This morning.

The Central Bank of Ireland has released the residential mortgage arrears and repossession statistics for the third quarter of 2016.

The Central Bank writes:

The number of mortgage accounts for principal dwelling houses (PDH) in arrears fell further in the third quarter of 2016; this marks the thirteenth consecutive quarter of decline. A total of 79,562 (11 per cent) of accounts were in arrears at end-Q3, a decline of 3.1 per cent relative to Q2 2016.

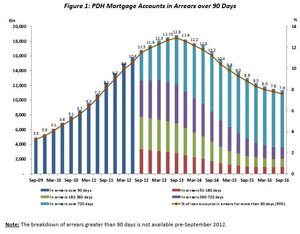

The number of accounts in arrears over 90 days at end-September was 56,350 (8 per cent of total), reflecting a quarter-on-quarter decline of 2.1 per cent. This represents the twelfth consecutive decline in the number of PDH accounts in arrears over 90 days.

Buy-to-let (BTL) mortgage accounts in arrears over 90 days decreased by 2.4 per cent during the third quarter of 2016. At end-September there were 14,518 BTL accounts in arrears over 720 days, with an outstanding balance of €4.3 billion, equivalent to 18 per cent of the total outstanding balance on all BTL mortgage accounts. There was an increase of 5.4 per cent in the number of BTL accounts where a rent receiver was appointed; this follows on from an increase of 1 per cent in the previous quarter.

Residential Mortgage Arrears and Repossession Statistics: Q3 2016 (Central Bank of Ireland)

Meanwhile…

In Saturday’s New York Times, Liz Alderman reported:

The Tobun family never missed a rental payment on their modest brick rowhouse in eight years. But in February, the couple, who have two young children, received a letter warning that they would be evicted when their lease expired. Forty of their neighbors got the same notice.

When they went to investigate, the tenants, in the working-class suburb of Tyrrelstown, discovered a trail that led all the way to Wall Street.

After Europe was ravaged by a financial and economic crisis, the giant investment bank Goldman Sachs snapped up huge swaths of distressed debt in Ireland, including the loans of Tyrrelstown’s developer in 2014. The developer [brothers Rick and Michael Larkin, of Twinlite] now wants out of the rental game and is selling the properties. As the owner of the loans, Goldman will reap a large portion of the proceeds.

Goldman has nothing to do with the possible evictions here. But because American banks have played such a large role in Europe’s housing recovery — and have made huge profits in the process — they have become the main target of a growing backlash among homeowners and renters.

“Somehow, these funds have gotten involved in our community,” Funke Tobun said. “They’re profiting, but it’s the people who are being made to suffer.”

Wall Street has become the biggest new landlord in Europe, as American financial firms have swept into cities, suburbs and towns to take to advantage of the fallout from the worst economic downturn since World War II. In the last four years, Goldman Sachs, Cerberus Capital Management, Lone Star Funds, Blackstone Group and others from America have bought more than 223 billion euros’ worth of troubled real estate loans around Europe, nearly 80 percent of the total sold.

The firms have made the usual calculation: buy distressed investments on the cheap during tough times, betting that the outlook will eventually turn and riches will follow. And the firms are paying little or no tax, by employing complex strategies that often involve subsidiaries with no operations or staff.

The huge profits and dubious tax strategies have made Wall Street a major object of frustration and anger, as people grapple with evictions and higher mortgage payments. In some cases, the Wall Street firms are passive players, the money men behind the landlords, developers or banks that are exerting force. In other cases, they are direct participants taking action.

…Ireland is now enjoying a robust recovery. But growth has been fueled partly by financial maneuvering, and the real underlying gains are far from even. More than 5,000 people have been left homeless by the crisis, with the government subsidizing many in shelters.

Mrs. Tobun does not have many options. She does not want to move farther out, since it would mean changing schools for her son who has special needs. A nearby rental is too expensive. Rents in Ireland have risen around 20 per cent since the crisis as home construction dried up after the bust.

…Like other Wall Street players, Cerberus came into the country quietly, creating a local subsidiary under a different name and setting up a complex and extensive web of interconnected businesses.

There are the 13 subsidiaries in Dublin, all with Promontoria in their names. They have no employees and no offices. They are all registered to the same address on Grant’s Row, a letterbox near Parliament. Those subsidiaries, in turn, are subsidiaries of holding companies in the Netherlands, more than 110 of which had the Promontoria name.

The structure has helped Cerberus profit in Ireland…

Wall Street Is Europe’s Landlord. And Tenants Are Fighting Back (New York Times)

Good times

We all rented.

that article claims taxi drivers make €40 in total over a 12 hour shift!!

