From top: College Green, Dublin 2; Michael Taft

What is the real story with Irish wages?

Michael Taft writes:

With all the talk about industrial action and wage claims and wage offers and summer of discontent, etc. etc. etc. it is worth taking a step back and to look at the big picture.

Are Irish workers paid too much in comparison with other EU-15 countries?

A blog written by the Director of the Nevin Economic Research Institute, Dr. Tom Healy, looks at the adjusted wage share in the economy. That’s one way of measuring wages – and it shows Ireland performing pretty badly in comparison.

Here I am going to approach this issue by quantifying the proportion of the economy that goes on wages. But whenever you go down this route you are faced with a big question.

Do we use GDP which is inflated by multi-national profits which are not generated here but are imported to take advantage of our corporate tax regime?

Do we use GNP even though this is also inadequate as it excludes actual productive activity? Or do we use the Irish Fiscal Advisory Council’s hybrid-GDP which attempts to measure our actual economic or fiscal capacity?

Let’s take a cautious, conservative approach and use GNP. In terms of EU comparisons this means using Gross National Income (GNI) which is essentially GNP including payments from the EU (CAP funding, etc.).

When we do this we find Irish workers, collectively, are paid a small percentage relative to workers in other EU countries.

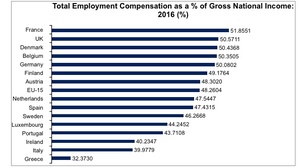

The EU Commission’s AMECO database estimates for 2016 finds that Irish employee compensation is near the bottom of the EU-15 table.

Employee compensation combines both wages and employer social insurance contributions; this is the standard measurement of wages and, as such, can be taken as a very close proxy to ‘labour costs’.

Throughout the EU-15, wages make up 48 percent of GNI. In Ireland compensation makes up only 40 percent – equal to Italy and ahead of lowly Greece (if we used GDP or the Fiscal Council’s hybrid-GDP, the percentage would be even lower).

What would happen if Irish wages rose to the average EU-15 level?

Total wages would rise by €15.4 billion, or 20 percent more than today.

That is the equivalent of €9,400 per Irish employee.

Of course, economies and wages are never so simple; therefore, you can’t run a slide-rule over gross numbers and extrapolate an optimal wage figure.

Much depends on the bargaining power of workers vis-à-vis employers, the position in the business cycle, the sectoral structure of the economy (high-tech? medium-tech?), compositional effect, productivity levels, etc.

However, we can’t get away from the fact that Irish wages take up far less of Gross National Income than in almost all other EU-15 countries.

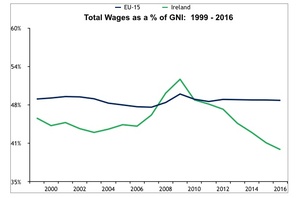

This is not a recent phenomenon.

Prior to the crash Irish wages remained well below the EU-15 average. The spike in at the beginning of the crisis doesn’t mean that Irish wages rose. In 2009, they fell by 9 percent and, again in 2010 by 7 percent. The reason wages increase in the graph is because GNI fell even faster – by 13 percent in 2009.

However, by 2011 normal business was restored and since then Irish wages have fallen by 8 percentage points.

One may dispute the legitimacy of a particular wage claim or wage offer. But when you step back and look at the broad landscape – just as Dr. Healy did – one can’t avoid the conclusion that Irish workers are not well paid in comparison with other European workers; at least not in terms of the proportion of the wealth that they generate.

Michael Taft is Research Officer with Unite the Union. His column appears here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

Best article ever on this site

Thanks Michael

and still the media, in this country, launches into every industrial dispute with the angle that the workers are at fault. I heard an interview of jack o’connor (not my favourite) by Pat Kenny on good Friday last and the sound of disgust/disbelief in kennys’ voice that a Luas driver might earn €30k was palpable. And yet they will say little and all about the rich (I sure the list includes some in the media) who avoid taxes

You dropped this in your moment of clarity – – – -> “blueshirts! damn blueshirts!”

blushirts clamps, blushirts

I musta been thinkin’ of euro-blushirts :)

The media in Ireland are generally more or less supporting of strikers and workers in general; it’s just that the Luas drivers are taking the absolute p1ss. The Clerys workers got a lot of sympathetic coverage, for example.

+1

Agreed

not true. lad who’s name is like my real name and is always doin it damage with your right wing posts. when the luas drivers first started, they were told they’re wages could and would rise up to 60k one day. years later, and theyve gotten no rise at all. but all the bosses did. so they want the bosses to shift some of their big increases down to them. but they wont. so then the media set about demonising the luas drivers, all in an effort to deter people in general from striking..

now you know

If they had a contract to enforce that, I’m sure that would have brought it to the WRC already.

