From top: Shelf in Dunnes Stores; Michael Taft

The economy is growing.

So why have Irish living standards barely lifted?

Michael Taft writes:

Following on from my recent blog which showed that middle income groups received less than the national share of income than the EU-15 average (due to high income groups taking more) it might be worth having a look at general living standards in comparison with other European countries.

This is about living standards, not just income.

Eurostat measures living standards through actual individual consumption. Unlike private consumption (i.e. consumer spending) actual individual consumption ‘ . . . encompasses consumer goods and services purchased directly by households, as well as services provided by non-profit institutions and the government for individual consumption (e.g., health and education services).’

It, therefore, measures consumption not only of goods and services, but public services provided by the government.

As Eurostat states:

‘Although GDP per capita is an important and widely used indicator of countries’ level of economic welfare, (actual individual) consumption per capita may be more useful for comparing the relative welfare of consumers across various countries.’

In short, actual individual consumption can be treated as a proxy for living standards. So what is the relative welfare of consumers (i.e. everyone) across Europe?

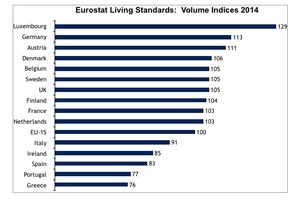

The above graph captures the relationship of real (after inflation) living standards in purchasing power parities between all EU-15 countries and the EU-15 average.

We can see that Ireland is in the bottom half of the table – 15 percent below the average. Our living standards are closer to Greece and Portugal than it is to the EU-15 average and the majority of countries.

Unsurprisingly, our living standards have been falling since we entered the recession. In 2008, Ireland stood at 95 – still below the EU-15 average and most other EU-15 countries; and that was with the wind of an unsustainable boom at our back.

During Fianna Fail’s reign (Austerity Round 1), it fell six points to 89. Under this government (Austerity Round 2), it has fallen a further four points to 85 (Austerity Round 2).

In 2014 our living standards fell relative to the EU-15 average – from 87 to 85. This coincided with all the good new stats.

In 2014, GDP increased by 4.8 percent – as often said, the fastest growing economy in Europe. In 2014, employment increased by 40,000. In 2014, the recovery started. This may help explain that oft-asked question: if the economy is growing, why don’t I feel it?

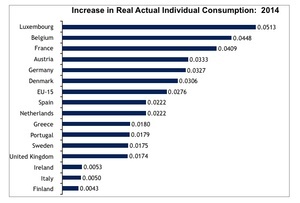

It should be stressed that this is a relative measurement – relative to the EU-15 average. In real terms (after inflation), Irish actual individual consumption per capita increased, but only slightly, while growth in the EU-15 was far higher.

Note the contrast: Belgium and France saw substantial increases in living standards even though GDP growth in 2014 was 1.1 and 0.2 percent respectively. Irish living standards barely grew, even though it had a growth rate of four times that of the two countries.

Looking at the two main components – consumer spending and spending on public services – we can see why Ireland trails. These are measured in purchasing power parities.

In 2014 Irish spending on public services was 7.5 percent below the EU-15 average while it was 32.3 percent below the average of our peer group – other small open economies (Austria, Belgium, Denmark, Finland and Sweden). This suggests that we would have to spend €2.4 and €10.5 billion respectively to reach these averages.

In 2014, Irish consumer spending per capita was 11.4 percent behind the EU-15 average and 14.2 percent behind the average of other small open economies. This suggests an increase in consumer spending for every man, woman and child of €440 and €550 respectively.

There are a number of explanations for this

First, the lack of labour rights in the workplace (e.g. collective bargaining, rights for part-time workers) which depresses wages; and, second, a weak social protection state – one that is characterized by ‘welfare for the poor’ and rather than protecting all those at work through access to affordable public services and income supports.

Another issue is high living costs. One may have a reasonable income but if services like childcare or prescription medicine or public transport are high, people will struggle after expenditure.

One can only hope that 2015 might see an increase in living standards. After all, we had a second year of being the fastest growing economy in the EU and further employment increases.

But we had that in 2014. And we still fell further behind in the living standards stakes.

Michael Taft is Research Officer with Unite the Union. His column appears here every Tuesday. He is author of the political economy blog, Unite’s Notes on the Front. Follow Michael on Twitter: @notesonthefront

But, But bawldy noonan told us we should be proud that we’re not like greece, as he shilled for the ecb coup against their elected government.

More people are working, wages are lower, cost of living has increased. The latter two negates all the good of the first. Life sucks a$$.

The cost of living hasn’t increased. Annual inflation is at -0.1%. The cost of living is actually dropping slightly.

http://cso.ie/en/releasesandpublications/er/cpi/consumerpriceindexfebruary2016/

Good article though and I usually have no time for Taft of his UNITE Union buddies.

It’ll be interesting to see the 2015 figures. if employment increased in 2014 by 40,000 that will start making itself felt in 2015…

In what way?

I also struggle to see how an increase of 40,000 people in employment would have an impact on their standard of living.

Cian is working off Fine Gael logic… working = happy… no other caveats involved.