What do all the free-market open-shirt hot-shots think will be the end result of evicting thousands of families on to the streets? A stiff letter to the Irish Times from an peeved family man sleeping in the park in the rain maybe?

Or perhaps a far less predictable reaction from thousands of working people, already in precarious situations, to removing any type of dignity they have by evicting them? Good luck making sure that happens without a hitch…

Its a ridiculous situation, should never have been allowed. But if they give the legal notice and do everything by the book then they do have a right to not renew a lease.

Make BLT repo’s non judicial,it’s all swings and roundabouts.

“We’re child-proofing childhood,” said Milanee Kapadia, when told that these seesaws were among the last in the city. One of her 4-year-old twins has special needs, and the seesaw, which requires cooperation and coordination, is just the kind of equipment her therapists recommend. So she comes regularly. “One little fall or a tooth broken and the next thing you know they are out,” she said.

http://mobile.nytimes.com/2016/12/11/nyregion/the-downward-slide-of-the-seesaw.html?referer=

Does anyone know if the figures are being adjusted for the fact that the total number of outstanding mortgages may be increasing each quarter relative to the number of accounts in arrears > 90 days?

As all mortgages are kinda outstanding, I take it you mean due to an increase in the volume of new mortgages, the percentage of mortgages in arrears(over 90 days included) is declining as a percentage of the total? Is that what you mean?

if you look at the underlying data (link in article) in Sept 2015 there were a total of 749,851 residential mortgage loan accounts outstanding with 92,361 in arrears [12.3%]. This dropped to 738,506 and 79,562 respectively [10.8%] by Sept 2016.

So in real terms the total number of residential mortgages decreased by 1.5% and the number in arrears decreased by 13.8%.

So 12,800 fewer homes were in arrears, and of that 2,000 were repossessed [repossessed on foot of an order OR voluntarily surrendered/abandoned] in the 5 quarters ending Sept 2016.

Oh, and the numbers of ‘Restructured Mortgages’ has remained fairly consistent at 120,000

Yeah that makes sense. I assumed that the total was increasing but as you rightly point out the total is decreasing.

ok thanks.

what do you mean “in real terms’? Are you not working out the percentages the same way, except year on year instead of quarter on quarter?

in real terms – I mean the raw counts of mortgages and arrears.

“Somehow these funds have gotten involved in our community”

Yeah, aided and abetted by FG and Baldy Noonan..the middlemen in Ireland’s enslavement.

“…a letterbox near Parliament”? What nationality was the writer of this?

By the way, apropos of nothing, Goldman Sachs is an anagram of Scandals Go Hm.

Both Canada and Denmark have solved their housing problems by making it illegal for non-residents to buy homes.

I’m guessing American, since it’s the New York Times.

“making it illegal for non-residents to buy homes”

Gets my vote

If they keep that trend up the amount of mortgages in arrears will eventually be zero.. due to repossessions. Great stuff altogether.

as I mentioned above 12,800 fewer homes were in arrears in the 5 quarters ending Sept 2016. Of that 2,000 were repossessed [749 repossessed on foot of an order + 1251 voluntarily surrendered/abandoned].

So 10,800 were sorted without repossessions.

According to the CBI, since 2009 fewer than one in three hundred mortgage holders have lost their homes through the court system. Will be a long time for arrears to get to 0 at that rate….

“Buy-to-let (BTL) mortgage accounts in arrears over 90 days decreased by 2.4 per cent during the third quarter of 2016. At end-September there were 14,518 BTL accounts in arrears over 720 days, with an outstanding balance of €4.3 billion, equivalent to 18 per cent of the total outstanding balance on all BTL mortgage accounts. There was an increase of 5.4 per cent in the number of BTL accounts where a rent receiver was appointed; this follows on from an increase of 1 per cent in the previous quarter. ”

can someone take the BTL’s away from the children please.

“I think we have to take the kids out a little bit from the safety bubble,” she said, placing her 2-year-old daughter, Sadie, on a seesaw too.

Traditional seesaws have other supporters, including occupational and physical therapists, who have noted with concern the increasing number of children who have problems regulating themselves emotionally and physically as childhood becomes more sedentary.

“To adults, seesaws might look like an accident waiting to happen,” said Lauren Drobnjak, a physical therapist in Cleveland and co-author of the book “Sensory Processing 101.” But “by rapidly moving the child through vertical space,” she said, seesaws provide input to a child’s vestibular — or balance regulation — system “in a way that no other playground equipment can.” And children learn strength and coordination when they hit the ground and push themselves back up.”