From top: Housing Minister Eoghan Murphy this morning with. Dublin Simon Community CEO Sam McGuinness during the launch of Simon Community Annual Review; Anne Marie McNally

Today the Minister for Housing described the level of rent increases in Ireland as ‘unsustainable’. Yet in doing so he offered nothing to actually address the issue.

Unsustainable to him is a word in a press release. Unsustainable, to a family in rented accommodation means potential homelessness.

Yesterday’s ESRI report should be the impetus needed for this Government to call an urgent halt to the dangerous way in which the rental sector in Ireland is developing.

It is surely time for recognition that an immediate nationwide rent freeze is required and it must seriously begin the debate regarding whether or not the Central Bank mortgage rules are having the unintended consequence of driving the rental sector further and further out of control.

The Central Bank mortgage rules were implemented in order to stop people taking on mortgages they could not afford.

But as a result of spiraling house prices, the deposit amounts required get further and further from ordinary worker’s reach and therefore so too does home ownership, this despite the ability of many to comfortably sustain a mortgage repayment.

Instead people have been forced to turn to the private rented sector where they find little to no security of tenure and escalating rental costs which are more often than not significantly higher than the mortgage payment they would have to make if they could just get a deposit together.

Recent data from Daft.ie shows that most mortgages needed to buy one, two or three bedroom properties cost substantially less per month than average rents for similar properties. In some cases, a mortgage is half the cost of the rent.

Similar data was published by Cairn Homes showing that it’s 50% more expensive to rent a property in one of its developments than it is to buy – a situation which cause the Cairns CEO to comment:

“That’s an extraordinary number that people don’t seem to fully understand.”

In ‘helping’ people to avoid mortgages they cannot afford, the Central Bank rules have forced increasing numbers of people to take on rents they cannot afford.

This creates a precariousness in people’s personal lives but also in our wider economy and society which is, to borrow Minister Murphy’s word of the day, unsustainable.

Nobody is winning here – except maybe, in the short-term at least, some landlords.

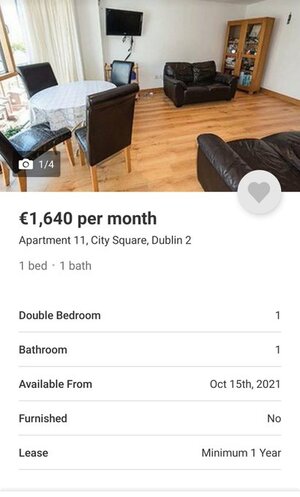

The ESRI report says the average rent in Dublin is now around €1,700 – a quick check on Daft.ie shows that is very much on the lower end of the properties available.

If you’re a single income household earning in or around the average wage of €38,871 (CSO.ie) per year and renting in Dublin, then a significant percentage (52.5%) of your earnings are being spent just to keep a roof over your head.

(Many households find themselves with little choice but to be single-income because the cost of childcare often makes it impossible for both parents to work full-time).

How, in reality, can anyone be expected to fork out almost €2,000 per month a rent, pay bills, buy food etc., and at the same time save towards a deposit for a mortgage?

While the catchphrase about rent being dead money is common, so too is the more apt one in this situation: ‘you can’t get blood from a stone’.

So we find ourselves in what is essentially a vicious cycle of renters paying ever increasing rents whilst getting pushed further and further away from the prospect of home ownership.

All the while they continue to age and if they do somehow manage to save, by the time they’ve got the deposit together their age becomes an issue for potential mortgage lenders and impacts on the amount they can borrow.

The effect of trapping long-term renters in high rents is that the mortgage rules are actually inflating the rental market AND driving up housing costs for everyone.

While most of the Central Bank rules are very welcome and help prevent people from over-borrowing and taking on mortgages they can’t afford, it does not take account of the significant difficulties facing those forced to rent at all-time high rates.

While at the same time trying to save for a forever-home where according to the Banking and Payments Federation of Ireland, the average first-time buyer’s deposit in Dublin is around the €55,000 mark.

There are already a number of exemptions and lee-ways built into the Central Bank rules for other groups including those in negative equity and for buy-to lets.

The Social Democrats very much support the Central Bank rules but with an addition of common sense when it comes to adapting to changing economic circumstances. We know the Central Bank has not to date been a very customer focused organisation but it is time for that to change.

The very real danger in continuing to ignore the effect these rules are having on the overall economy is that house prices AND rents will rise as the rules will continue to make it more lucrative to put a property up for rent than to sell it.

We can already see this happening with REITs and Cuckoo funds pre-buying units thereby denying first-time buyers the chance to even bid on traditional ‘starter’ homes.

If a renter can prove, over a sustained period that they are capable of meeting high rental payments, are not over-stretching themselves, and are moving to a much more sustainable and affordable arrangement; that should be factored into how much of a mortgage can be accessed by way of reduced up-front deposit requirements.

That’s not risky, that’s just sound economic sense.

Anne Marie McNally is Political Director of the Social Democrats

Rollingnews