60k for a job that requires 7 weeks training?? If their labour is really that valuable, I’m sure that they can find a similar job with no required qualifications for similar money.

I don’t know why you keep bringing up training time as if it has anything to do with anything. They were promised a raise. They didn’t get it. The top brass *did* get a pay rise. That is ridiculous. As for the WRC, Mulvey says the other day that Union leaders would be welcomed like heroes if they brought back the proposed deal which involved cutting for new recruits. Today he talks about reversing the decision to cut pay for new teachers and nurses. The mainstream narrative has been very much anti strikers.

Are they looking for 60k?

It doesn’t matter about the training.. any job transporting the public is bound to be pretty stressful.

The company is losing money; anyone else who went looking for a 50% pay rise in a company losing money, who can be replaced within 8 weeks, would be laughed out of the place. This is why the media, and the public generally, aren’t as sympathetic with the Luas workers as they generally are with strikers.

If they’re losing money, why did the top brass get raises then?

I have no idea; they are a private company, so they can pay their execs what they like, I suppose. Although I haven’t read anything other than an internet anecdote in support of this story, so am taking it with a grain of salt.

But you’re happy to make judgements on their claim that they’re losing money when they posted a profit of nearly over €800k in 2014 (http://www.irishexaminer.com/business/luas-operator-profits-slide-despite-more-passengers-363215.html) and also signed a contract of €150 million that same year? You’ll happily say the drivers shouldn’t ask for money because the company is losing money even though they’re not but you’ll take the “anecdote” that the bosses gave themselves pay rises “with a pinch of salt”. I mean, come on.

800K would go nowhere near covering the cost of increasing their labour costs by 50%.

– the headline in the link you posted says ‘luas operator profits slide’; they have continued to slide, with the Luas posting a loss of €870,000 last year.

??? I don’t get it. Did you not think I could just click on the link and paste the first sentence?

“A record year for the Luas in 2014 was not enough to prevent pre-tax profits at its French-owned operator declining by 34% to €872,270.”

Their profits declined TO 870k. That’s a profit of 870k. You said they were losing money and then said the claim the executives took pay raises was an anecdote you’d take with a pinch of salt. Clearly they are not losing money.

From your link there Moyest –

“According to returns just made to the Companies Office, Transdev Dublin Light Rail Ltd sustained the drop in profits from the structure of its new five-year €150m contract with the Rail Procurement Agency.

As a result of the new billing structures in place in the contract, which commenced last year, revenues at Transdev decreased by 15% to €48.8m in 2014.”

So profits are down as they’re paying the Irish government 150m over 5 years… seems like there’s plenty of money there..

@ Moyest – you are correct; I was mistaken.

I’m still not sure how they are going to increase salaries by 50% on their not-that-substantial profits. And why would they; I’m sure that they could find people to drive the Luas for €45k or €50k, anyway.

But the drivers aren’t asking for raises of 50%. *Some* of them are asking for a 40% raise and *most* of them are looking for *10%*. Over 3 years. Why did you say they were looking for 50%?

And the Dunnes workers a few years back.

The Clery’s workers showed up to work and the doors were closed on them.. some of them working there for 40 odd years.. their employers riding off in the sunset with their millions.

Comparing the Luas workers to the worst case scenarios of employers shafting their workers doesn’t really show that the media are sympathetic to the plight of workers looking for a decent wage.

How are they taking the p1ss exactly?

And yet… fastest growing economy… mumble mumble bullsh!t… something something recovery… trickle down mumble mumble…

All TDs should be asked if they believe in trickle down economics.

And any that say yes, should be fired for being a gullible muppet capable of believing in fairies and bullsh**

That ATM costs 0.35 Euro to use unless you’ve a nice bank balance.

#hit_the_bottom

some good points but this article is a bit simple and doesn’t take into account a lot of other variables.

If you look at it on a micro level; Company A and Company B both offer the same services. Their staff perform identical duties and are paid exactly the same. Company A, however generates 150% more turnover than Company B (down to better marketing, more efficient processes, etc.) So the staff in Company A generate more on the same wages. Should they have their salaries increased? Some would say yes, and then the same question, if that turnover % reduces do they have their wages reduced?

That is usually what bonuses are for.

I think linking the wage for the job to the revenue the job generates is a little bit illogical.

