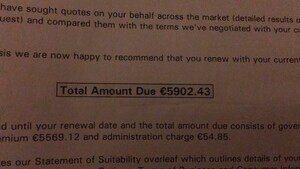

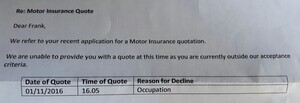

Car insurance protest in Dublin city centre in 2016

This morning/afternoon.

We knew this day would come.

Via RTÉ:

Six motor insurance companies have signed legally binding agreements to reform their internal competition law compliance programmes, following an investigation by the Competition and Consumer Protection Commissio

The development brings to an end a five-year long investigation by the CCPC into suspected “price-signalling” by organisations operating in the insurance market – an anti-competitive practice where businesses make their competitors aware that they intend hiking prices.

The CCPC said the agreements in no way give the industry a “clean bill of health” and it has written to the Central Bank outlining its concerns about the broader culture of the industry and the “repeated interventions that have been needed to address issues in the sector.”

The six firms that have signed up to the legal commitments are AIG Europe SA, Allianz PLC, AXA Insurance DAC, Aviva Insurance Ireland DAC, FBD Insurance PLC and AA Ireland Limited.

However…

Brokers Ireland, which was also the subject of the probe, has declined to sign up to the agreements.

*swerve*