding process. Sources said that some of the underbidders were unhappy with the sale process, although this is not uncommon. However, more than half of the shareholders have already voted in favour of the deal, which would suggest that it is a fait accompli. It is understood that the higher offer was made at a late stage in the sale process, which was handled by Davy Corporate Finance.

“As part of the deal with O’Brien, shareholders will get about €5million, but the rest will be used to satisfy debt owed to the Irish Bank Resolution Corporation, which was formerly Anglo Irish Bank. IBRC will have to take a hit of more than €100 million, as the bank had advanced more than €150 million in loans to the company. However, the deal needed to garner the support of shareholders, which is why there was a sweetener in the deal for investors.”

Also around that time, it was reported that French company Altrad claimed it was denied the opportunity to make an offer for Siteserv – saying it had been prepared to offer €60 million for the firm but that it was ‘effectively denied the opportunity because its representative was told the Irish group was not for sale’.

Ray Neilson, a senior manager with Altrad, told the Irish Times that he had emailed Harvey four times before the deal was agreed with O’Brien but that he was told the firm was not for sale – a claim Siteserv rejected.

Indeed, just a few weeks ago – following questions from Murphy – Siteserv released a statement saying:

“In terms of media comment concerning a competitor, Altrad Group, Sitserv PLC (in liquidation) said at the time of the transaction, that neither its board or its advisors ever received any formal approach or offer from Altrad prior to accepting the Millington offer and that any claims regarding a proposed formal or executable offer for Siteserv PLC were spurious and vexatious.”

Readers may wish to recall how, at an EGM of Siteserv – after its sale to Denis O’Brien and during which Altrad claimed it had offered €60million for Siteserv – Donal Donovan, of the Irish Independent reported:

“[Ray] Neilson claimed his firm should have been allowed to table an offer to buy Siteserv before bids for the company closed last month. The Altrad representative said his firm made an initial approach to Sitserv chief Brian Harvey back in September, but only learned of the planned sale of the company once the process ended in March. He questioned whether the board was aware of the French interest and claimed Altrad’s offer could be worth 33pc more than the bid accepted by the board.”

“CEO [Brian] Harvey confirmed he had received a number of approaches from Altrad executives in the run-up to the sale, but that they had been informal and vague. No offer to buy the business had been put to him. Mr Cooney said an approach from Altrad had only been made on Tuesday, after the EGM to vote on the sale of Sitserv had been called. He said the Altrad approach was non-binding and indicative.”

A few weeks ago, in another reply to Murphy, Noonan revealed that there were concerns raised about the Siteserv deal.

He said:

“Through this review, Department of Finance officials were made aware of certain aspects of the transaction which raised concerns with the quality of some of the decisions taken in respect of this transaction, including, among others, that legal advisors to the company referred to in the question had also acted for the purchaser, that a payment had been paid to the shareholders of the company referred to in the question, that some of those shareholders were members of the Board of the company referred to in the question and that a significant proportion of those shareholders appeared to be clients of the financial advisor on the transaction to the company referred to in the question.”

Further to this, Ms Murphy asked the Minister for Finance for specific details surrounding the bidding that led up to the sale of Siteserv – to essentially find out why Millington won the bid.

Mr Noonan said that, following a meeting about the sale in May 2012, and a further review of the sale in June 2012, another meeting was held on July 25, 2012, between him, his officials, IBRC’s chairman, former Fine Gael leader Alan Dukes, and IBRC’s CEO, Mike Aynsley.

In the meeting, Noonan’s officials raised a number of concerns with IBRC. Their concerns included:

“…the decision to allow the sale process to be held by advisors of Siteserv, the bidding process, entering into exclusivity with one of the bidders and the decision to exclude trade buyers.”

Mr Noonan also revealed that yet another meeting was held in August 2012 between the former secretary general of the department of finance, John Moran, and Aynsley, at which point, “the transaction had been concluded and no further action could have been taken”.

You may recall that last December, Mr Noonan stated that IBRC acted “at an arm’s length to the State” and that “commercial decisions in relation to IBRC were solely a decision for the bank.”

This was Ms Murphy’s latest question:

“To ask the Minister for Finance in respect of the departmental review of the sale of Siteserv to Millington by the Irish Bank Resolution Corporation, the process that resulted in him being convinced that the sale amounted to the best outcome for the State; if he and his officials looked at both rounds of bids; if so, the number and name of the companies that made bids in the first round; the place in the hierarchy Millington fell; the number of those bids that went forward to the second round; the criteria for moving to the second round; the place Millington, the winning bid, fell in the hierarchy in terms of the amounts bid; if the tender process was uniform for all bidders; if not, the reason for same; if not, the way the bids were ranked; and if he will make a statement on the matter.”

Michael Noonan’s responded yesterday:

“I am advised that, on foot of a meeting between officials from my department and senior management of IBRC held on 31 May 2012, it was agreed that my department would review this transaction to better understand the decisions taken by IBRC.