It’s perfectly logical. A company exists to make money. Everyone helps in making that money. If our work helps in creating 150% more money than last year, why should our boss get all that extra money? He didn’t earn that on his own. We helped him. If the revenue goes down and our boss can’t afford to pay us as much as he used to, then we have options. He can ask us to accept a lower wage. Some might take it, some might not. If nobody takes it, then I guess he shuts down.

Robert Reich has been saying this for years about the US economy.

Productivity rises, real worth of wages stagnant, hollowing out of middle class leaving ultra rich, working poor and welfare dependency.

Yep, the best little country in the world in which to be a facsimile of an oppressed US minimum wage worker.

+1 Watched the documentary ‘Inequality for all’ that you linked to recently…was very good.

You have the likes of Walmart making huge profits, and the U.S. government subsidising Walmart employees with food stamps because the pay is low. Then you have the Walmart CEO coming out saying spending is down because the economy is in terrible shape… Eh, hello duh like.. A good healthy well paid middle class is what increases spending over all. Even some wealthy individuals are starting to get this.

There was a wealthy CEO on the documentary who earned about 30 million the year prior, I think he said.. he said he paid about 11% tax over all. He was saying that’s there’s only so many nice cars he can buy ,only so many flat screen TVs, only so much money he’ll spend.. He had a pillow/mattress company, and he realised that sales were down because people couldn’t afford his good quality pillows.. he said he’d only need x amount of pillows himself.

There’s no real trickle down effect.. the rich hoard their money away. Wage inequality is at an all time high.

I don’t see why a tram driver shouldn’t be paid 45k.. after tax that’s about 650 a week. That might be enough where they could afford to get married, have children, buy a house…. maybe, with two working in the house.

“I don’t see why a tram driver shouldn’t be paid 45k.”

Me either. And I say that as someone who works in IT, spends a lot of time studying for certification exams and makes roughly 45K.

Michael’s ratio is flattered by the artificial increase in GNI since 2009 by the arrival of several ‘re-domiciled’ plcs – see here: http://www.cso.ie/en/media/csoie/surveysandmethodologies/documents/pdfdocs/Redomiciled,PLCs,in,the,Irish,Balance,of,Payments.pdf – likely to have been around €8bn in 2015.All of this boosts GNI (denominator) but not the numerator (compensation of employees).

Regarding the chart – the ratio of employee compensation to GNI only climbed above the EU-15 average in one year, 2009. This was because because Irish firms experience a MASSIVE and UNPRECEDENTED shock to their profitability that year. Not surprisingly they responded by cutting workers – employment fell by 7.8% that year. That is the biggest single year of % decline in the EU15 between 97 and 2017 – about 300 observations.

Short version: employment growth needs profitable firms.

Nice post Fack, thanks.

High five. That’s very good, indeed.

Fact Checker – as the EU Ameco database merely reports the national accounts data, irregular issues such as company inversions are not recorded. We can’t definitely measures any productivity arising from this practice but I suspect it would be low. The data above does flatter – but not by much. Assuming projections hold and the impact of inversion grows at the same rate as GNI, employee compensation would only rise to 42.1 percent of GNI. There is no change to Ireland’s ranking.

Thank you Michael. I appreciate that it does not make a huge difference to the ratio.

I just wonder which firms are in a position to pay workers a whole lot more? I refer you (as per last time) to this Seamus Coffey post: http://economic-incentives.blogspot.com/2015/07/and-whatever-youre-having-yourself-stat.html

78% of private sector employment is by Irish-owned firms. The domestically-owned firm sector in Ireland has the second-HIGHEST labour share of value added in Europe (ie, workers take home proportionately more than owners more than nearly anywhere else). This is presumably because these firms are not particularly profitable!

As for the rest, there is very little argument that non-Irish firms pay better (this even holds in low-productivity sectors like retail). OECD data show that high-skilled Irish workers are among the best-remunerated for their skills internationally – no doubt due to the predominance of high-tech, foreign-owned firms which reward high skills.

So I ask – which sector of the business economy is in a position to start paying its workers a huge amount more overnight?

Fact Checker – the issues using that data revolve around structure of the indigenous sector (very high levels of low GVA activities such as hospitality) and the position in the economic cycle (data from 2012). Need a more thorough sectoral breakdown to see what sectors but take indigenous manufacturing. Using wages/turnover (as Gerry Brady from IBEC used in a tweet exchange with me yesterday), shows that in this sector wages would have to rise by 20 percent. But even then we must examine the sub-sectors to see where the gap is. Further, there is just a straightforward compensation per hour – which Unite will be publishing soon. So watch the space over at my blog for follow-up to these important questions.

