Just this.

Just this.

“The tax avoidance schemes are so complex it elevates the position of accountants, causing young talented people to gravitate to these jobs rather than becoming engineers or moving into positions that build innovation,” says Jim Stewart, associate professor of finance at Trinity College Dublin.

“It is also dangerous. With the stroke of a pen in another country, companies located in Ireland relying on tax incentives could choose to relocate.”

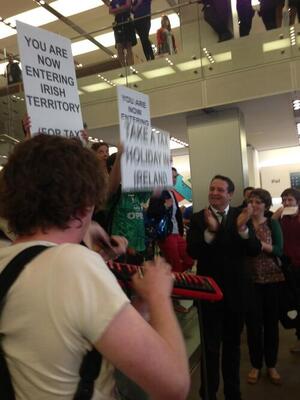

And Ireland’s success in attracting investment and its use of fiscal incentives is less popular abroad.

Nicolas Sarkozy, the former French president, tried to make an increase in Ireland’s corporate tax rate a condition of the country’s €67.5bn international bail out in 2010. Dublin stood firm against Paris, but criticism is intensifying amid evidence of multinationals using increasingly complex tax avoidance strategies to avoid even paying the 12.5 per cent rate in Ireland

Last year a US Senate committee pinpointed three Microsoft subsidiaries in Ireland as playing a key role in an “aggressive” global tax structure aimed at saving itself billions of dollars in US tax. In 2011, the structure saved the company $2.43bn in US taxes. Google has also been widely criticised for using legal tax avoidance strategies, dubbed the “Double Irish” and the “Dutch sandwich” by the accountants who devise them.

John Christensen, director of the London-based Tax Justice Network, says loopholes in Irish tax law enable companies to book profits at near-zero tax rates. “Ireland’s membership of the EU means that many countries that apply withholding taxes on payments to tax havens treat Ireland as an ‘onshore’ country. These factors make Ireland a useful conduit for tax avoidance,” he says.

Michael Noonan, Ireland’s finance minister, rejects the accusation that Ireland is a tax haven and points out that multinationals employ thousands of people in real business activities. “It is America’s tax code that allows for this tax planning,” he told parliament recently, referring to the system that allows US multinationals to pay their tax in Ireland, not the US.

Privately, Dublin is concerned about the Organisation for Economic Co-operation and Development’s call for countries to catch companies dodging corporate tax.

Left wing rag.

Great tax race: Ireland’s policies aid business more than public (Jamie Smyth, Financial Times)