We need more bedsits with endless Star Trek re-runs! And money making opportunities like turning bedsits into niteclubs… Mine….. I’ll call it Deep Space Mine at the weekends and sell entry tickets to… Dublin’s smallest hipster club feat. Cisco Doin’ Disco on weekends! A feature presentation mid evening called, Couching with the Cardassians… and we could invite Rachel and Stephen.. or Stephen and Rachel.

will there be a slow set?

It will be attended by the slow set.

There is much to agree with in this piece.

However, Michael claims that more developed workers’ rights would boost their purchasing power and push up consumption. This might well be the case.

He then correctly points out that prices are high for “childcare or prescription medicine or public transport” in Ireland and lowering these would increase purchasing power.

But he cannot have it both ways. Pushing up wages will INCREASE prices paid by consumers of these services and/or reducing prices will PUSH DOWN wages for workers in these sectors. So on net nothing changes.

The only ‘magical’ way to increase living standards is to enhance productivity and/or increase labour force participation. This has worked well for the last few centuries. It’s a pity Michael has nothing to say on how to achieve it.

You make valid points, Fact Checker. However, the increase in wages is more complicated than assuming an automatic increase in consumer prices. The impact may be mitigated by productivity increases, increase in value-added (whereby both profits and wages increases but the ratios stay the same) and the low levels of the labour share. We should also note that increasing wages, even in labour dense sectors, does not fully translate into consumer prices. In the Hospitality sector, the impact would be only .4 since that is the percentage wages make up in total enterprise expenditure – and that’s on a static basis. However, considering that value-added increased by 16 percent in the hospitality sector, a wage rise can be sustained with minimal impact. And with the extra revenue for the Government, more resources can be put into public services, thus driving down social living costs. This is not to dismiss the impact of wage increases on prices – only to suggest that is much more complicated and have to be seen in the wider sectoral context that firms are engaged in.

“And with the extra revenue for the Government, more resources can be put into public services……….”

Another way of saying more of your taxes can be wasted on cossetted, non-productive, unfireable, gold-plated pension inheriting, public service union members. No thanks!

That’s not what he’s saying at all. Good lad.

Wrong again, sweetie.

Yes you were, petal.

Thank you Michael. I appreciate all of your points.

Maybe there is room in profit margins for higher wages. This blog post suggests that domestic-owned firms have the lowest share of profits as a share of turnover in Europe though (http://economic-incentives.blogspot.lu/2015/07/and-whatever-youre-having-yourself-stat.html, see last chart).

Actual individual consumption (AIC) was indeed high in 2008. However that year saw a current account deficit of over 5% of GDP, suggesting that these levels of consumption were not being financed entirely from domestic resources. This reduced over time as lower consumption translated into lower imports. While AIC is indeed lower today, we can state with greater confidence that it is sustainable, and not at risk from a prompt reversal if investor sentiment toward Ireland turns.

I am familiar with Seamus’s post and he is correct in the figures he puts forward. However, it is slightly skewered by the structure of the indigenous market economy. In Ireland, 17 percent of employees work in the hospitality sector – a low-waged, low value-added, low-investment sector. In the EU-15 the figure is less than half. When turning to high-valued added activities such as manufacturing, Irish employment is half. This means that Irish labour share is structurally low. A better approach would be to examine shares on a sectoral basis but even here we must be cautious since a single year – especially when Ireland was coming off a severe recession and still in stagnation – might not capture the norm.

Mr Taft makes an excellent argument here for reducing the punitive rates of tax paid in this country by anyone earning more than 36,000 annually which dramatically reduces their purchasing power.

fact

Lol. No he doesn’t.

Damp, a grown up can explain to you if you can find one. Good chap.

Exactly! Our higher pay income Tax ceiling is 36K!! In the UK you can earn £66K Sterling before you hit the ceiling. USA is over $100K!! We are shafted as usual from every angle in Ireland.

Ireland actually has the second lowest labour taxes in the EU. I don’t get this myth that the workers are heavily taxed in Ireland.

Anyone making over 36k is.

Not so. The tax rates are highly progressive until they reach about €80K. Then they flatline. The wealthy don’t pay their share.

“The wealthy don’t pay their share” – that’s a startling generalisation. If they’re paying the full income tax, USC and PRSI, then they ARE paying their share. Its the dodgers that kill me.

Ireland was bankrupt a few minutes ago. Most people are weighed under with debt. But “the fastest growing economy in the world”…

We learn nothing here and produce nothing of value. Monkeys on a roundabout of self delusion.

Like yer ma.

Mind your tongue Funster!

union shill blames our misplaced bloated public spending on the reason we dont have a high standard of living. ALso advcates that unions and collective bargaining would help, yet complains about the high consumer prices that unions cause.

what do you want sir shillington.

Unions cause high prices? Lol.

Check your bill from the ESB.

I did.

So he just proved you wrong.

Lol. Nope.

Well done. I’m surprised you can read.

This is going to kill me…but… he has a point.

See documentary “Inequality for all” for fuller explanation.

http://www.theguardian.com/film/2013/feb/02/inequality-for-all-us-economy-robert-reich