Michael,

Any chance you could explain this to me, in plain English. I’d really appreciate it, thanks! (pg 19)

http://www.budget.gov.ie/Budgets/2015/Documents/Economic%20Impact%20of%20the%20FDI%20sector.pdf

The analysis below is for sectors where output is relatively evenly split between Irish and non-Irish-owned firms, where the share of GVA of Irish -owned firms is between one third and two- thirds of total GVA for the sector.

These six sectors are not particularly representative, accounting for only €2.6bn of 2008 GVA. Still, what is noteworthy is the consistently higher productivity in the foreign -owned firms compared to the indigenous firms. This holds across sectors where output is relatively evenly shared by country of ownership. Compensation per employee is also consistently higher in these firms, with a crude premium of between 10 per cent and 33 per cent for workers in foreign -owned firms

+1 Fack Checker

There is definitely a two tier economy.

There are the highly profitable MNCs and then there’s the domestic Irish sector. A small cohort of highly efficient (from a per employee profitability perspective) generate an outsized share of the overall economic value.

This is mirrored in our income tax returns where a small cohort of workers pay the bulk of income tax.

Anne

Basically they are saying that multi-nationals are more productive than indigenous firms and, as a consequence, wages are higher in the multi-national sector. By focusing on the selected sectors, they were hoping to get a like-for-like comparison, or close to it (for instance, you can’t compare a multi-national pharmaceutical with a domestic meat factory). There’ s nothing surprising in this – however, it does beg a question that is rarely asked: why does native capital go into less productive, low value-added sectors. For instance, in the market economy (essentially the private sector), nearly 50 percent of employment in the indigenous sector can be found in hospitality and wholesale/retail. This is well above the European average even factoring in that we have a high level of tourism. Does that answer the question?

@Andy

Skills are very well rewarded in the Irish labour market.

Unfortunately the opposite is the case at the other end of the labour market. This is where small, indigenous firms employ low-skilled workers and it is not at all pretty.

Wages are low and profitability is low because these firms are not particularly productive. There are many reasons for this:

-investment low due to (some) bank lending constraints and weak profitability

-small market means incumbent firms don’t fear entry and can get by without innovating

-at the same time Irish market is too small to get scale to build up for export either

-formal educational attainment is rising but there is some evidence that it is much easier to gain educational credentials than before. OECD PIAAC data shows pretty poor levels of adult literacy and numeracy given the level of alleged formal educational achievement.

-high-skilled workers peel off to better paid MNCs and public sector

-not enough support for apprenticeships from firms or government

-low formal education and poor business processes probably INTERACT with each other too in a negative sense.

Short version: many Irish firms are not innovative, many of their workers have low skills. Unlikely that they have potential to start increasing wages soon.

It actually does, thanks Michael..

I was reading about output/productivity to get to grips with the meaning of some of the terminology. I’m trying to figure out how productivity is measured in the service industry too.. fascinating stuff.. :)

In terms of what Fact Checker said above – “78% of private sector employment is by Irish-owned firms. The domestically-owned firm sector in Ireland has the second-HIGHEST labour share of value added in Europe (ie, workers take home proportionately more than owners more than nearly anywhere else). ”

Trying to understand that too.. Proportionately more of the GVA here, but that doesn’t necessarily mean they are well paid at all.

I wish layman’s terms were used a bit more to explain some of this.. I was watching France 24 last night and they had an economist on talking about the Panama Papers and he mentioned something about keynesian economics versus chicago school versus reaganomics. I was thinking how in the name of god is anyone supposed to interpret what he’s advocating unless they’ve studied economics? The presenter reprimanded him btw.. :)

Anne

In laywoman’s terms: value added for a firm is all sales less all input costs (machinery, licenses, utilities, etc). What is left over is divided between owners (gross operating surplus aka profits) and workers (compensation of employees aka wages). These are economic concepts and do not always map neatly to accounting uses btw. Productivity is gross value added per worker.

In the short run a firm can only pay more wages if it reduces profits, or vice versa. The wages:profit split depends on many, many things like:

-bargaining power of workers (union density, in-demand skill sets, etc)

-concentration of market – firms with monopoly power will be able to charge higher prices

-cost of capital

About half of all of those in employment in Ireland are employed by Irish-owned firms. The rest is self-employment, public service and foreign-owned firms.