This review took place by way of a meeting between officials from my department and senior management of IBRC, on 11 June, 2012. At this meeting, IBRC officials explained how the sale process was conducted, from the selection of the original 50 candidates through to the 8 bids ultimately submitted and the selection of the winning bidder [Denis O’Brien’s Isle of Man vehicle Millington].”

“Following this review, a further meeting was held on 25 July 2012, which I attended along with officials from my department and the chairman [former Fine Gael lead Alan Dukes] and CEO [Mike Aynsley] of IBRC.

At this meeting, the transaction referred to in the question was discussed further, along with a number of other topics. I can confirm that at this meeting, it was put to senior management of IBRC that officials in my department had concerns with a number of decisions taken by IBRC in relation to the sale of Siteserv, including the decision to allow the sale process to be held by advisors of Siteserv, the bidding process, entering into exclusivity with one of the bidders and the decision to exclude trade buyers.

It was at this meeting that senior management of IBRC confirmed to me that the transaction involving the sale of Siteserv was thoroughly assessed by the board of IBRC prior to them approving it and that the transaction was managed in the best manner possible to achieve the best result for the State.

A further meeting between the former secretary general of the department of finance, John Moran, and the then CEO [Mike Aynsley] of IBRC took place in August 2012 at which this matter was also further discussed. A that point, the transaction had been concluded and no further action could have been taken”

“Notwithstanding the fact that a new Relationship Framework had been put in place, it was decided (following the meeting with John Moran and the then CEO of IBRC [Aynsley] in August 2012) that a senior department of finance official would be seconded to IBRC to explore opportunities for deleveraging with a view to maximising the recovery for the taxpayer.

This had the additional benefit of providing greater oversight while supporting the management team. The secondment of Neil Ryan to IBRC commenced shortly after.’

There you go now.

Previously: ‘The Best Deal For The State’

Denis O’Brien, Fine Gael And The Water Meter Deal

(Photocall Ireland)

Thanks Catherine Murphy

CRIMINALS

I hope so. It all stinks but is it illegal? Could this be a case for LCD?

they say ‘the price of democracy is eternal vigilance’ , or maybe its freedom rather than democracy, but man isnt that exhausting ….

The Banana Republic.

This.

Bets on now folks – whos gonna be the FG nominated scapegoat who’ll take a chunk of the blame in exchange for a 6 figure retirement package and sloppy seconds on a used mansion in Dalkey?

My moneys on Dukes, Noonans too vicious to retire until his blood dries up and they finally weld his pockets shut.

How many retirement packages on top of handy nixers does Dukes need ffs

Keep it simple lads

Out Out Out

That’s the call

Out Out Out

Ück ’em out

Out Out Out

Wipe them out

I’ve liked to believe that for the last few years Alan Dukes has been an elaborate art prank by Doug Jones.

Simple answer to all these allegations…

http://i.imgur.com/Nu7Odle.jpg

Very good Bodger and Catherine thank you

If it weren’t for the fact that the “Moriarty Tribunal into the award of the second mobile phone licence” produced its final report 4 years and two weeks ago, the report was immediately given to the Gardai, it took the Gardai two years to investigate the allegations and evidence collected by the Tribunal, and the DPP has been considering the matter for at least two years, and not a single person has been charged. If it weren’t for these facts, I’d be calling for a “Moriaty II Tribunal into the sale of Siteserv and the award of the water meter installation contract”.

Both controversies – and I think you can call the award of the second mobile phone licence in 1994 a “scandal” – happened under Fine Gael’s administration. Michael Lowry flourished for at least 17 years after the first scandal. Ministers Noonan and Hogan have so far flourished after the Siteserv sale.

Siteserv stinks to high heaven.

Any chance of a bullet point summary?

Dubloony, we’ll be working on one over the weekend and will have it up as soon as possible.

Has anyone FOI’d the Dept of Finance and the Dept of Environment

for the documentation attached to setting up,of a regime to charge

for water and sewage, they should look at a time frame of over 20

years, the revelations would make interesting reading…indeed to who

was avocating “water Raxes”.

Noonan has not answered Murphy’s questions. What is her recourse here and is there ANY legislation in place to compel ministers to answer Dail questions fully and truthfully?

Nope, the Dail is a creature of the Executive, utterly and completely.

Win an election in Ireland and enjoy untrammeled power for five years so long as you have enough slackjawed voting fodder to dimly march through whichever lobby you tell them.

For those looking for a summary of sorts. Here’s a snapshot of PQS & replies to date. https://steller.co/s/4HwZdseabkC

So Noonan zero details of the sale process apart from saying the Department of Finance and IBRC are getting the best outcome for the taxpayer? A big reply but nothing said. I hope Murphy pulls him up on this. He cannot just not answer surely?