Most Irish firms generate low value added per worker because they are unproductive. Because they are unproductive wages are low and profits are low. This is true compared to non-Irish owned firms and indeed the indigenous sector elsewhere in the EU.

A good friend of mine has worked in management the retail sector for both an Irish-owned and a German-owned retailer (they are household names). He says the difference in business processes is stark:

-Irish firm works on pen and paper, faxes, phone calls

-German firm works on computers, all is automated

German firm is more productive (much lower workforce despite lower prices). You can see this when you go on the shop floor. German firm is almost certainly more profitable, and also manages to pays its workers better too.

Thanks for all that Fact Checker..

Where you say -“Most Irish firms generate low value added per worker because they are unproductive. Because they are unproductive wages are low and profits are low”

Unproductive in what sense? Percentage of owner share of profits are lower relative to other EU countries? There are no profits?

It’s a scale isn’t it? At what point do you class a sector as unproductive?

Productivity is low because value added per worker is low. Value added (recall) is wages plus profits.

Profits are generally not negative although, memorably, the entire construction sector in 2010 recorded negative profits!

I digress. Output per worker in indigenous firms in Ireland is a) MUCH lower than foreign-owned ones; b) lower than in indigenous firms in other EU member states.

In theory you could have a low-productivity firm where workers claim most of the value added as wages, or owners claim most of it as profits. It depends on their relative bargaining power. But my major point (which I will end on again for the 2 people left reading) is that no matter how wages and profits are allocated in indigenous Irish firms, there simply isn’t very much to go round because the firms are not very productive.

While Ireland might be home to 9/10 global top 10 tech firms, etc, etc, many indigenous SMEs have a dismal online presence and can barely list their phone number.

Anne, for Kenyesian economics vs Chicago school,I founf The Shock Doctrine by Naomi Klein had a good rundown of the differences. You may not agree with her politics (I honestly can’t remember where you stand, but bear in mind that I do agree with her and I’m a die-hard lieftie), but her explanataion of the history and differences is very good.

Thanks Lorcan.. I’ll look into that book.

Fact Checker, thanks again.

What I’m getting at, in terms of where you say, ‘productivity is low’… this is comparatively speaking, right?

And wouldn’t costs here such as insurance costs, finance costs (interest rates are higher here than other EU banks for instance) obviously have a bearing on the value add/productivity?

Anne

Yes. Output per worker (aka productivity) in indigenous Irish firms is lower than equivalent firms elsewhere in the EU.

Business input costs will of course have a bearing too. Energy, insurance, interest costs and business rates are all high in Ireland and will weigh on value added. On the other hand things like setting up a business, paying tax, etc, are generally considered to be easy in Ireland.

Thanks Fact Checker..

Low productivity (comparatively speaking) per worker to my mind sounds misleading, when you factor how it’s calculated.

Thanks Anne. I have no idea what you mean however.

I’m not sure what you’re thanking me for.. but anyway, I’ll try to explain what I meant.

Irish employees being classified as having low productivity, seemed to be suggestive that they’re inefficient, when that’s not the case.

Thanks Michael for keeping that conversation going, and Fack too obviously :)

“Irish workers, collectively, are paid a small percentage relative to workers in other EU countries”

Could the fact that we have one of the lowest workforce particiaption rates of any developed country have something to do with this?

News ta me, any links?

@Clampers

http://files.nesc.ie/nesc_reports/en/137_Jobless_Households.pdf (page 6) and https://www.welfare.ie/en/downloads/WorkandPovertyPres10Dec2012BMDW.pdf slides 7 and 8

No. Participation is indeed low.

If workforce participation magically increased by 10 percentage points presumably the stock of capital would also need to increase too and there is no reason to believe that the wages:profit share would change.

Sorry, but this is meaningless. What is the relevance of aggregate wages as a % of GNI / GDP or whatever? What is relevant is whether, on the one hand, workers are being rewarded sufficiently (after tax) and, on the other hand their output is proportionate to that cost (productivity). As it happens we have a host of capital intensive multinational activity (ICT, Pharma, Aircraft Leasing) that inflates GDP (even before GNP adjustments) and therefore depresses the % of Aggregate Wages / GNP. Its like Taft goes digging every week for contrived statistics to justify the positions he already holds.

OK. I hear you. May I ask, how would you present comparative figures? Or do you know of a link with comparative figs that you would have some agreement with ?

Not knocking, just askin’ :)

keep the recovery going

and sure havent FG already gone back on the abolishing the USC promise? they got that out there before they’ve even formed a government. thanks a bunch all you gullible tits who voted for em.